Canadian retail sales data for December is due at 1330 GMT on Thursday 22 February 2018

Survey has:

- expected 0.0% change on the m/m (i.e flat) while prior was +0.2%

And, for excluding autos:

- expected 0.3% y/y, prior +1.6%

What the bank analysts are expecting (bolding mine):

RBC:

- We expect nominal retail sales edged 0.1% m/m lower in December.

- Indications are auto sales will be little changed in the month, while higher gasoline prices should boost gas station receipts by ~1%.

- Excluding these items, nominal "core" sales should be down ~0.5% m/m.

- Netting out price impacts would see volumes down a modest 0.2% m/m. Such an outcome is consistent with a lowering of household consumption growth to a more sustainable level of ~2% annualized in Q4 from the 4% annualized pace in the first three quarters of 2017.

Scotiabank:

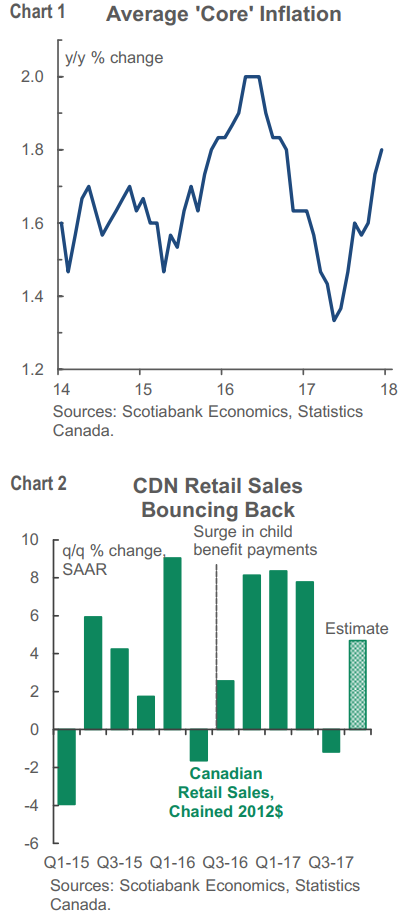

Retail sales have been on a stellar run again. Can they keep it up in December's estimate on Thursday?

- The dollar value of sales has been on a solid growth trend and November's 1.6% m/m gain was the biggest since the start of last year and one of the biggest months over time. I'm going with a small gain this time but it would require continued strength outside of auto sales volumes and gas prices and there is always the caution that the retail sales growth estimate is largely a crap shoot.

- Gasoline prices and our estimates of seasonally adjusted auto sales fell in December. Indeed most of the December rise in headline retail sales was due to higher prices as the volume of retail sales grew by only 0.3% m/m and had its shining moment the month before during October.

Pending December's estimate, sales volumes were tracking about 5% higher in q/q seasonally adjusted and annualized terms. That reversed the prior quarter's soft spot to restore a solid growth trend

Income growth is the main driver now with the massive increase in child benefit payments still supporting the level of sales.

TD Securities:

- Retailers should end 2017 on a soft note due to a drag from autos and a snap of cold winter weather.

- Gasoline sales will make a positive contribution, but weakness in other core components should constrain ex-autos to a 0.2% advance.

- Volumes should edge lower, providing a soft hand-off to Q1, but solid gains from October and November will result in a strong quarter for consumer spending.