Closed below the 200 day MA. Then above the MA yesterday. Today back below

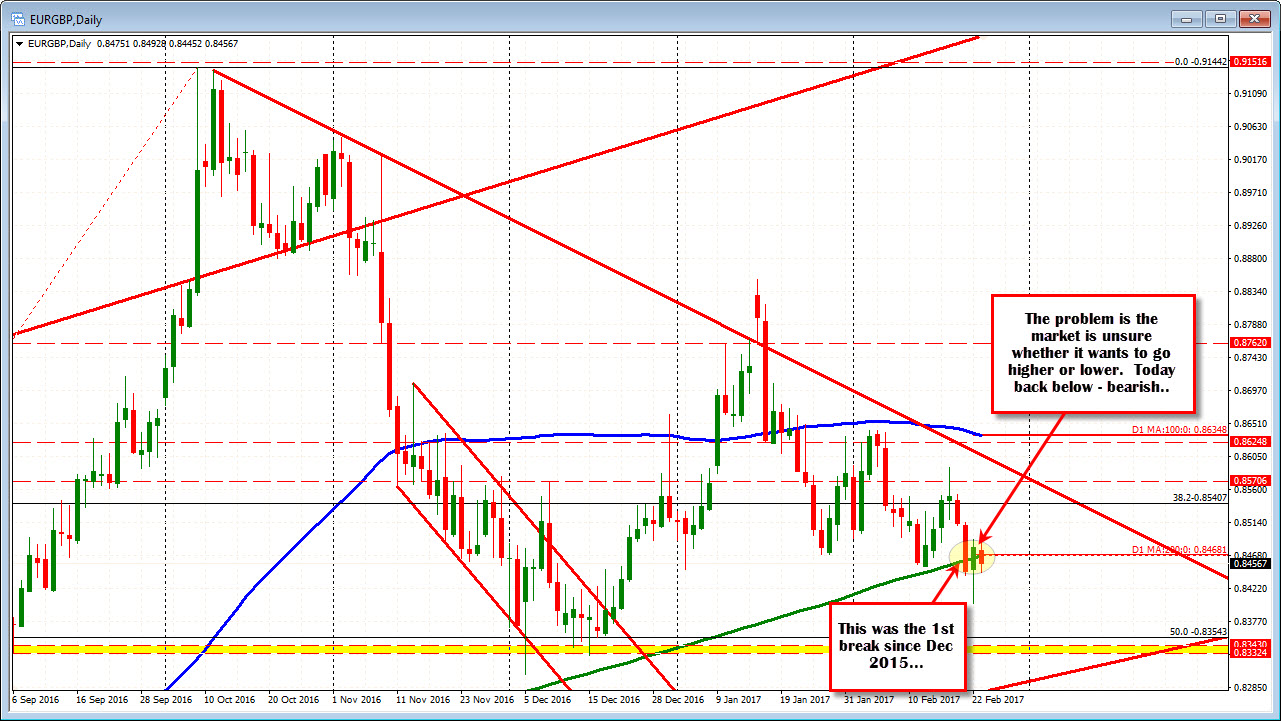

The EURGBP closed below the 200 day MA for the first times since Dec 2015 on Tuesday. Bearish.

Yesterday, that break sent the pair lower, but the price rebounded and closed back above the 200 day MA. Bullish.

Today, the pair is trading back below the key MA (at 0.8468).

The market is messing with us.

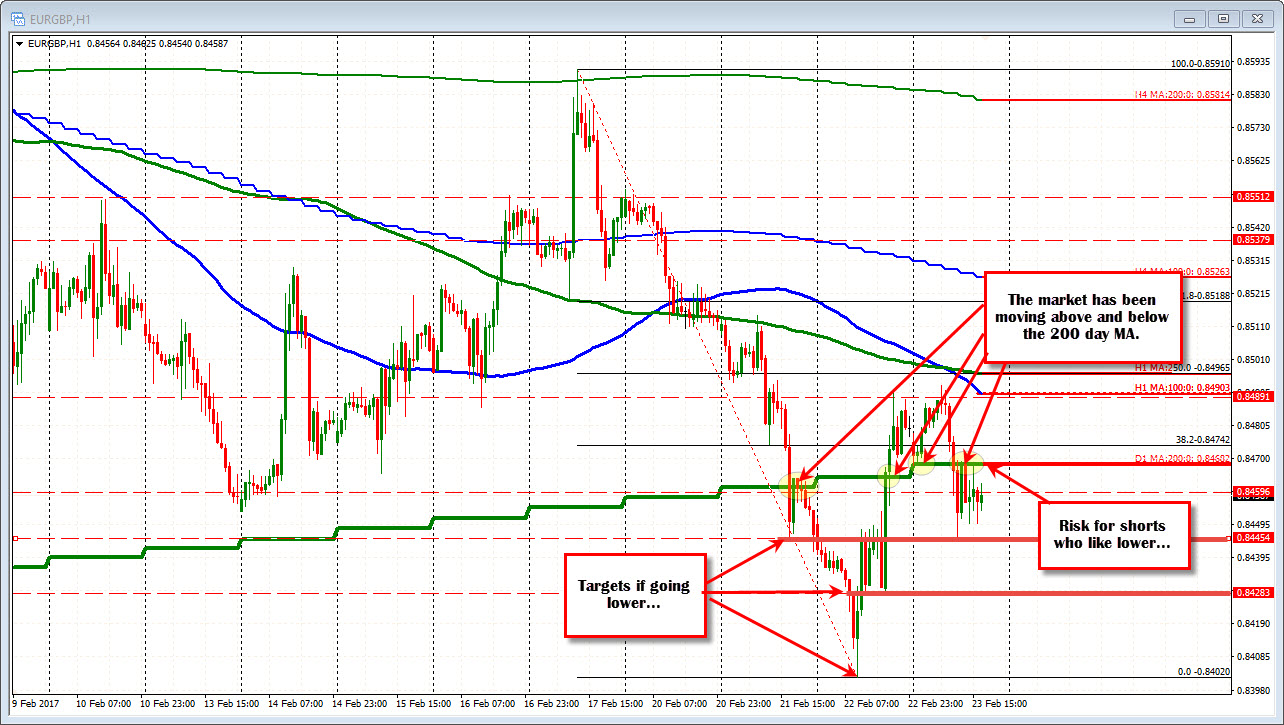

If you look at the hourly chart with the overlay of the 200 day MA, you can see the "markets" struggle around the MA level. There has been stalls at the MA level on all three days. Today traders bought against the level in the Asian session. IN the London session, there was a break back below and over the last 7 or so hours, that MA has been a ceiling for rallies.

So indeed there is a bit of a messing with us with the moves up and the moved down, but the traders seem to be trying to use the level for bullish/bearish clues. Move below = bearish. Move above is bullish. IF you can lean and it holds, you have the potential for a move in the direction of the break.

Right now, bears more in control below the MA line. The target to get and stay below is the 0.8445 level. That was the swing low on Tuesday and again today (traders can buy against that level too if bullish). If that level is broken, the 0.8428 and then the low from yesterday at 0.8402 will be targeted.

On a move back above the 200 day MA and traders will be looking toward the 100 and 200 hour MAs at 0.8490 and 0.8496.