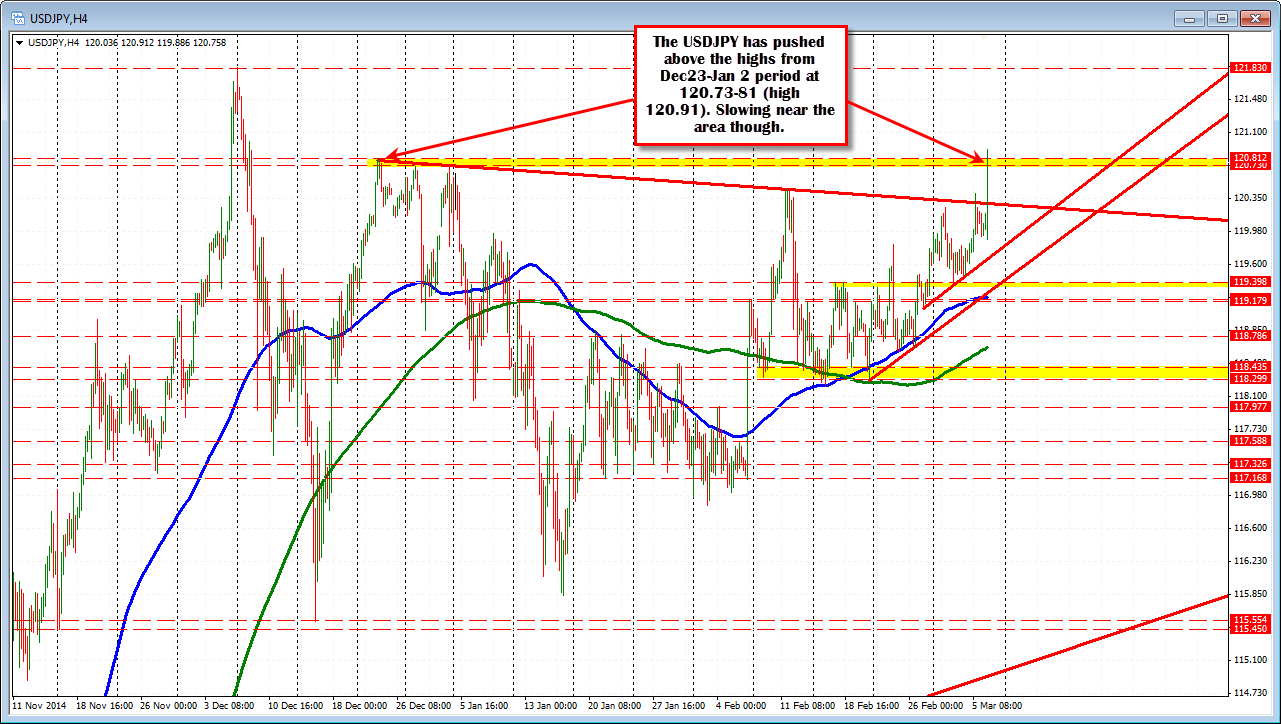

The end of December/early January levels tested

The USDJPY surged higher after the stronger-than-expected US jobs report. The price has extended above the end of December/early January highs at the 120.73 to 120.81 area. The high has reach 120.91 currently. However, there is a bit of a stall near these key levels as the market consolidates and plans the next move.

If the trend higher is to continue, the 38.2% retracement of the move higher today, should solicit dip buying (see 5 minute chart below). That level comes in at the 120.52 level. The 50% comes in at 120.399. Look for traders to lean against this area on dips. On a move below the 120.399 level, traders will become disenchanted with the move. There could be a further slide back toward the 120.19 area.

Looking at the daily chart, the price is breaking and moving away from the pennant formation. This should lead to higher levels technically. The high water mark in 2014 came in at 121.833. It would be the next upside target to get and stay above should the upside trend reestablish itself. On a break above that level, there is not much resistance until the 2003 highs at 123.66 and 124.13 (July and June 2003 highs).