Near middle of the range for the week.

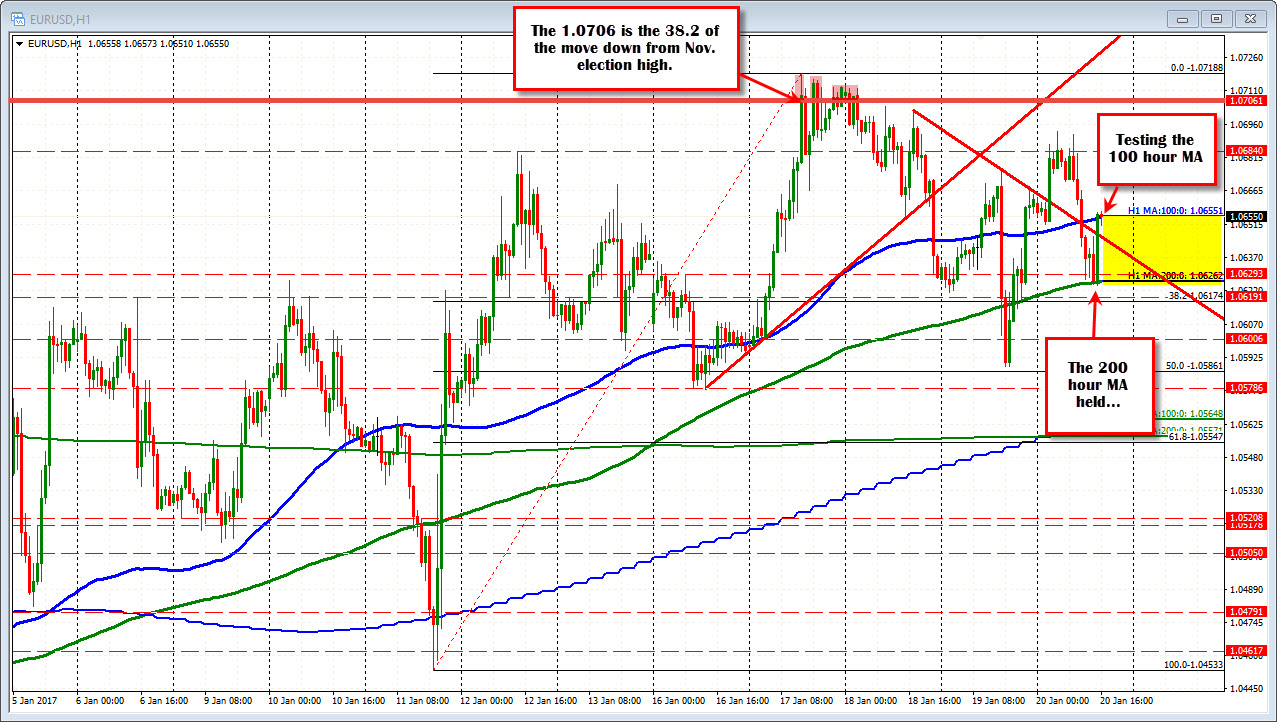

The EURUSD started the NY session near lows and also trading against the 200 hour MA (green line in the chart below).

The price has rebounded and now trades near the 100 hour MA (blue line) at the 1.0655 level. Remember, the price has used that MA line as a bullish above/bearish below line in trading this week (follow the price action around that line). The line is also near the middle of the trading range for the week. The high was reached on Tuesday at 1.07188. The low was at 1.05786. The midpoint comes in at 1.0649 - not far from the current level.

Given the markets are entering the new President Trump era, it kinda makes sense to gather around neutral areas. The 100 and 200 hour MAs make sense. That can change with the flows of the day. It is a little more bullish staying above the 200 hour MA.

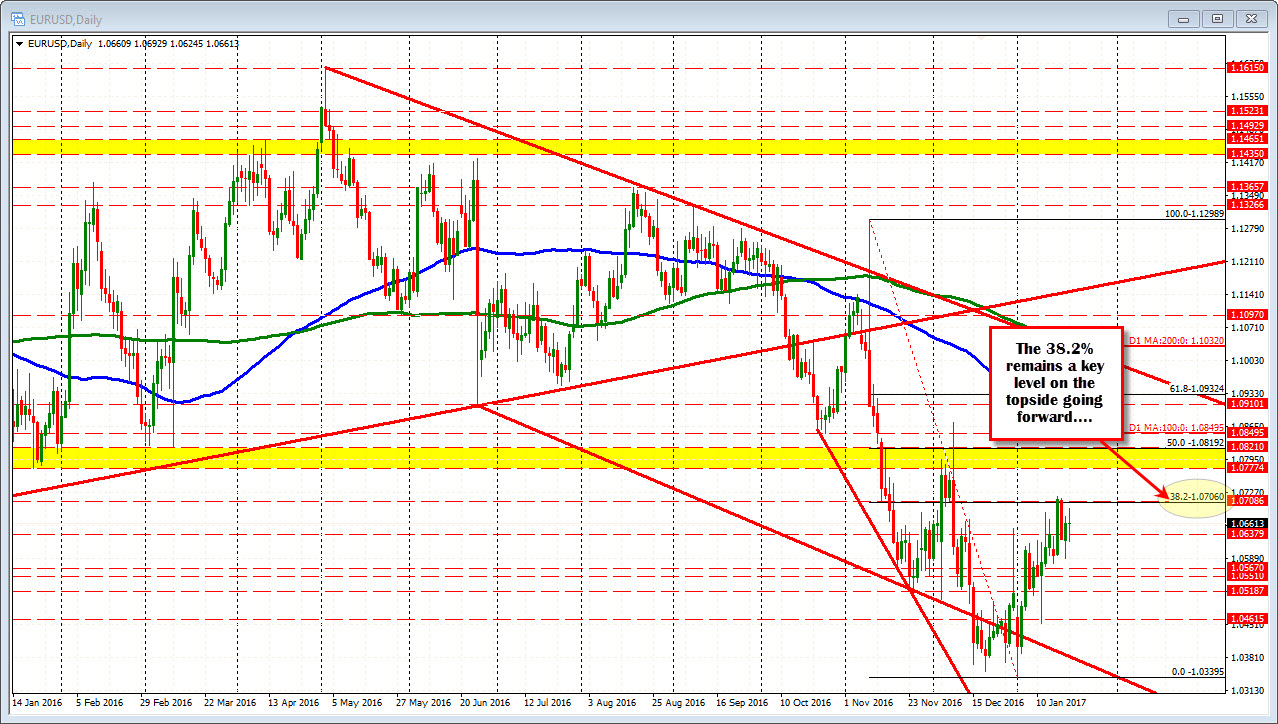

Overall for the week, the pair extended a little bit above the 1.0706 key resistance level on Monday. That is the 38.2% of the move down from the November 2016 election day high. The market stalled.

At the lows on Monday, the sellers tried to take the price below the 100 hour MA for the first time and could not keep that momentum going.

Yesterday Draghi sent the pair lower on his dovish comments, but after he was done, the sellers turned to buyers, and the move back above the 200 hour MA (green line) helped the bulls.

Overall, the theme is buy low/sell high with MAs now in between. The market is waiting for the next clue. That seems to be focused on the new President and we know, that will likely comes with a lot of volatility - especially as the markets get used to the how he will communicate (it could be anytime) and what he does. NAFTA and TPP is expected to be early targets.

The EURUSD is making a move above the 200 hour MA as I type and trades to 1.0664. Expect up and down volatility though. .