It took 3 1/2 days of consolidation/sideways trading.

The GBPUSD has NOT been reactive to the France election.

Last week was the GBPUSD day in the sun as it rallied on the back of the snap election news. Since that announcement, however, the GBPUSD has been going sideways.

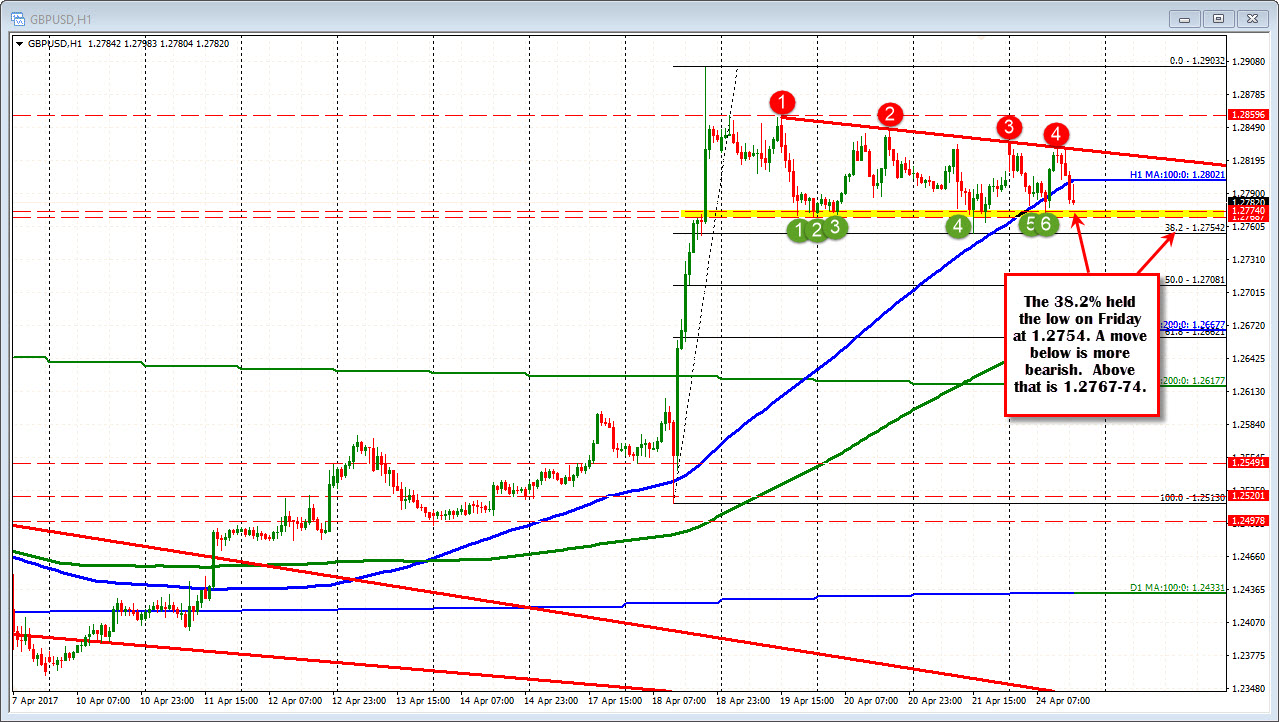

The 38.2% of the move has stalled the fall (that happened on Friday) but looking at the highs from the hourly chart below, the tops have been confined to a slightly downward trend line. That trend line comes in at 1.28309 currently. The high today reached 1.2836. Other highs will likely provide resistance barring some fundamental news that sends the pair scooting higher (from the USD or GBP stand point).

The consolidation has allowed the 100 hour MA (blue line in the chart above) to catch up with the price today. We are currently trading below that MA line for the 2nd time today. The pair is looking to test the support defined by swing lows in the 1.2767-74 area. The 38.2% retracement of the move up from Tuesday's low at 1.2754 is also a downside target today.

So the range is defined to 1.2754 below and 1.28309. In between sits the 100 hour MA. Look for traders to swing between the extremes with caution on breaks.