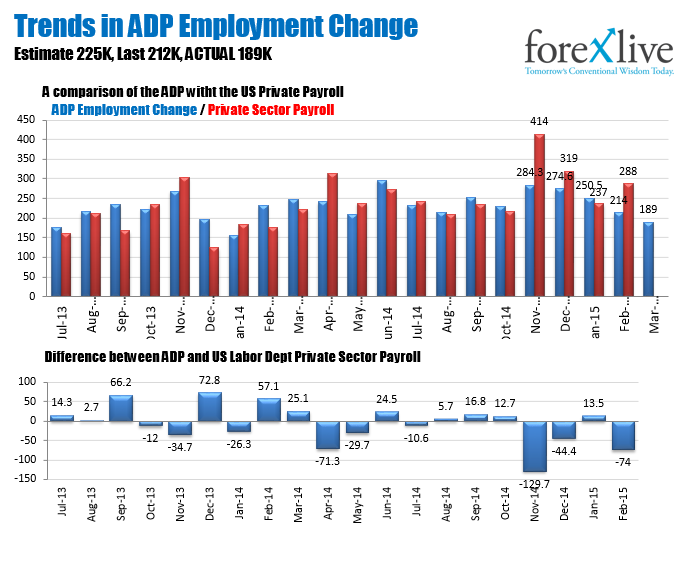

ADP comes in weaker than expected at 189K

The EURUSD has moved higher after the March ADP employment report came in weaker than expectations at 189K vs estimate of 225K. Note that although weaker then expectations, it does not necessarily follow the Labor departments measure for private payroll. In the month of November, the Labor Department reported a gain of 414K. While ADP was down at 284K - a130K difference. In December, the difference was 44.4K. In 3 last 4 months, the ADP has understated the Labor Department's data (January data showed ADP at 250K vs 237K or 13.5K difference - see chart below)).

So, although the number is week, it must be taken in context with the recent history.

