USDCAD finds little support as it falls down the lift shaft

We're sitting just off the 1.4161 lows in the loonie as oil prices continue to rip higher. It's a very difficult market for chart watchers as we're being led by something else.

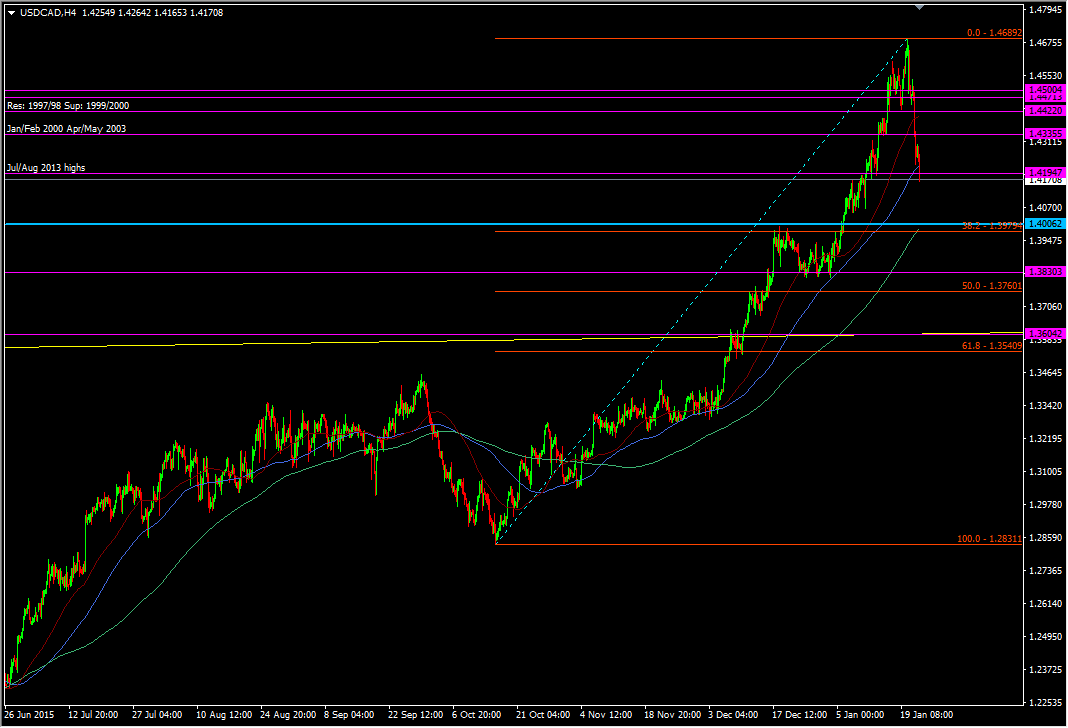

I often warn that volatile one way directional moves can be followed by equally volatile reversals and the 4 hourly chart is testament to that

USDCAD H4 chart

The swing in the reasons for the move are two fold;

- Oil is rising (carries the biggest weight)

- The market was looking for a dovish BOC and didn't get it (least weight but still significant)

Lots of people will be thinking that this is just a temporary fall and the market will get back to the highs so they're picking levels to get in at. WARNING! WARNING! In moves like this you cannot overly rely on the lower time frame tech levels to support you, and you need to keep traders very tight if you want to fight it.

Reader Solange put up a chart in the comments showcasing the fib encompassing the Jan move. There's nothing wrong with it at all and sensible analysis. However, again, I urge caution on using such short term time frames to pick levels right now.

Personally I wouldn't touch it until unless we got nearer to the 1.40 mark. With all the other support levels gone pretty easily I look for where there's stronger looking levels and confluences of longer term tech. I've drawn a fib from the Oct move. That's still a little short on time for my liking but in takes that whole move and it adds to the 1.40 support I'm seeing.

Remember, there's no rush to jump in for feeling left out. So you may have missed the move up, and so you may have missed selling the top. It doesn't matter. What matters is that you assess the picture now and find the places to enter that offer you the least amount of risk.