Stays above support but looking for momentum

Last week the USDCHF had a trend like move off the lows that extended into the trading on Friday (see video from last week HERE).

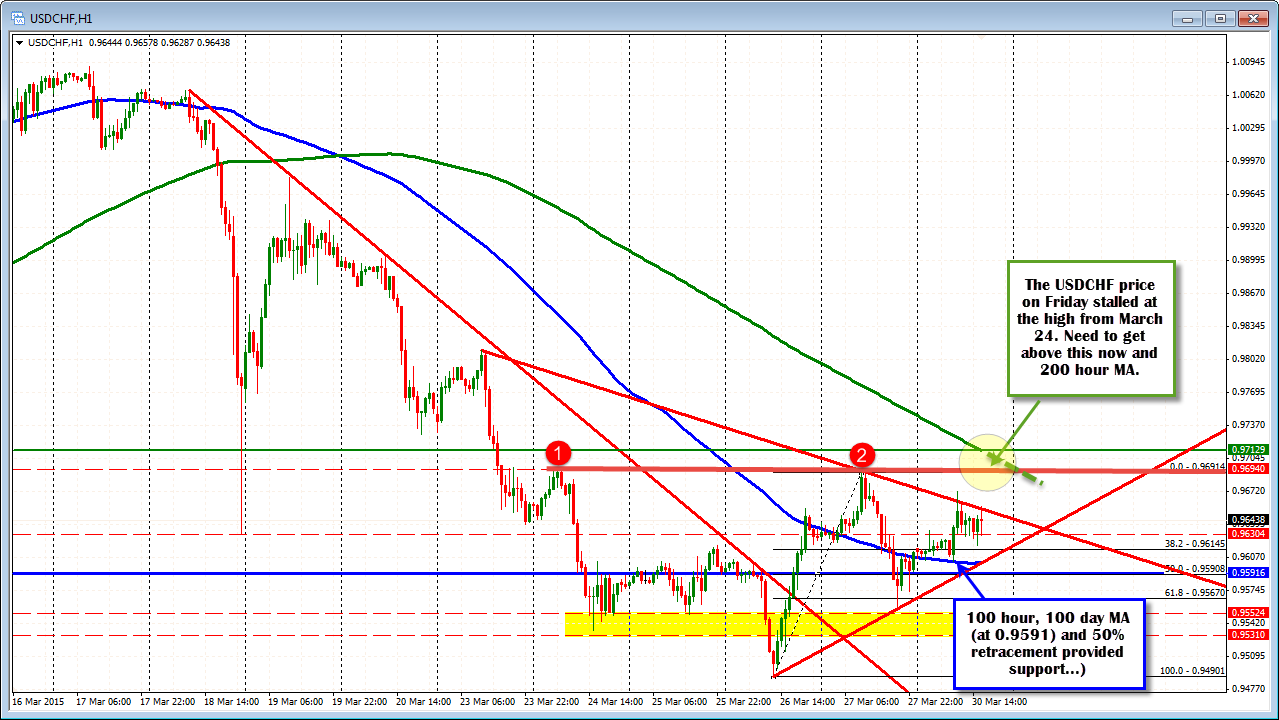

That rally fizzled with the price falling back below the 100 hour MA (currently at 0.96027) and the 100 day MA (at the 0.9591 level - blue horizontal line). The price for the week closed near these levels.

In trading today, the price action has been more bullish, although it also is more choppy and lacks sustained momentum so far. Nevertheless, the price in the Asian Pacific session was able to hold above the 100 hour moving average (blue line in the chart above). The price in the London session ratcheted up a notch. A negative is that topside trend line was broken, but failed on the first break (see chart above).

The move and holding of the 100 hour/100 day MA below give the buyers more of an advantage, with the trend line being the next target to get and stay above. The double top at the 0.9694 and the 200 hour MA at 0.97129 (and falling) will be the next hurdles. Close support comes in at 0.9630 which was the low after the FOMC meeting. There have been no closes below this level over the last 9 or so hours of trading.