RISK IS ELEVATED..

Risk is elevated. Why? There is Market risk (that is with us all the time), event risk and liquidity risk (that is not always with us). The BOJ reported "call around" is a potential event risk that unlike an economic release, is untimed and could happen again at any time and you just saw what could happen as a result of it (the USDJPY got within 14 pips of unchanged in an instant (it was down 233 pips at the lows of the day).

When risk is high (and risk - like even "call around" intervention risk - is not defined), you really are more gambling. No one knows when a call will come to a dealing desk or even if rumors of calls will make the rounds. If you think you know, you are wrong. So that makes trading more of a gamble.

Market risk from the price action can be managed via technical levels but in rock, paper, scissors, the Event risk will override the market risk (PS Liquidity risk goes with the event risk).

If there were just market risk, what do I see?

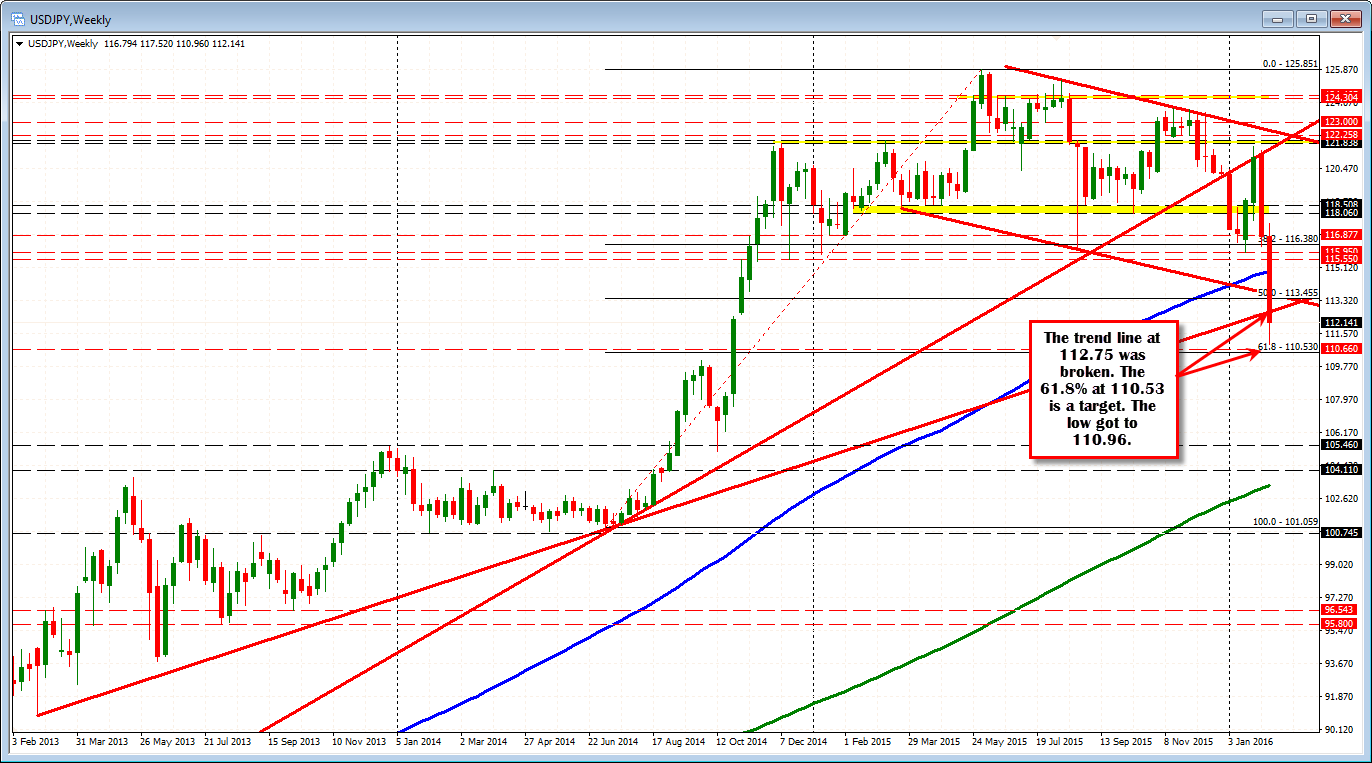

Taking a look at the weekly chart, the price has moved below a trend line at the 112.75 area. the low fell short of the 61.8% retracement of the move from the July 2014 low (the consolidation low before the trend move higher). The low came in at 110.96. For your guide the low to high ranges 650 pips for the week. That is the highest going back to May of 2010 when it reached nearly 700 pips. There are not many weeks with ranges of this magnitude. Can it be extended? Yes but it does get harder.

Drilling down....The hourly chart showed an acceleration of the trend below lower channel trend lines currently around the 111.88 area. That move failed with the move back into the channels. So that is now a support area.

Drilling down even further to the 5 minute chart, the pair moved above trend line resistnace and the 100 bar MA at the 111.97 level currently. The 200 bar MA on the same chart (green line) comes in at 112.51. The 38.2% is at 112.57. The price trades between them after the spike high failed and came back down.

Overall, traders who were brave in selling are not so brave now after the shot across the bow from the BOJ. Expect choppy trading to remain however as stocks and yields and oil exert there influences in trading today. Risk is elevated.