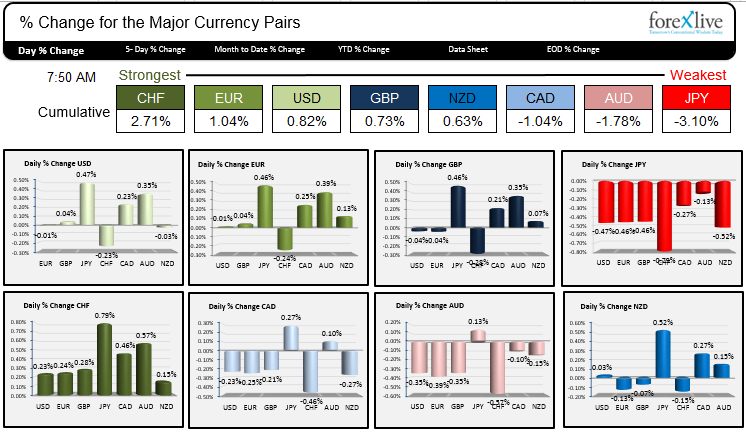

May 27, 2015: CHF is the strongest. JPY is the weakest.

As North American traders enter for the trading day, the Swiss franc is the strongest currency will be Japanese yen is a weakest currency.

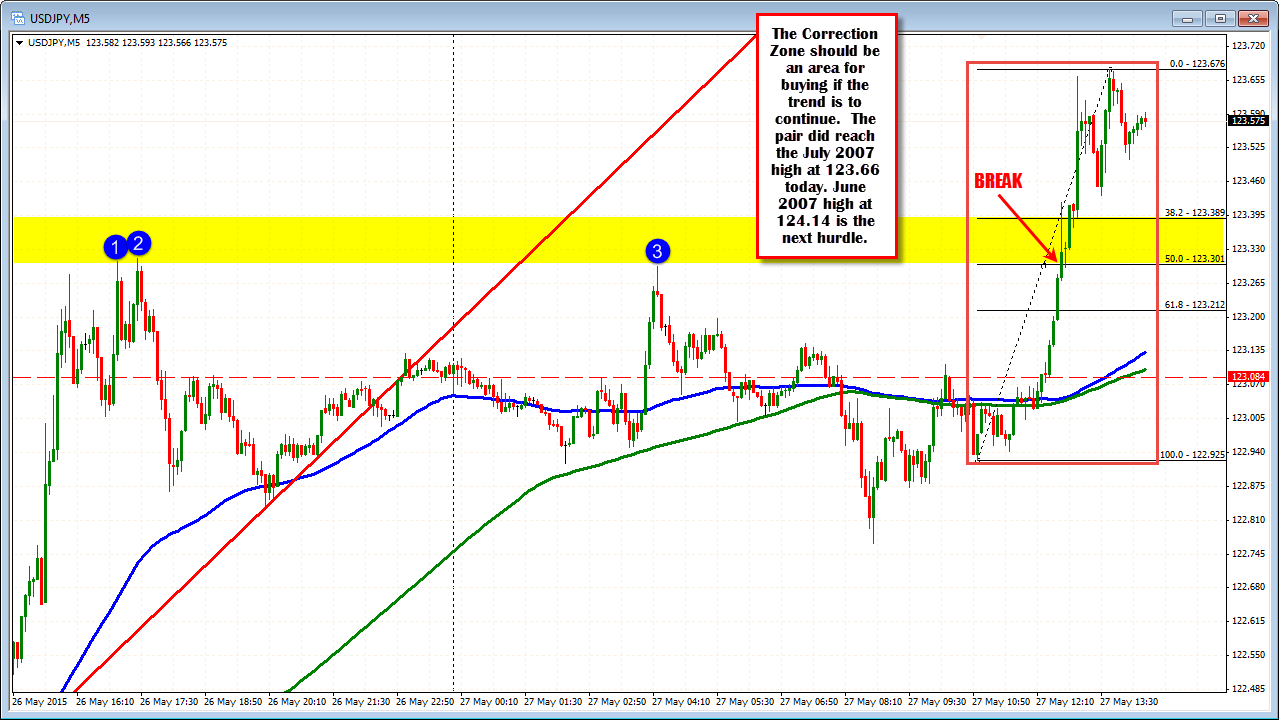

The JPY continues its tumble. The USDJPY rose to a high price of 123.67. This took out the high from July 2007 (on my chart at least) by 1 pip (the high was 123.66 - it is moving to newer highs now). The June 2007 high extended up to 124.14. Move above the 124.14, and the headlines will read "the USDJPY is trading at the highest level since December 2002" - yes 2002. The highs in the 2nd half of 2002 extended from 125.69 to 126.00. Those will be the next targets.

