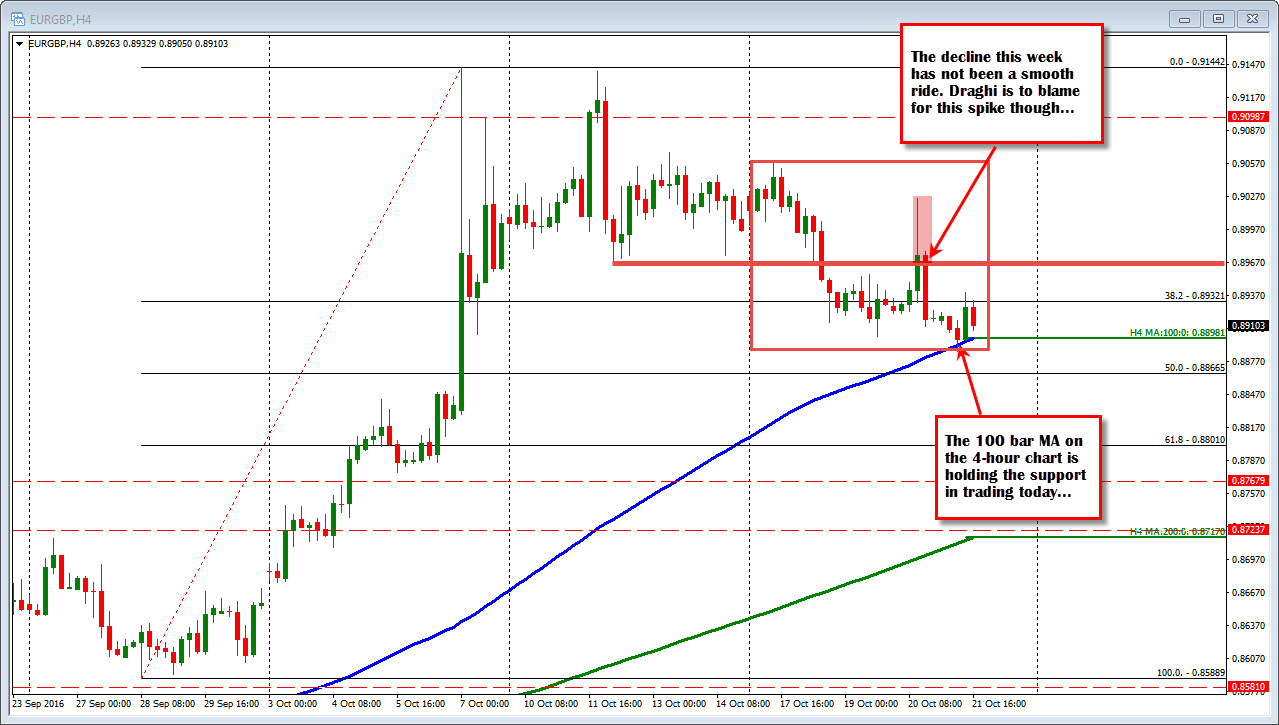

100 bar MA on the 4-hour chart also in that area. Key support going forward for the pair.

The EURGBP has modestly moved lower in trading this week an in the process has moved down to a key support area.

