1st break since Election day

The EURUSD has moved above the 200 day MA at the 1.0884 level to a high of 1.08897 in early NY trading (green line in the chart below). This is the first break of the 200 day MA since the US Election day spike (was quickly reversed though). The last time the price closed above the MA line was back on October 7th, 2016.

The pair has marched through the minefield of resistance levels today on the back of the failure of the healthcare repeal and replace late Friday. The price gapped higher at the opening (the high on Friday came in at 1.08177 - remember the 1.0819-28 ceiling? We are moving away from that area today). The low today is 1.0824. The market will remember that 1.08177-24 gap, but it does not have to be filled anytime soon.

The move higher today has taken the price above prior swing levels at 1.08495 and 1.08724. Check and Check. The break above the 200 day MA was the next hurdle. Check. The 1.0910 is the swing low going back to June 24 2016 and is the next target above. A move above that and the 1.09775 is the 50% of the move down from the May 3rd high.

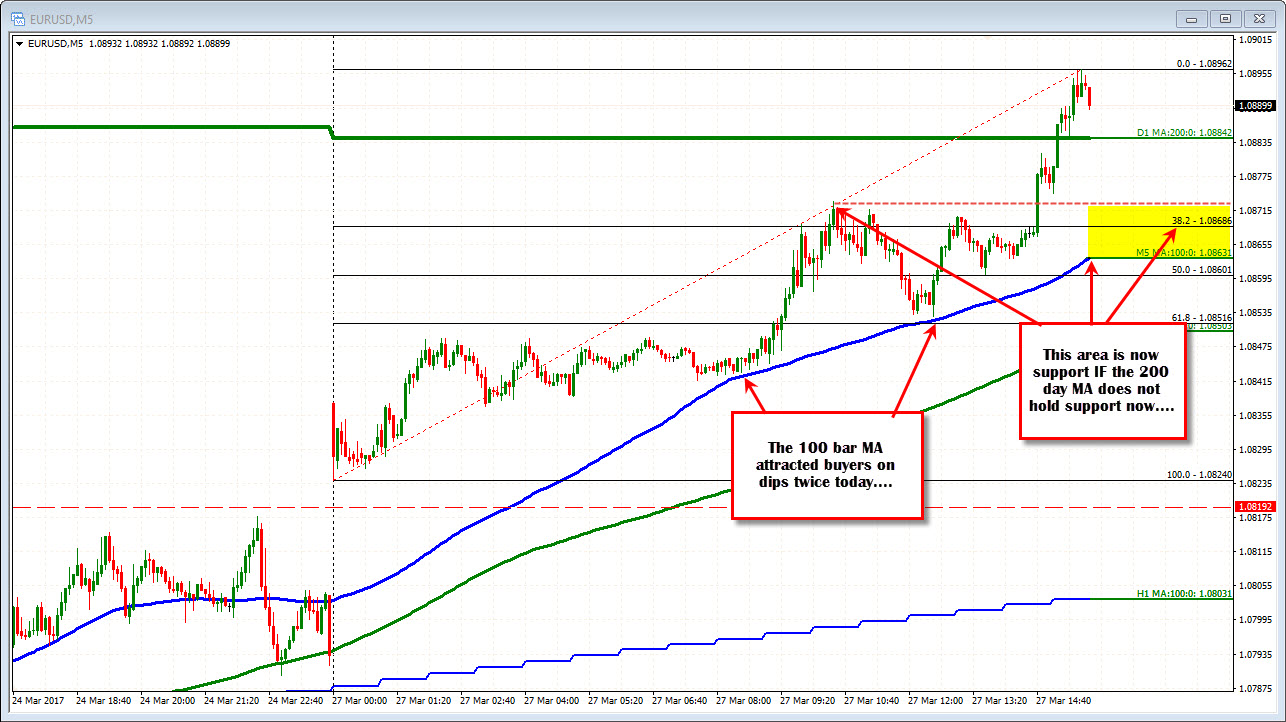

The high just extended to 1.0896. The buyers/bulls will like to see the 200 day MA find support now. Stay above and the bulls are in full control. A move below muddies the bullish waters a bit. A move below would look toward the 1.0863-73 area (see 5 minute chart below). The 1.0673 is the earlier high for the day. The 38.2% is at 1.08686 (of the trading range today). The 100 bar MA on the 5 minute chart is at 1.0863 now and moving higher. That MA had stalled the fall on two separate occasions today. So watch that MA on corrections today.

A break of a key MA like the 200 day MA has to be respected. The range for the day is at about 104 pips (from the Friday close). That is above the 22 day average of 72 pips, but with the levels being taken out one-by-one today - without much of a fight - the buyers are in control. The selllers have to prove they can take back control, by taking back some of the breaks.