On the downside the 123.30 is the 50% of the trend move up in trading today (see red box in the chart below). It is also near the highs from yesterday and earlier today (see chart below). This is the closest support in trading today.

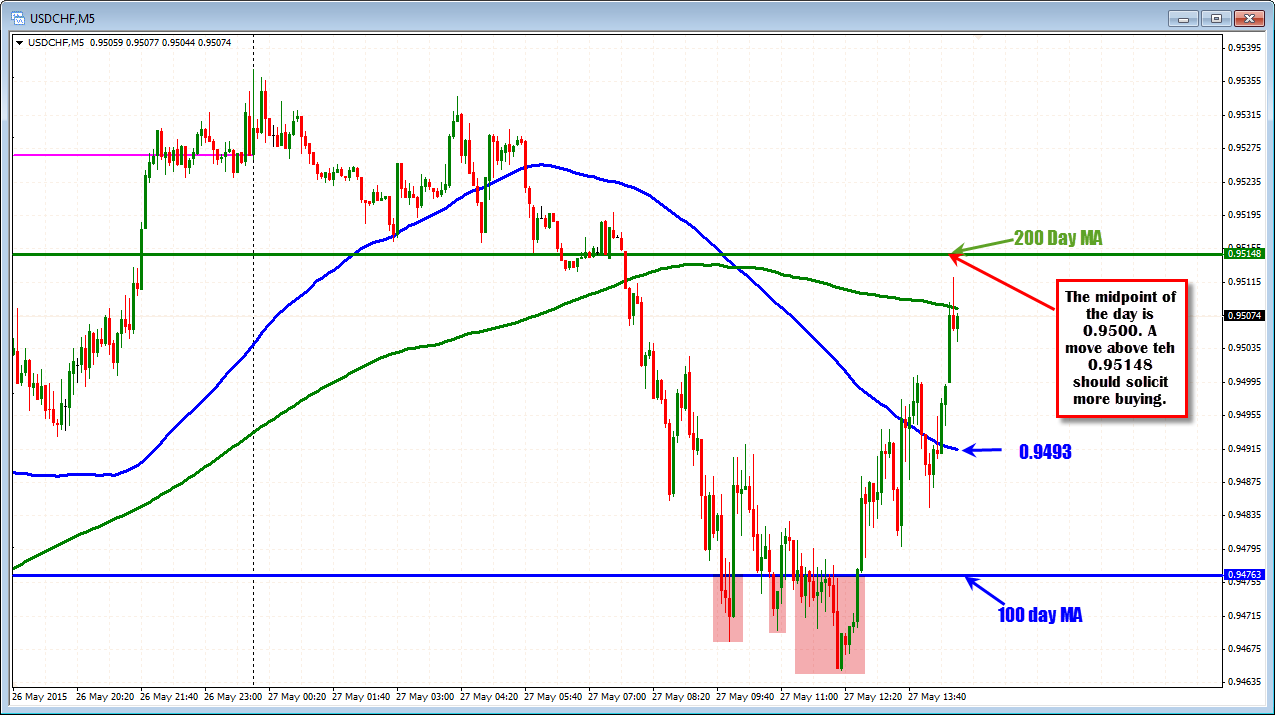

The CHF is the strongest currency today with most of the gains coming against the JPY. Against the USD, the USDCHF yesterday climbed above - and close above - both the 100 and 200 day moving averages at 0.9476 and 0.9514, respectively (those are the levels today). The pair made a feeble effort in extending above yesterday's high at 0.9534 (the high reached 0.9537) near the opening day levels, before moving back lower through the 200 day moving average and even back below the 100 day MA (see chart below). Since then, the price has moved back higher, and is back up closer to the 200 day MA level once again. Watch for support at 0.9492-9500 today. A break above the 200 day MA should solicit more upside potential.

The economic calendar is light today. The Bank of Canada interest rate decision at 10 AM ET will be the main focus. Gov. Poloz of the Bank of Canada was a bit more upbeat last week and speech citing the country had weathered the oil price decline shock. No change in rates is expected.