Muddy comments will make for muddy trading

The FOMC meeting minutes will be released later today, and I have to wonder what can they say.

In the statement they said:

- Economic growth has moderated somewhat.

- Labor market conditions have improved further, with strong job gains and a lower unemployment rate

- Labor market indicators suggests that underutilization of labor resources continues to diminish

- Household spending is rising moderately; declines in energy prices have boosted household purchasing power

- Business fixed investment is advancing

- Recovery in the housing sector remains slow

- Export growth has weakened

- Inflation has declined further below the Committee's longer-run objective, largely reflecting declines in energy prices.

- Survey-based measures of longer-term inflation expectations have remained stable.

- Inflation is anticipated to remain near its recent low level in the near term, but the Committee expects inflation to rise gradually toward 2 percent over the medium term as the labor market improves further and the transitory effects of energy price declines and other factors dissipate

- The Committee continues to see the risks to the outlook for economic activity and the labor market as nearly balanced

- The Committee anticipates that it will be appropriate to raise the target range for the federal funds rate when it has seen further improvement in the labor market and is reasonably confident that inflation will move back to its 2 percent objective over the medium term.

Overall, it is a muddy statement. Sure they took out the word "patient". The Fed wants to tighten at some point. When that is, is not so clear.

The bearish takeaway from the last decision that forced the dollar sharply lower, was the large decline in the target end of year rate to 0.625% from 1.125% - even though it made a lot of sense to put it there. It was simply too high at 1.125%. Also, Janet Yellen tends to talk more dovishly as well. The EURUSD rallied nearly 500 pips. By the next day, it was down by 400 to 1.0600.

Where do we stand now and how should traders look to trade it.

For me, just because it was "dovish" last time does not mean it will be as dovish this time. The full Fed is "talking", so it is a consensus vs Janet Yellen just talking (it is tough to not have a bias).

As a result, bullish or bearish can come down to how the headlines are presented, highlighted, ordered. When it comes down to that risk is increased. It is roll of the dice.

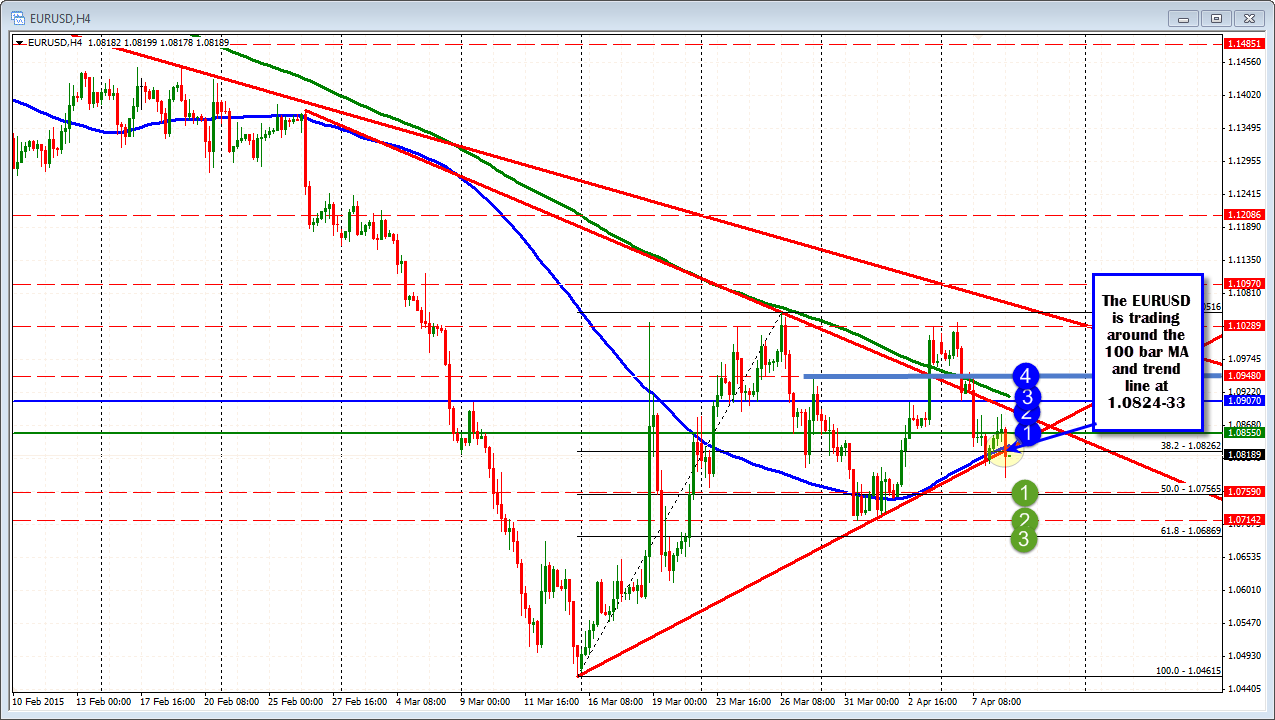

What we know from a technical perspective is the 100 bar MA on the 4 hour chart is at the 1.0833 level and trend line is at 1.0824 level. So this becomes the line in the sand for bullish and bearish.

On the topside, there is resistance at:

- 1.0855 - 200 hour MA (not shown)

- 1.0900-075 - trend line and 100 hour MA (not shown).

- 1.0918 - 200 bar MA on 4-hour chart (green line in the chart above)

That would imply around a 136 pip trading range. That is doable of course. A move above the 1.0918 level would look toward:

- 1.0948, and then

- 1.1000-1.1050 area would be targeted again.

ON the downside., the:

- 1.0756/59: 50% of the move up from the March low and the low for September 2003

- 1.0714 - Lows from March31/April 1 (this would imply a 171 pip range for the day)

- 1.0686 - 61.8% of the move up from March low (about 200 pips)

My guess is the meeting minutes are sufficiently ambiguous to cause a potential move but retracement as well. I don't see a clear path or continuation path.

The one caveat is the market is still so short from commitment of traders, that if the upside is the way, buying a correction of the initial move (say 38.2% of a initial move with a stop if the market moves 50-60% of the move), might be a trade idea. Does it make sense to me to have a position into the report. Nope.