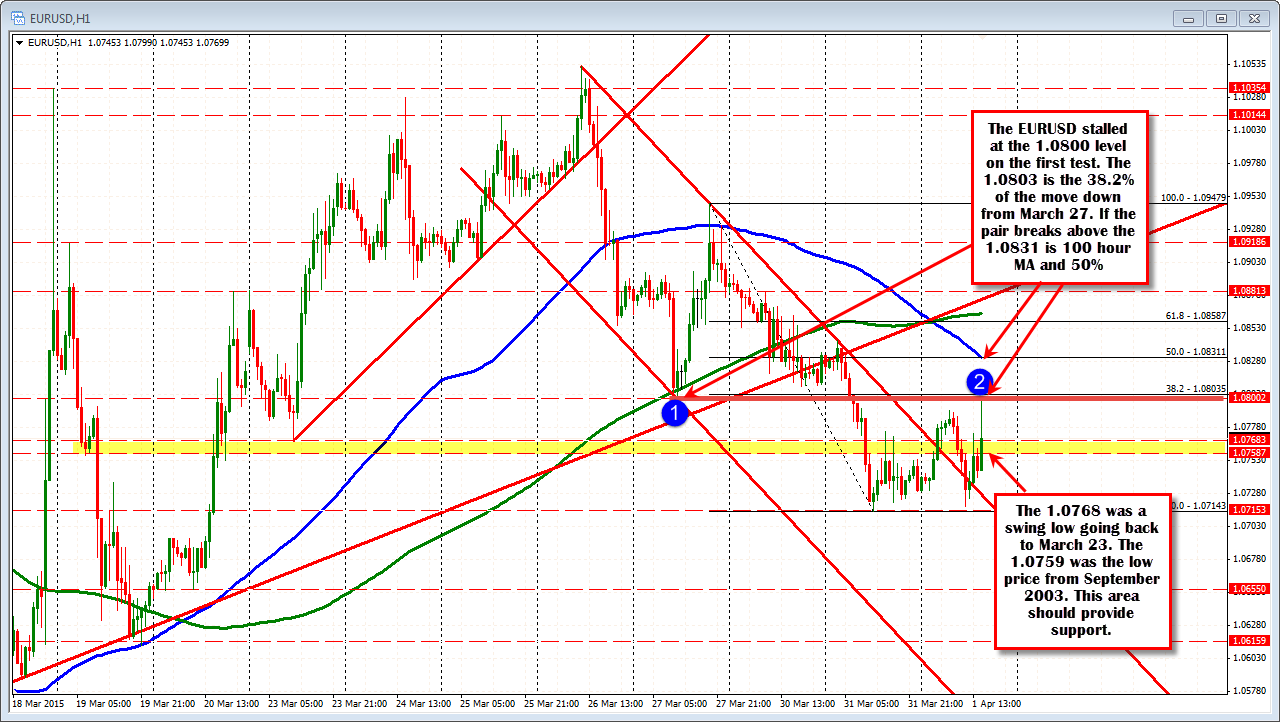

Nevertheless, the EURUSD has moved to new session highs on the initial move (it has since come off a bit). However, on the move to the upside, the price did stall at the 1.0800 resistance target level (high came in at 1.0799). This level corresponds with the low price from last week's trading (at 1.08003). The 38.2% retracement of the move down from the high on March 27 (see chart below), comes in near that level as well (at 1.08035).

If the price is to move higher in trading today - and look to test the next upside target at the 100 hour moving average and 50% retracement level at the 1.0831 level - this area needs to be broken (the EURUSD back down in the 1.0768 currently).

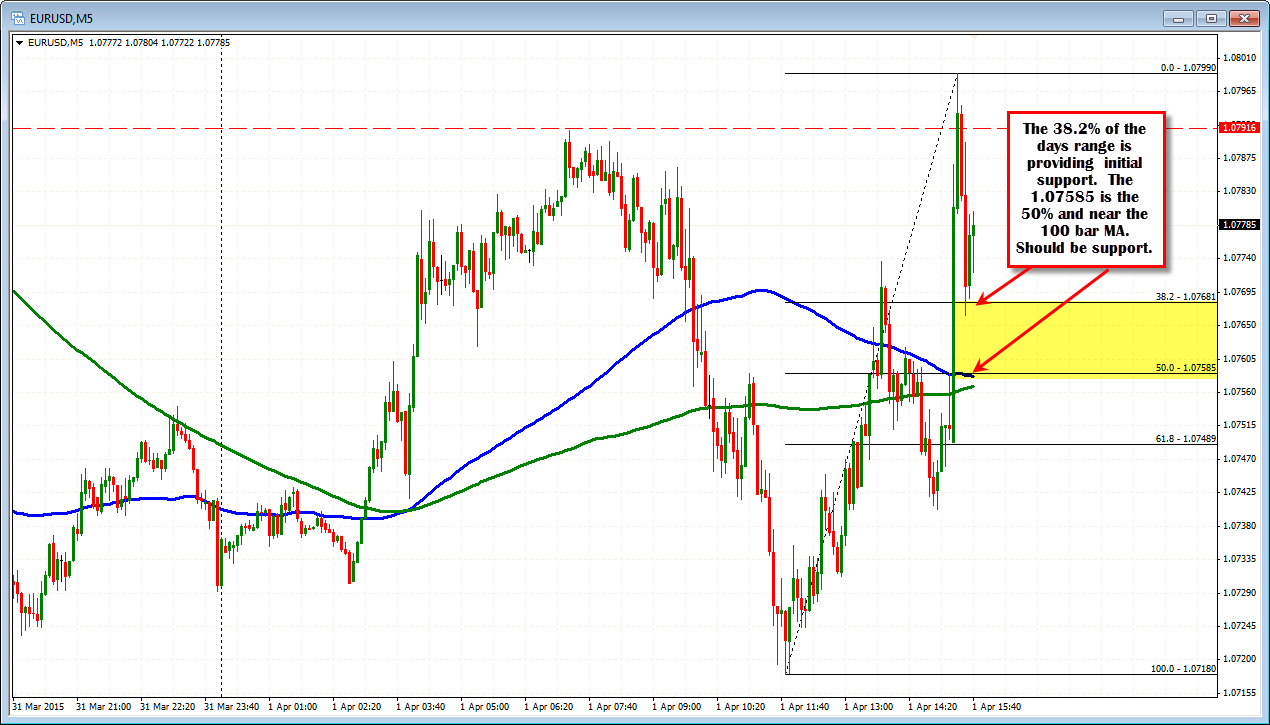

On the downside, support will now be eyed at the 1.0759-68 area. The 1.0768 corresponds with the swing low going back to March 23. The 1.0759 is the low price from September 2003 (not shown). Looking at the 5 minute chart below, that area is also the 38.2%-50% of the days trading range. The 100 and 200 bar MAs (blue and green lines in the chart below), also come in near this area.

It is tempting to extrapolate he ADP to the Labor data, but the data does not support that idea. As a result, the cautious trading is probably warranted.