Moves a bit lower (extends to downside) after CPI/retail sales

The Canadian retail sales remained fairly elevate in May with a 0.6% gain (vs 0.3%) after a 0.7% rise in April (was 0.8%). The CPI headline was a lower at 1.0% vs 1.1% but the core numbers were a little higher than expectations.

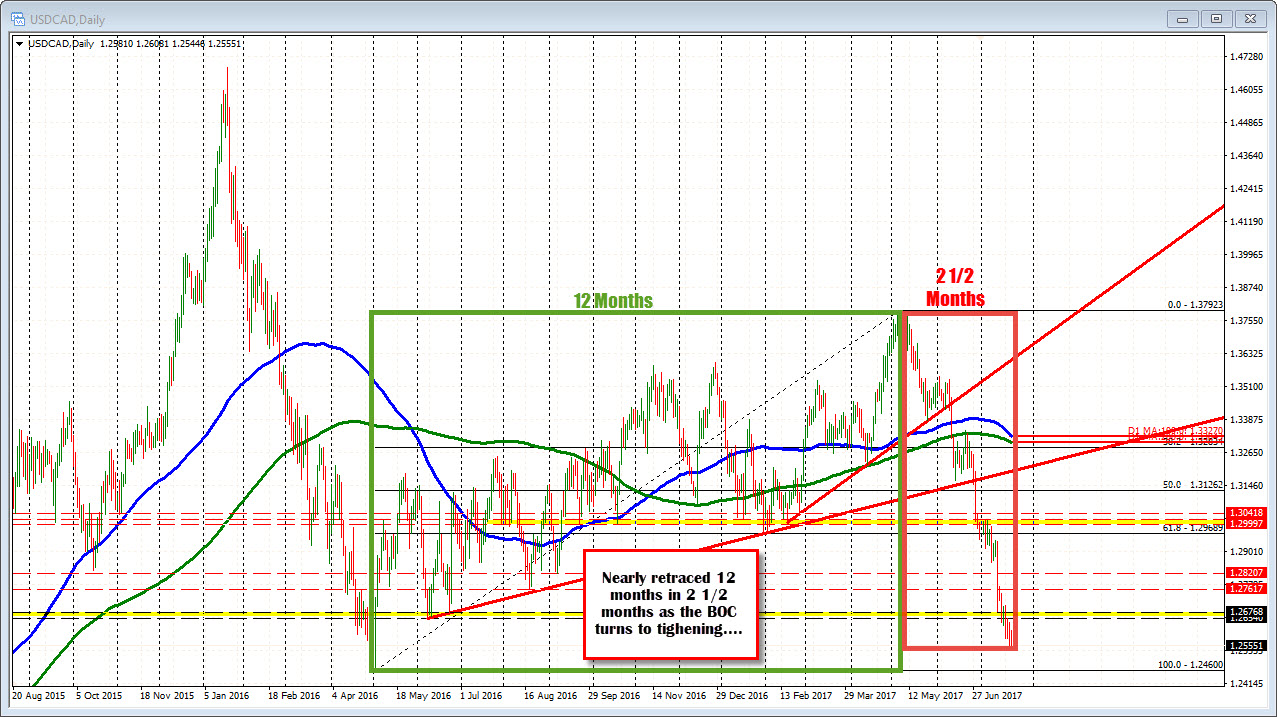

The USDCAD fell after the report with the USDCAD trading at new session lows. The pair is testing the low from yesterday at 1.25398. That is the lowest level since May 2016 when the low reached 1.2460. That low ultimately led to the 2017 high of 1.37923 reached in May 2017 (one year later). Over the last 2 1/2 months, that entire gain is being whittled away (only 90 more pips to go for a full retracement. It was a slow climb but a fast decent as the BOC shifted to tightening.

Technically, in addition to the target below (expect buyers on the first test with stops below), the pair remains below the key 100 hour MA (see blue line in the chart below). That level is at 1.26218 now. The high today reached 1.2608. If the price is to correct higher, that MA needs to be breached and remain broken. The last time the price moved above the 100 hour MA was on July 12th when 4 hourly bars closed above, but failed. The price is down 360 pips from that failed break currently. The MA is also nearly 300 pips lower. As the price goes lower the hurdle to get above the lagging MA becomes easier but it still needs to be done to turn the bias around (even a bit). So far, sellers remain in full control, and the dip buyers just get frustrated.

A move below the low from yesterday will look toward the natural support at 1.2500. A lower trend line on the hourly chart comes in at 1.2522 and then 1.2502. Keep an eye on those levels for additional technical clues.