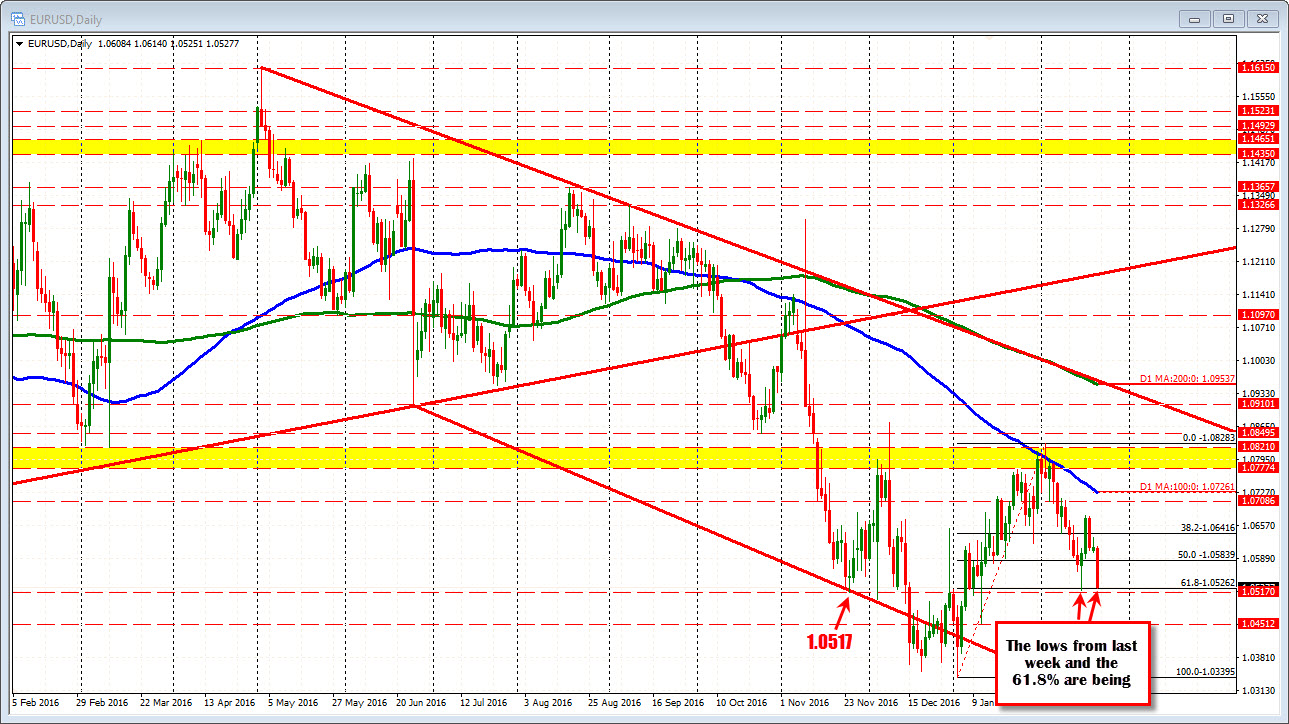

Tests the lows/retracement

The EURUSD is trading at new session lows at 1.0525. Looking at the daily chart, the 61.8% of the move up from the January low comes in at 1.0526. The low price from last week reached 1.05208. The swing low from back in November reached 1.05171. So there is cause for pause - at least from a technical perspective. Fundamentally, the dollar is being supported by higher rates and a rising stock market which is helping the greenback, but this is a key area technically for the pair. PS The EURUSD is the biggest mover today.

If the price is to turn around from the support area, we will need to see the pair start to take back some levels from the trend like move lower today. The 100 bar MA on the 5-minute chart (blue line in the chart below) is currently at 1.0549 and moving lower. That MA was tested at the opening, and then near the start of the European trading session. A move above that MA would be a sign the sellers are being challenged by buyers at the support area.