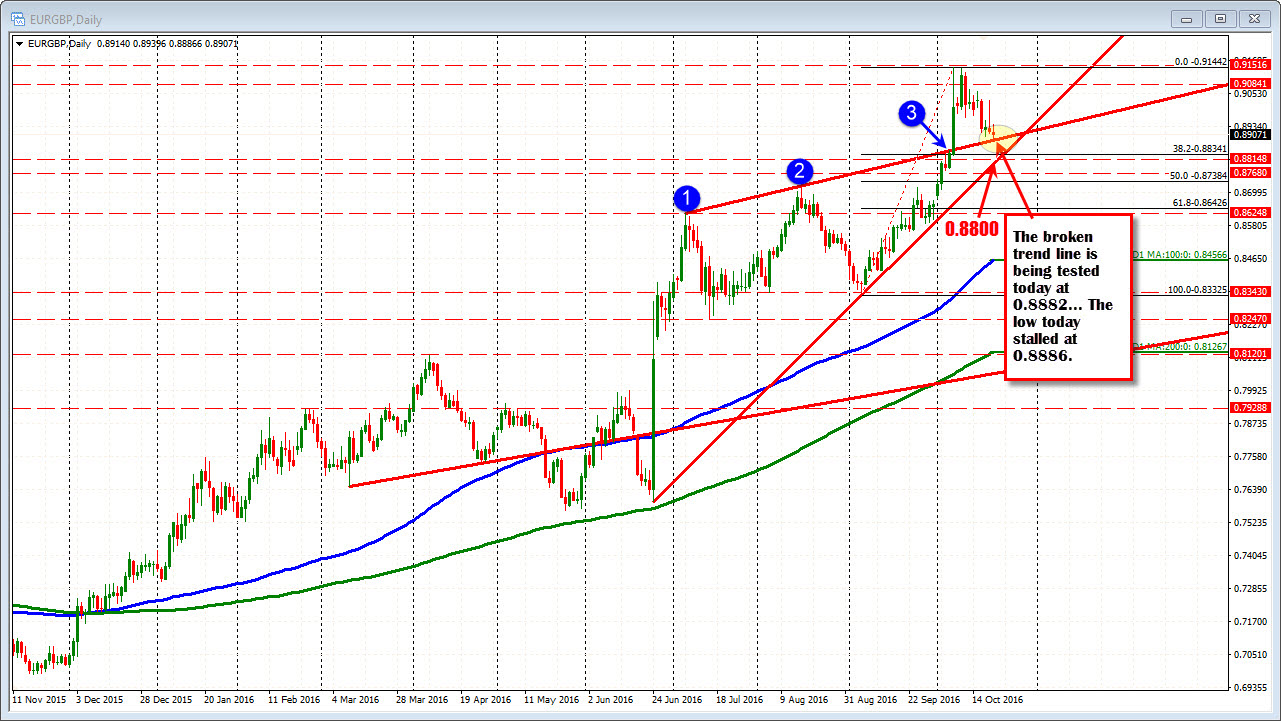

Looking at the daily chart below, the pair moved above a topside trend line earlier in the month (on Oct 7th) and extended to the highest level going back to February 2010 at 0.9144. On October 11, a retest of the high fell short at 0.9140. That helped to start the modest correction lower.

That fall has returned to the line that started the last bullish run. The underside of the trend line connecting the July, and August highs (there was a 3rd test right before the break earlier in the month - see blue circle 3) cuts across at 0.8885. The low today came in at 0.8886 currently . The trend line attracted some buyers at the lows as risk could be defined and limited, and we have seen a rebound (up to around 0.8940).

Drilling down and looking at the 4-hour chart (see chart below), at the lows today, the price was testing the 100 bar MA on that chart. That MA at the lows came in at 0.8889 (the low price extended to 0.8886). The MA currently comes in at 0.8898.

So what we know technically, is that there is some good support on the daily chart at the underside of the broken trend (at 0.8885) and on the 4 hour chart at the 100 bar MA (at 0.8898 currently). The combination will help to define the bias for the pair going forward. Stay above and the move is just a correction. Look for a bounce, and the price to retest (and potentially get back above) broken levels (0.8967, 0.9025, 0.9057, 0.9098 and the highss at 0.9144). Move below and stay below that line and the market will start to move further toward other support/corrective level. Those targets include:

- 0.8865 - 50% of the move up from the Sept 28 low

- 0.8834 - 38.2% of the move up from the September 6 low

- 0.8800 - Trend line on the daily chart above

- 0.87384. 50% of the move up from the Sept 6 low.

Key line in the sand tested today. Going forward (it may be next week) we will see what the price action brings around those key levels.