GBPJPY joining the selling party.

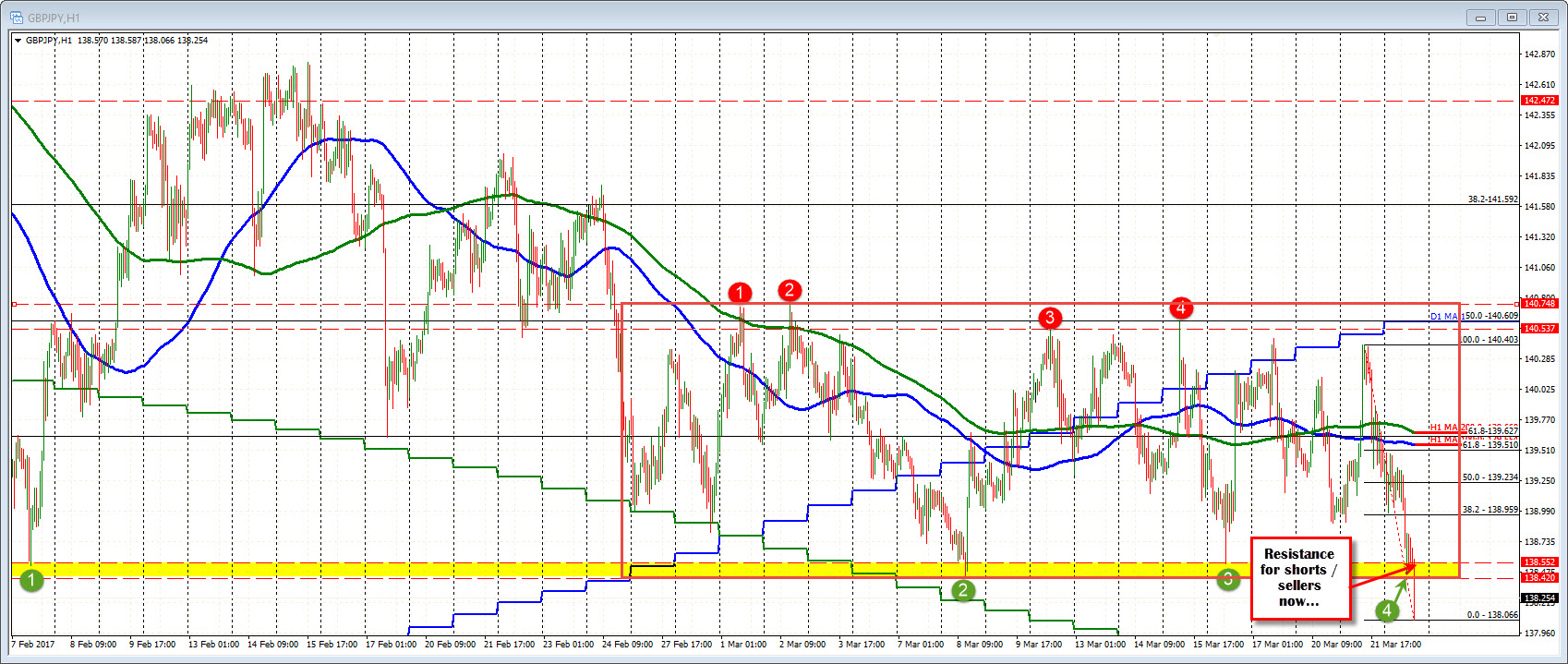

Yesterday while JPY pairs were moving lower, the GBPJPY ended the day higher. There was higher inflation data out of UK and that supported the pair. Nevertheless, the high price in the pair tested the 100 day MA and fond sellers against the level (blue line in the chart above) and the pair did close near the lows (although still up on the day).

Today, the pair has joined the selling party. As the USDJPY makes new lows, so is the GBPJPY (in fact the GBPUSD is making new lows too). For the GBPJPY, the pair is trading at the lowest level since January 17th - taking out the swing lows from Feb 7th at 138.53 and the low from March 8th at 138.43. We just reached a new low of 138.06.

Looking at the daily chart the 200 day MA at 137.488 is the next key technical target for the pair. The 4 times, the daily price has tested that MA line, there have been buyers leaning.

Looking at the hourly chart, the up and downs of late had a bottom floor area at the 138.42-58. We tested that area today, then fell/broke below. It represents close resistance now for shorts/sellers.

US stocks are opening up mixed.