Follows dollars lead...

The dollar has been bid in early NY trading, and the EURUSD has tracked lower as well.

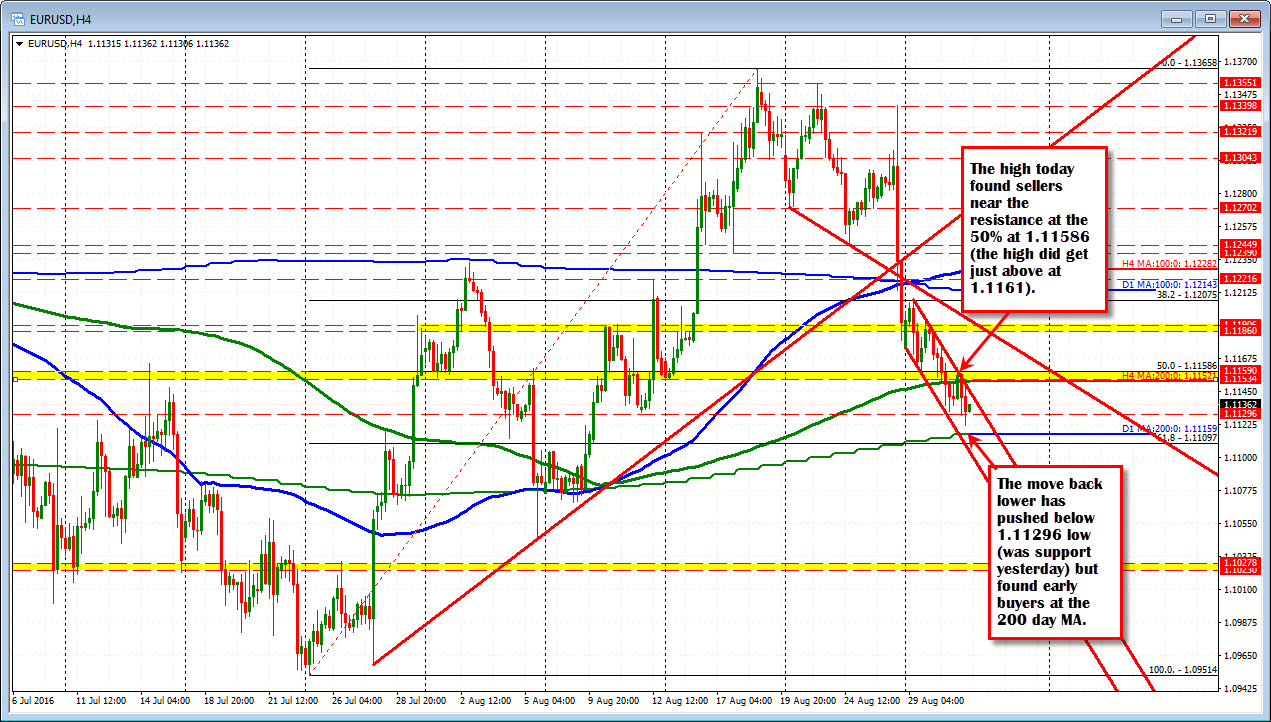

The pair reached new lows for the week/ new lows going back to August 10th. The low is 1.1122. The pair got closer to the key support at the 200 day MA at 1.1116 area. The price has rebounded to 1.1136 currently.

Is the low close enough to the key target?

It seems that traders might have come in early against the key MA level. Pips have been hard to come by with the EURUSD this week (i.e. ranges are narrow still), so traders have lots of time to prepare for it (see post from yesterday:"EURUSD getting closer to the 200 day MA. Slowly the price moves lower"). Time will tell but so far, the traders who were quick on the buying trigger against the MA level are happy.

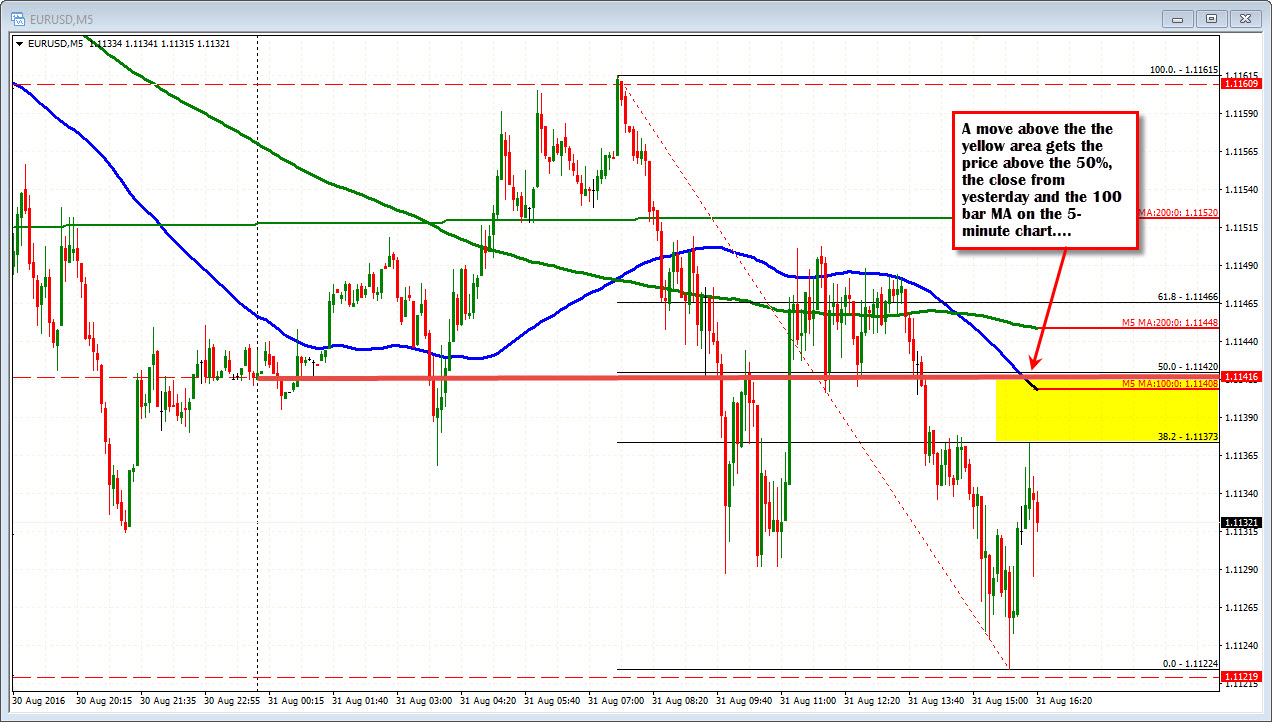

What might make the buyers more happy and signal a more bullish potential?

The midpoint of the day's trading range (it is only about 40 pips so anything can happen), comes in at 1.1142. The close from yesterday is also near that level at 1.11416. THe 100 bar MA on the 5- minute chart below is at 1.1141. Get above those levels and the 200 bar MA at 1.11449 currently, and traders will start to think the test of the 200 day MA was close enough (the buyers will be more happy/comfortable).

Dip buyers are happy but they can get happier above 1.1141-44 area. The range is still narrow so anything can happen. A rally to 1.1142 could just as easily be a sell level for the buyers/or new shorts. A move below the 200 day MA would trigger more selling.