Canadian January CPI data is due at 1330 GMT on Friday 23 February 2018

- CPI NSA m/m expected 0.5%, prior -0.4%

- CPI y/y expected 1.5%, prior 1.9%

I posted two previews here: Preview of Canada CPI data due Friday

A few more now from the locals (land of snow & moose locals that is)

(bolding mine)

BMO:

- Consumer prices likely jumped 0.5% in January, fuelled by the resurgence in energy prices. Gasoline prices were up over 3%, while heating oil saw an even larger gain. The rest of the basket is expected to see rising prices as well, as January is a seasonally strong month for inflation. Indeed, seasonality suggests that we'll see some chunky increases in the CPI over the next five months.

- And, there's some upside risk from the 20.7% increase in Ontario's minimum wage. There's anecdotal evidence of price increases at restaurants, and broader cost pressures are possible.

- Despite the anticipated strong headline print, annual inflation is expected to decelerate four ticks to 1.5% y/y, as January 2017 saw a monster 0.9% m/m surge.

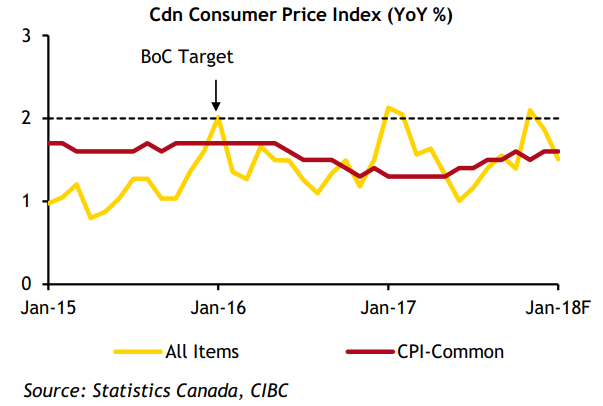

- The Bank of Canada's core CPI measures have ticked higher in recent months, consistent with the closing of the output gap. For January, there's a bit of downside risk in the trimmed mean due to a tough year-ago comparison, while the weighted median and common component measures look to be unchanged. The trend in underlying prices is higher, which should continue as long as the economy holds up.

CIBC:

- The annual rate on headline prices will slip by a few ticks to 1.5% given echo effects from last year, but underlying inflation trends should still look decent in the ... CPI report. Indeed, we're likely to see a trend-like 0.2% SA gain in ex-food and energy, a fourth consecutive reading of that magnitude. If this move is sustained, this stripped down measure will have converged to the 2% headline CPI target by late Spring.

- Gasoline prices should also be a catalyst for the healthy 0.5% NSA monthly gain in inflation. Crude prices firmed in the late stages of last year, and started the year at elevated levels. That's a reason we see pump prices tracking gains a bit over 10% year-on-year in Q1.

- Forecast Implications - Inflation - and its underlying drivers - appear to be on a more sustainable footing in the early stages of 2018. The Bank's new core metrics have on average moved higher, and wages have shown some signs of perking up. Still, we're far from an overshoot, and there isn't a reason for the BoC err on the side of aggressive tightening.