Also moves further away from ceiling area...

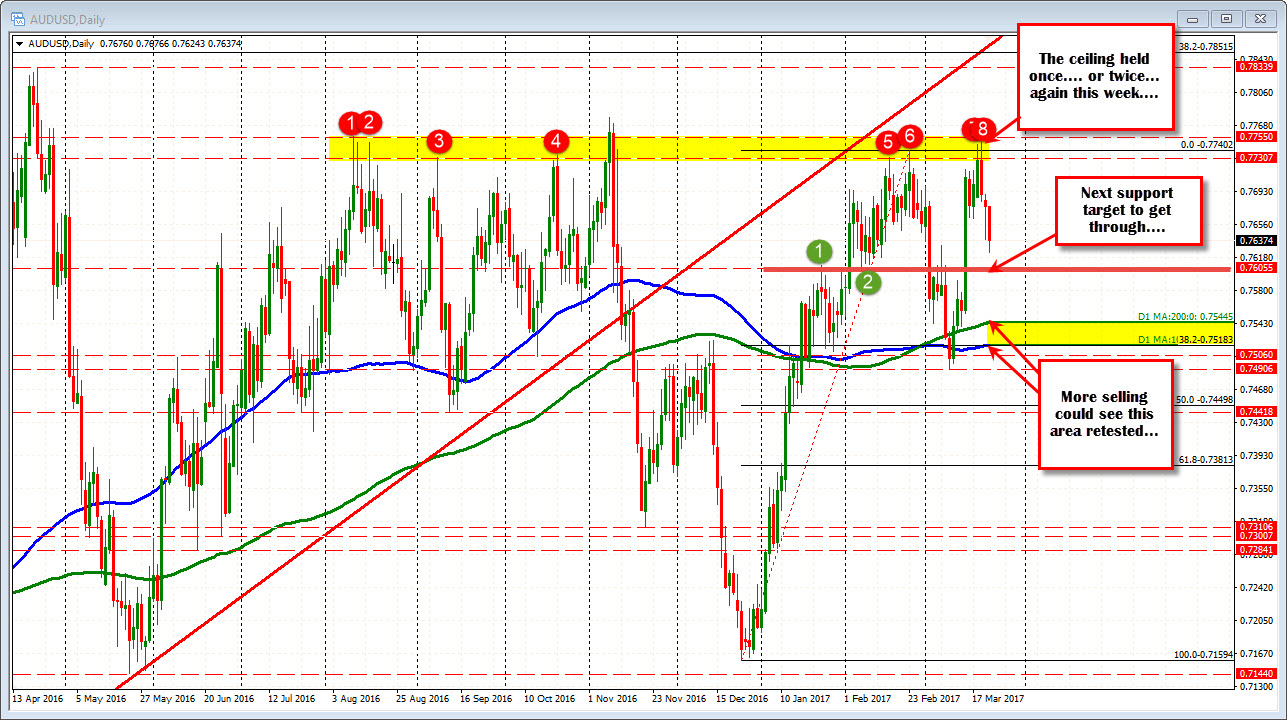

The AUDUSD moved up a key resistance area at the 0.7730-55 area on Monday and Tuesday. The ceiling area has been defined by swing highs going back to August 2016 (see red circles on the daily chart below). The high reached 0.7747 and 0.7749 respectively.

The failure to extend above the ceiling, has moved further away from that ceiling over the last 3 trading days.. The move lower started when the stock market got hammered on Tuesday. Do we need a "No" and the expected tumble in stocks to send the pair lower going forward? On a "Yes" do we get a dollar rally that sends the AUDUSD lower as well OR does a "Yes" send the risk pairs like AUDUSD move higher? On a "No Vote" (i.e. a postponed vote), what does that do? What do you think?

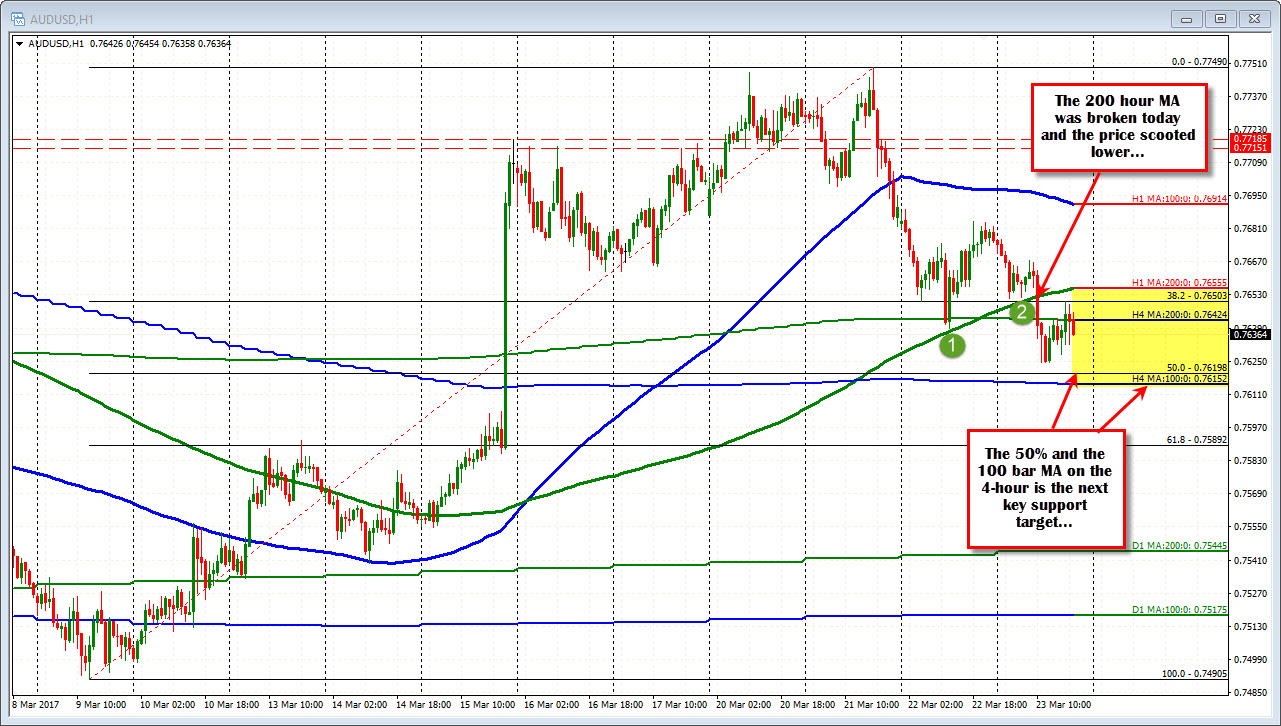

Looking at the hourly chart, the pair has moved between the 200 hour MA above at 0.76558 and the 50% of the move up from the March 9 low AND the 100 bar MA on the 4-hour chart at 0.7615-198. Those levels bracket the bulls and bears. Move above the 0.7655 pushes the technical story more to the bullish side. Move below the 0.7615 and that technical story tells more of a bearish story.

We held a key ceiling.

The price has moved to a more neutral area before a key event.

That happens often.

The question now, is how the story plays out? The "market" will decide. The price action and technicals will play a part in how that story is written.