The ride has not been a smooth one for the common currency today

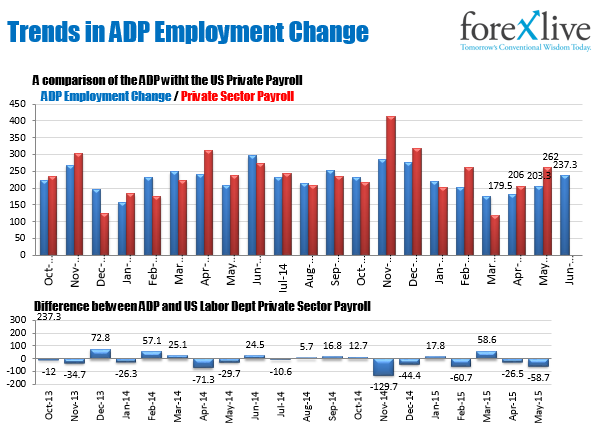

The EURUSD traded at new lows for the day after a bumpy London morning session saw the common currency fall, squeeze higher and then tumble back down. US ADP employment rose by 237K in June which was higher than expectations of 218K. The prior month was revised up 2K to 203K. The US payroll numbers will be released tomorrow (not Friday due to the July 4 holiday) with expectations for 230K. ADP has been running weaker than the US jobs reports with 5 of the last 7 months showing smaller increases than the private sector jobs report from the Labor department (see chart below). So the higher number should be encouraging for Friday's report (or so one might think). ISM employment component data will be eyed on later today.

Looking at the hourly chart, the high today screamed back above the 100 hour MA for a total of 2 minutes (I looked) before reversing and moving back lower. That may have been enough to trigger a few stops admittedly but such are the risks when event headlines from Greece can cause a "fast break the other way".

The pair has extended the days range on the latest fall to the 61.8% of the move from the Monday lows. That comes in at 1.1077. The next major target at the 100 day MA is approaching at the 1.1047 level (see horizontal blue line in the hourly chart above). ON Monday the market fell below the 100 day moving average. When the price moved back above it, the sellers started the short covering surge higher. There should be support buyers against the level on a test today. .

On the topside now, the 50% of the the move up for Monday that the 1.1115 area should put a cap on the topside if the bears are to remain in control. I would expect patient sellers to come in against this area today. A move above the 1.1122 level (50% of the days range today so far), would not be something shorts would appreciate.

WHen the markets are choppy and have fits of up and and down big swings, the market players get antsy. So be patient in your trading.