....but declines stall

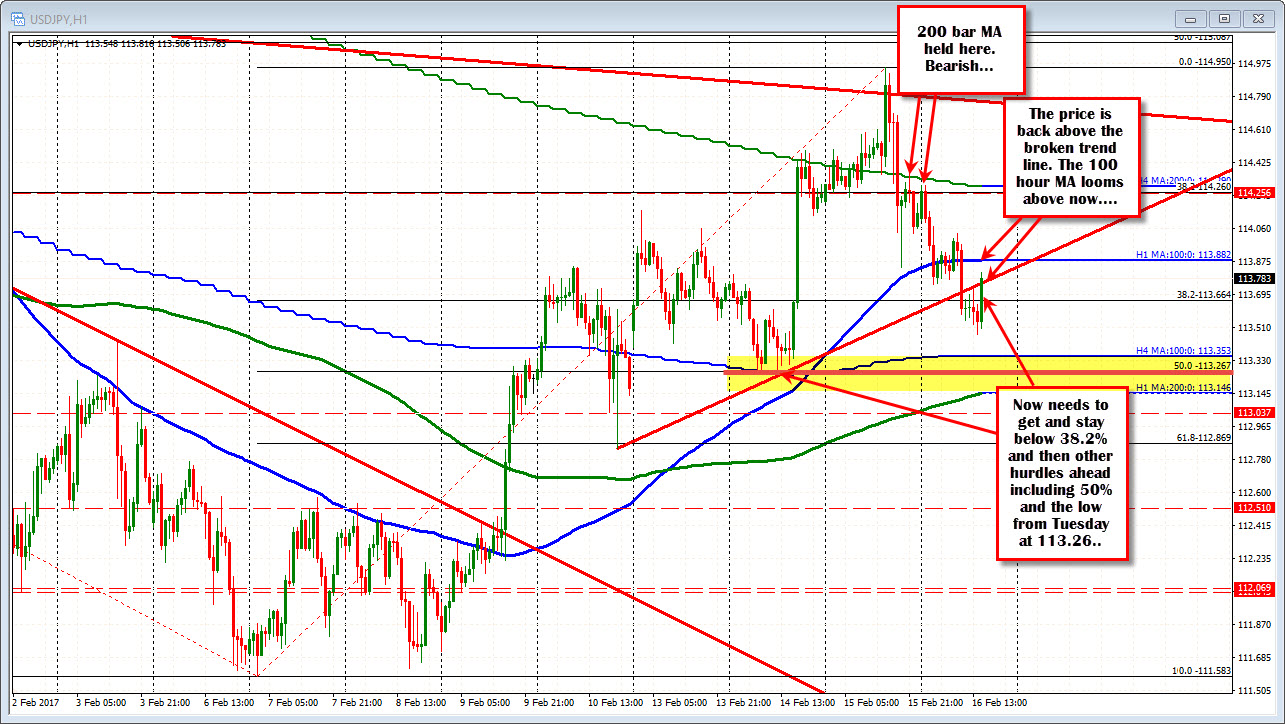

The USDJPY was pushed lower in trading coming into the NY session extending below an upward sloping trend line (currently at 113.77) and reaching a low of 113.476. The price has rebounded a bit after the strong Philly Fed index. Housing and claims data was not bad either.

Traders are trying to keep the bearishness - started at the beginning of the day - but the dollar selling is being tested.

The day started by staying below the resistance against the 200 bar MA on the 4-hour chart. More bearish. The price reached the 100 hour MA and consolidated. The London traders took the pair to the lows into the NY session.

Now with the better data, traders are getting a little more squirmy and we have seen the modest correction back higher (such is the markets these days). The price just moved back above the broken trend line. The 100 hour MA is the next hurdle to content with now on the topside at 113.88. ON the downside now, get below 113.66 will give shorts some breathing room technically (38.2% of the move up from the Feb 7 low).

The pair is lower on the day, but data took some of the wind out of the sails.