Brent has run up to the highest since the middle of last year

With stage one of the OPEC deal done and dusted, the next part of the plan is to get all the non-OPEC nations onboard. OPEC's Barkindo has set up meetings for Dec 10th and so far 14 countries are on the Vienna invite list;

Mexico

Oman

Kazakhstan

Bahrain

Colombia

Congo

Egypt

Russia

Trinidad & Tobago

Turkmenistan

Azerbaijan

Bolivia

Brunei

Uzbekistan

(h/t @Lee_Saks)

Whether they all turn up or if more are added remains to be seen but the market is being boosted by the fact that the wheels are in motion. What also remains to be seen is whether OPEC hits any snags in getting some or all of these countries to do their bit as if not, the whole thing could unravel. With OPEC looking at 600k in cuts from non-OPEC, of which Russia is onboard for half of that, it's shouldn't be too hard to achieve. However, this is oil and you can never say never.

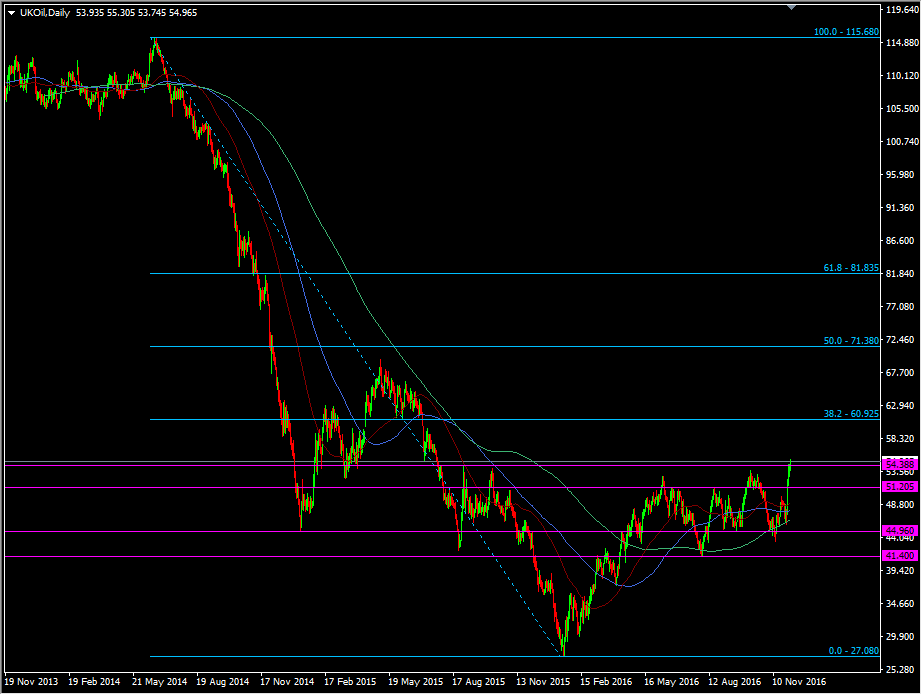

In the meantime, Brent has broken into the $55 area and ran to a high of 55.30. That hasn't been sustained though and we're back under to trade around 54.80, with 55.00 resisting now.

Brent daily chart

The 54.40/50 area is one I had flagged for a while and that should be where we see further support in a general market drift. We should see additional support down around 53.70/80, 53.00 & 52.80.

For the upside, the 38.2 fib of the 2014 fall at 60.92 is the biggest target but look for 60 to put up a fight and some minor levels through 57.50-80, 59.00 and 59.50/60.

If we get a deal done with non-OPEC then that should give prices another nudge higher, before we then move on to whether the deal actually works and does what it intends to do.