Gold broke down on Friday, why more declines are coming.

"May and June. Soft syllables, gentle names for the two best months in the garden year: cool, misty mornings gently burned away with a warming spring sun, followed by breezy afternoons and chilly nights. The discussion of philosophy is over; it's time for work to begin."

- Peter Loewer

The worst sign for a market is when it can't rally on good news. April was a dream month for the gold bulls.

- Soft economic news prompted much speculation about a later Fed hike

- The US dollar dove late in the month

- The ECB continued to print

- Commodities were broadly stronger

Even with all those tailwinds, gold couldn't make any headway. Repeated tests of $1220 failed and after the Fed restated its optimistic outlook, gold prices took a $40 tumble. On Friday the April low of $1175 gave way in a quick move down to $1170.

That leave little support on the chart until the March low of $1144.

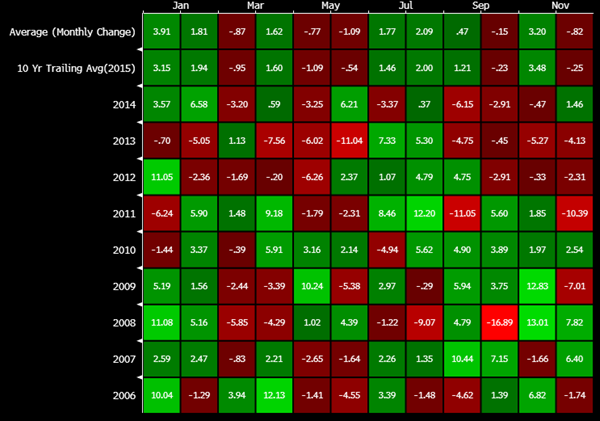

But that's not the only reason to bet against gold as the calendar turns. May is the worst month for gold -- on average -- over the past decade. Prices average a 1.1% drop. The past four years have been especially dire, with prices averaging a 4.33% decline.

Many traders are skeptical about seasonals. In all honesty, they shouldn't work in a market that's even remotely efficient. Yet time and time again, seasonal patterns appear in charts. In April we talked about how the pound had climbed in 10 consecutive years. The skeptics warned a tough election was coming and that the US dollar was in a bull market. What happened? The pound rose 3.6%.

It's not just may, the May-June period is the worst two month period on the calendar.

Alone, seasonals aren't a good enough reason to make a trade. But with the technical breakdown and the inability to rally on good fundamentals, the table is set for a feast on gold bulls in May.