The USD is a bit higher. October 17, 2017

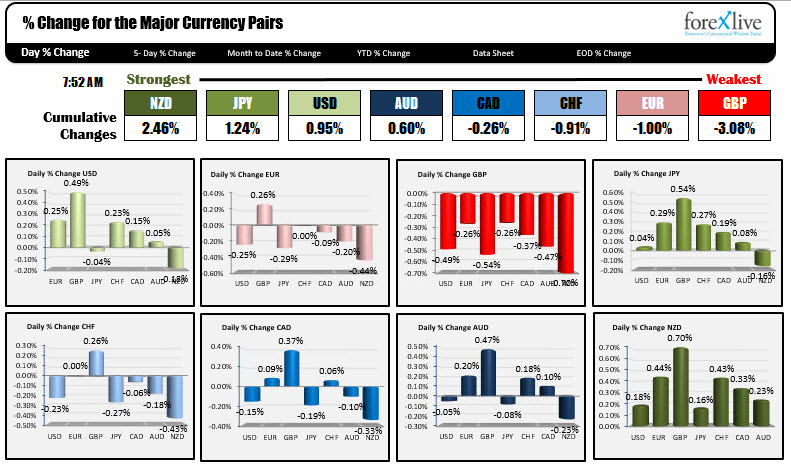

As NA traders enter for the day, the NZD is the strongest while the GBP is the weakest. BOE's Ramsden and Tenreyro gave more cautious responses in their testimony and Carney did not hint of a November change. As a result, the GBP is the biggest mover of all the currencies.

The USD is a bit higher on the day with most of the gains in the GBPUSD pair (up 0.49%). The greenback is also higher by 0.25% vs the EUR, and 0.23% vs the CHF. It is unchanged vs the JPY and down -0.18% vs the NZD.

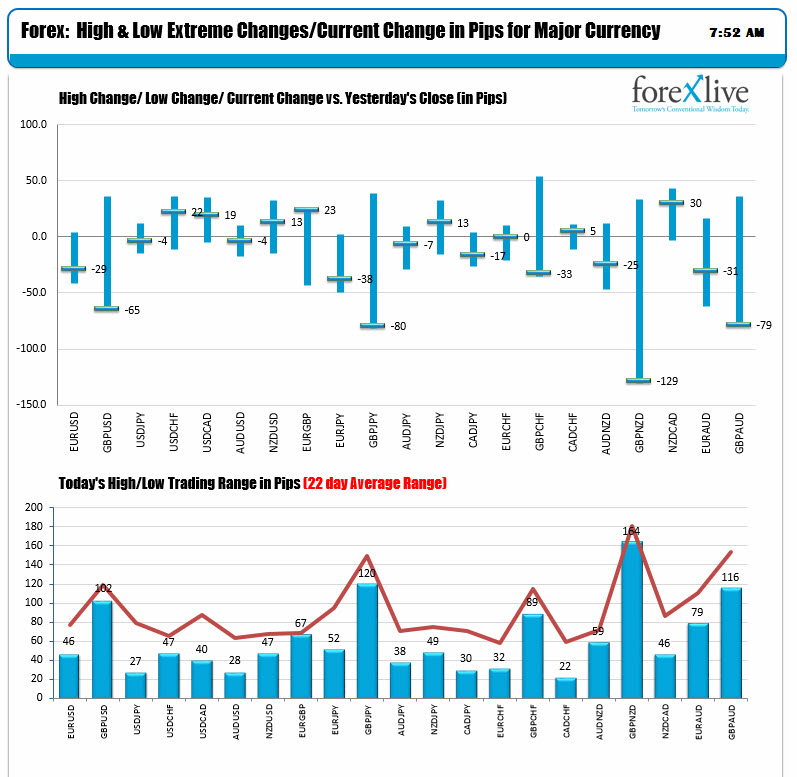

The GBP pairs (see lower chart in the charts below), are approaching the 22 day average ranges with the NY sessions to go, and all the GBP pairs are trading at their extreme levels (GBP lower) after trading higher (for GBP) before the BOE comments. Reversals. The EURUSD is more trending today having only been positive by a small amount in earlier in the day. However, it only has a 46 pip trading range. The 22 day average is 77 pips. So there is room to roam.

On the schedule:

- Import prices will be released at 8:30 AM ET/1230 GMT

- Capacity utilization and Ind. Prod. will be released at 9:15 AM ET/1315 GMT

- NAHB housing market index will be released at 10 AM/1400 GMT

- The NZD Global Dairy Trade auction results will be released at some time this morning

- FOMC Harker speaks at 1 PM/1700 GMT

- BOC Wilkins speaks at 3:30 PM ET/1930 GMT

In other markets today, the snapshot shows:

- Spot gold up $4.47 to $2557.64

- WTI crude is up $0.25 to $52.11

- US stocks are mixed in pre-market trading: S&P futures are unchanged. Dow futures are up 21 points. Nasdaq futures are down -2.25 points

- US yields are lower by a little. 2 year is 1.534%, down 0.4 bp. 5 year is 1.9464%, down -0.3 bp. 10 year is 2.299%, down -0.4 bp. 30 year 2.8176%, down -0.6 bp