USDJPY making new highs. EURJPY lags, but with EURUSD holding support....

It is one of those tail wagging the dog trades perhaps...

As noted in a prior post,the EURUSD kept finding support against the 61.8% retracement of the move up from the April low.

Meanwhile, over in the USDJPY-land buyers have continued the run higher in the early NY trading hours.

So that combination of EURUSD support and USDJPY strength, has led to the EURJPY getting a boost in trading today. Either that, or traders are simply buying the EURJPY.

Looking at the daily chart, the pair has been moving lower over the last 8 or so days of trading - mainly on the back of the EURUSD weakness. Today the pair traded at the lowest level since May 5 at he 133.085. The 100 day MA looms below at 132.85 area. Close but not exactly a good test of that line. I guess the same could be said on the topside on that chart. That is the price got close to the 200 day MA (green line) back on May 5th. So overall, the pair is trading between those two goal posts - defined by the longer MAs. Eventually, there will be a break one way or the other, but that is likely for another day.

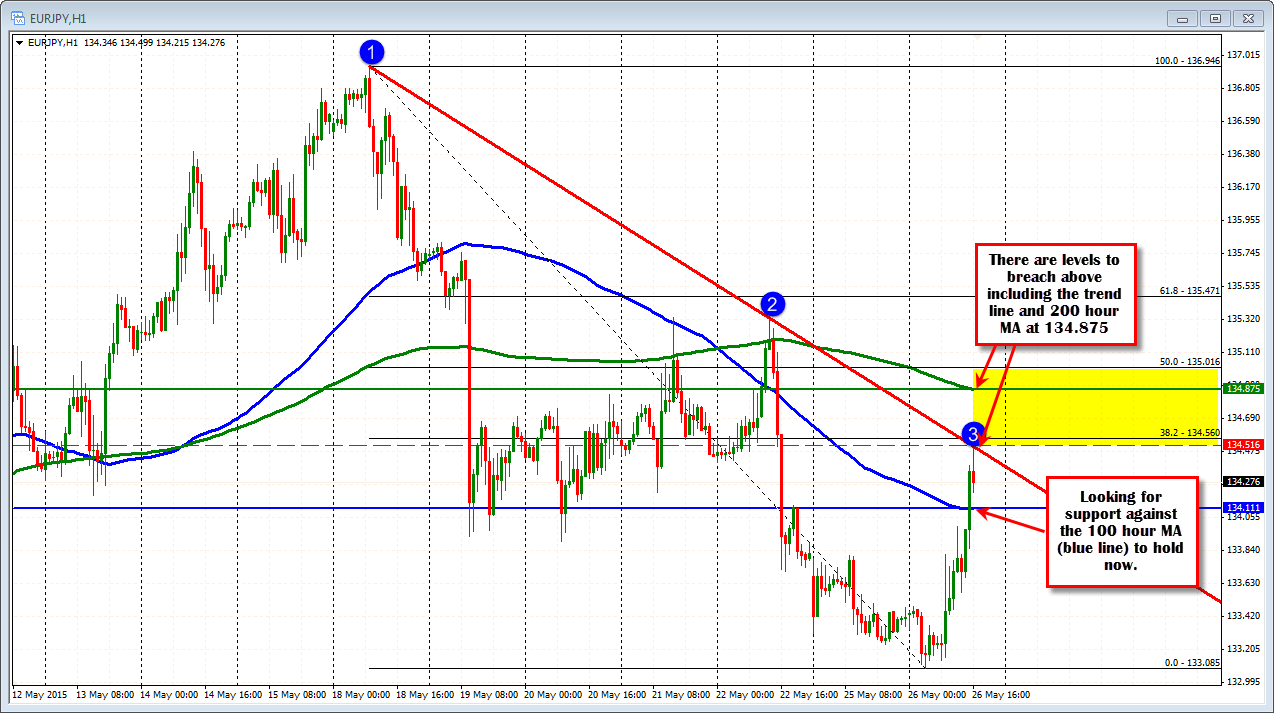

Looking closer in at the hourly chart, the last hour of trading has seen the price move back above the 100 hour moving average (blue line in the chart below). That MA level comes in at 134.11. That level will now be close support for traders. Stay above, and the buyers from below will continue to feel like they are in control - move below and their joy may start to wane. I will give them the control for the day. I expect buyers on dips.

On the topside, the pair has bounced off the trendline on the first test, and remains below the 38.2% of the move lower. So although, more positive/bullish for the day, there is some work to do. Those targets come in at 134.50-56. A move above should gather more buying interest in the pair and will be the next challenge if the buyers want more joy.