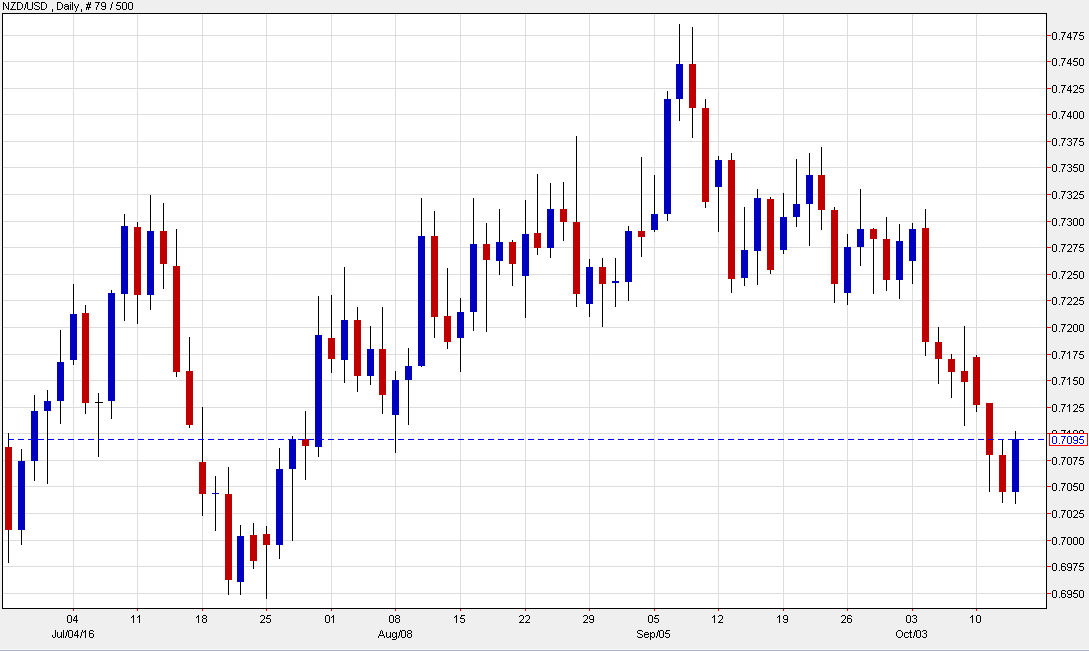

Kiwi dollar finds support ahead of 0.7000

The New Zealand dollar is in the midst of its biggest daily gain in more than a month.

There isn't anything New Zealand-centric behind the rally. Rather it's an oversold rebound on broad-based USD weakness and a decent day for commodities.

The reversal today threatens an outside day but even if it happens, the magnitude of the reversal candle doesn't point to a sustained rebound in my eyes.

But it still warrants some caution. If it extends tomorrow, it could spark a retest of 0.7220, which was where the pair broke down last week.

Looking ahead, the main event to watc his the release of Q3 CPI on Tuesday (late Monday in the US). The consensus is just 0.1% y/y and that leaves a high risk of a miss that technically puts New Zealand into year-over-year deflation.

That would be the kind of thing that puts pressure on a central bank to act sooner rather than later. Currently ,the market is pricing in an 87% chance the RBNZ moves on Nov 10.