Did someone mention Greece

The action in the EURUSD today, looks like last week...

- Gap lower (the low today got within 14 pips of the low from last Monday)

- Corrected 50% of the gap move lower

- Then moved above the 50% retracement level

In last weeks trade, the price moved to and through the close from Friday and the 100 hour MA. It was a race to higher and higher levels with traders scrambling to buy.

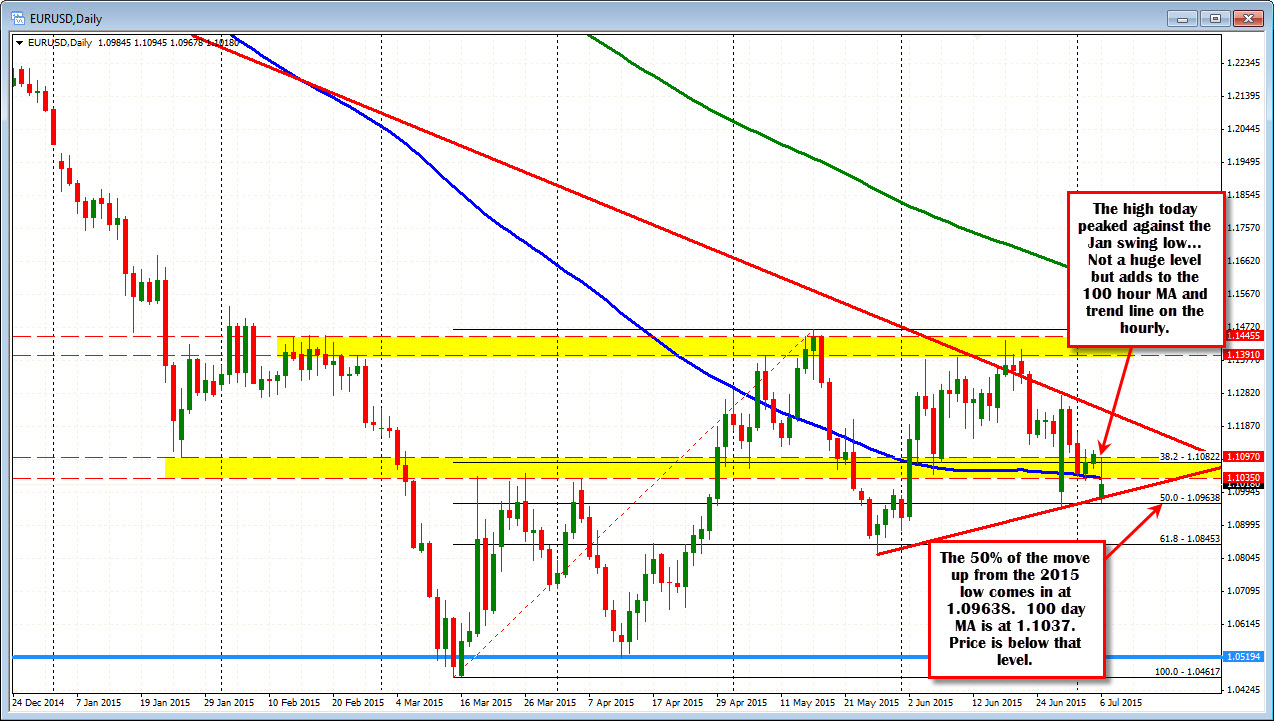

This week, the 100 hour MA at 1.1096 (currently at 1.1092) held the top in the London morning session AND a topside trend line (see hourly chart above - great technical borderline to lean against - the high reached 1.10945) and the price has rotated back lower. In the process, the pair has moved back below the 100 day MA now (at 1.10375).

In the current hourly bar, the price is holding below that 100 day MA (at 1.10373) and that level will be a key borderline to watch for traders now. Stay below bears in control. Move above the buyers may return.

So if I were to summarize the day so far..

- choppy correction

- patient sellers against the 100 hour MA and topside trend line

- sellers trying to keep a lid against the 100 day MA now

We cannot rule out continued choppy trading from now until infinity (or at least until the headlines from Greece continue). So please be patient in this pair.

The next targets on the downside have to be the swing lows from today at 1.1010, 1.0991 and 1.0968.

The 1.0963 is the 50% of the move up from the 2015 low to the May high (see daily chart above). The low today got within 5 pips of that level. The low from last Monday came in at 1.0953.

The markets will continue to be influenced by the action in the Greece but with Greece supposed to put together a new agreement which the creditors may or may not accept, who knows what will happen. So be patient and take into consideration the risks. Later today the Markit US composite PMI and service PMI will be releaseed at 9:45 am and the ISM non manufacturing composite index will be released for June (56.4 estimate vs. 55.7). The data will be a welcomed distraction.