Crude oil helping to weaken the CAD

Yesterday, Pres. Trump took a shot at Canadian dairy farmers and NAFTA while in Wisconsin. Not too surprising given his affinity to pander to the crowd he is speaking to (even though he had trouble remembering Wisconsin's Rep. Paul Ryan's name).

Anyway, Trumps comments helped to send the USDCAD higher (CAD lower).

Today, the stronger USD, and a fall in the price of crude oil, seems to be pressuring the CAD even further. Crude oil is trading down about -$0.80 or -1.53% to $51.61.. The low extended to $51.43 (the high reached $52.65). At the lows, the price tested the 50 and 100 day MAs at $51.40 and $51.68 respectively. We are seeing a modest bounce off the lows. Does a stall in the Crude stall the rally in the USDCAD. Be aware. Key support for the crude oil.

Looking at the USDCAD daily chart, the price moved above the highs from earlier in the month at 1.3454. The high has moved to 1.3474. Topside trend line comes in at 1.34948. The high from March reached 1.3533. Those are the next two targets from the daily chart.

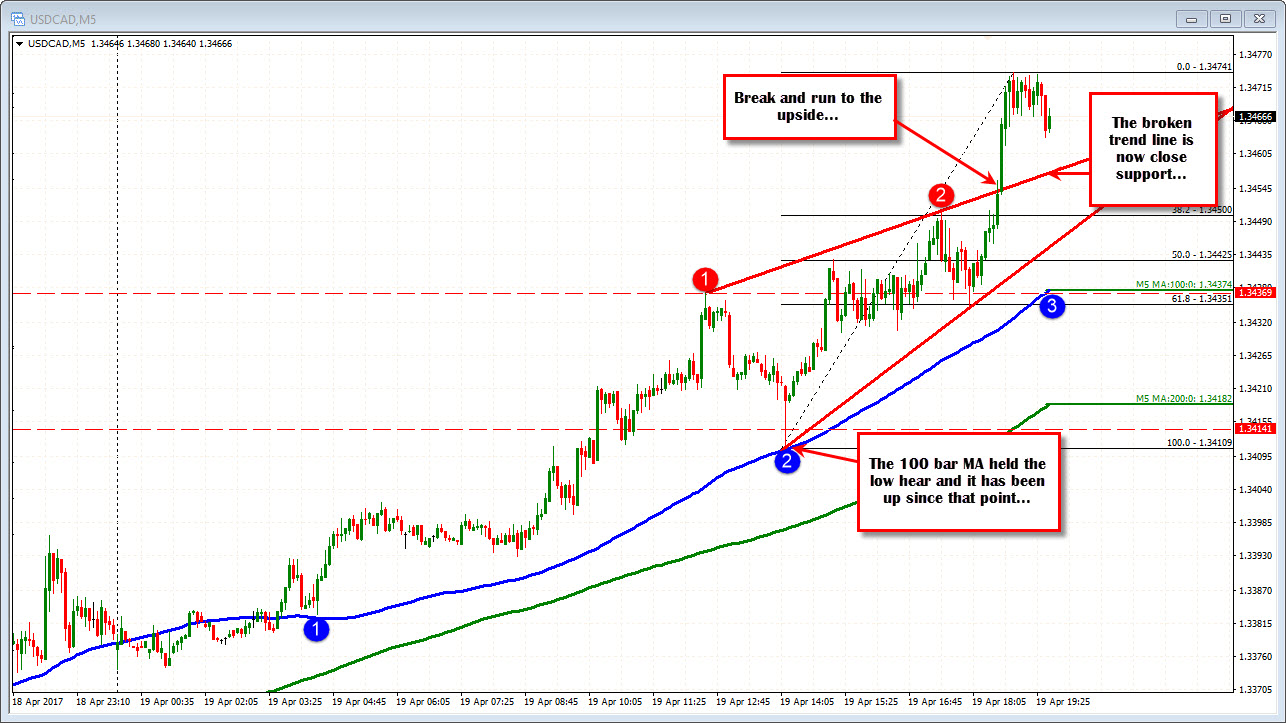

Drilling down to the 5- minute chart, the price today has shown the bullish bias. The price bounced of the 100 bar MA early in the NY session and moved higher, The price action picked up speed on the break of a topside trend line at 1.3454. The underside of that trend line comes in at 1.3457 now. A move back below that line is not the end of the world but does show the market is a bit more muddy (failed break).