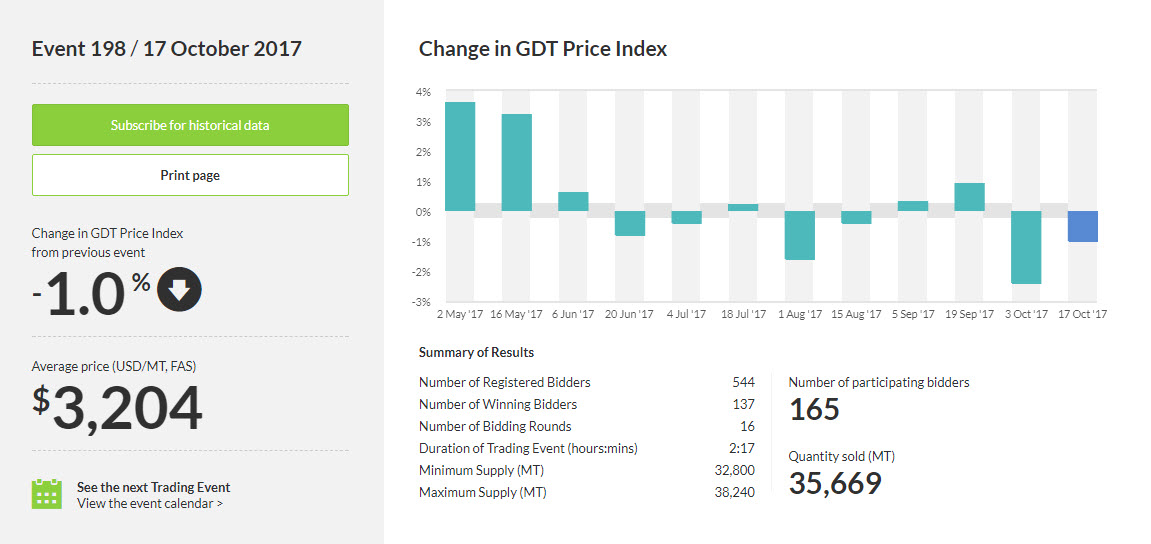

Global Dairy Trade fell -1.0%

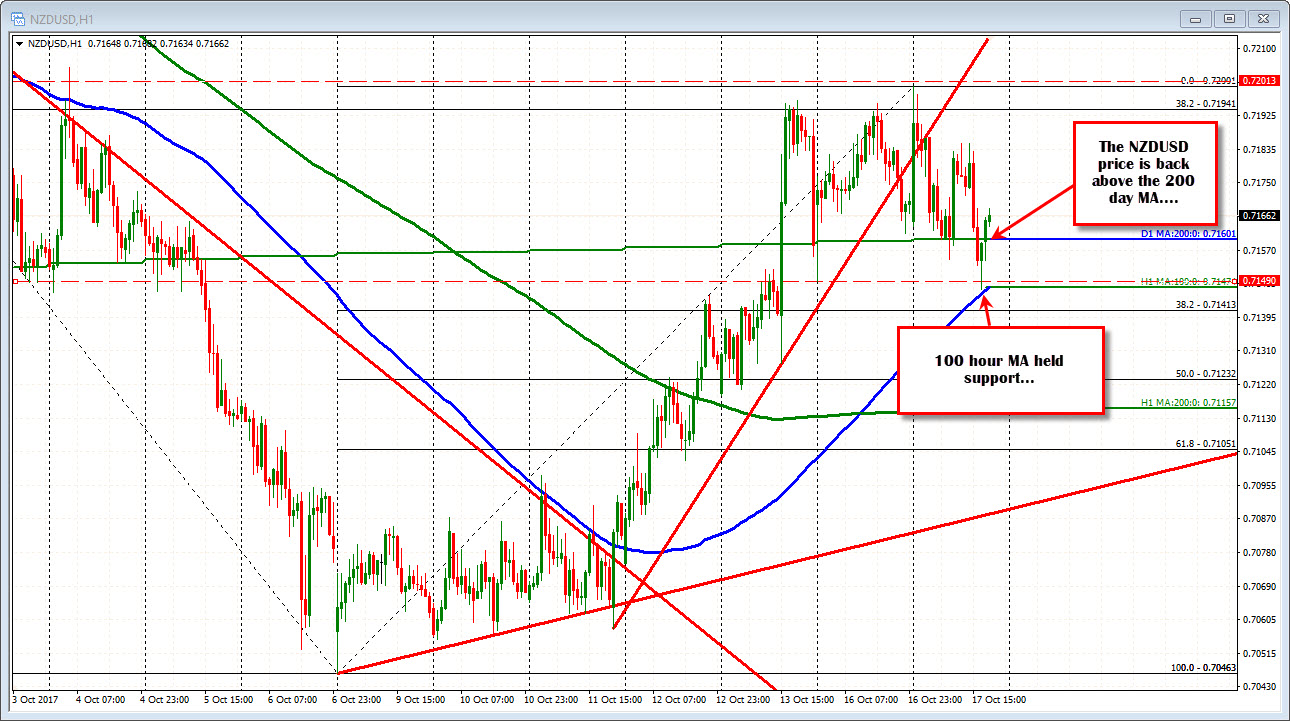

The NZDUSD fell down to test the low from Monday at 0.7149 and the 100 hour MA at 0.7146 (currently at 0.7147). The low reached 0.71468. Buyers leaned and the price has moved back to the upside.

The move to the upside over the last few hours has taken the price back above the 200 day MA at 0.70601. That is now close support/risk for the dip buyers.

Drilling down to the 5-minute chart, the pair is up retesting its 100 and 200 bar MAs (blue and green lines) which are converged at 0.7170. Yesterday we closed at 0.71699. So all three levels are clustered around the level. That makes the level right here, important intraday. Those buyers from below may look at the level to lean as risk can be defined and limited.

So there is a little battle going on between the 200 day MA below at 0.7160 and the intraday stuff above at 0.7170. Only 10 pips separate the two but that is what makes the fight interesting.

PS Global Dairy Trade auction prices fell by -1.0% today.

See the history of the data below.