But buying beers in Europe is getting cheaper for us Brits ;-)

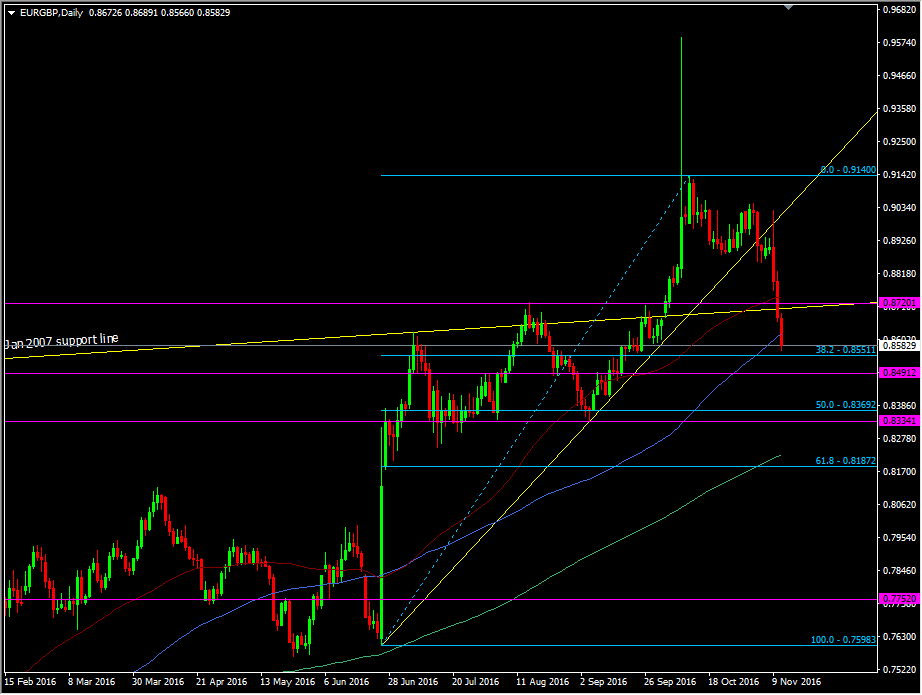

The move in EURGBP is quite astounding. We've lost over 450 pips in three days.

EURGBP daily chart

That's a very strong move and quite possibly confirms a complete change in the trend. Technically, the levels have been less than helpful. I was watching 0.8720 and the 2007 support line and it breezed through. The ma's we're largely ignored and nothing seems to be able to halt the slide. As we know, at some point we'll stop falling somewhere, and one place that may put up a fight is at the 38.2 fib of the Brexit vote jump. Below there is the S&R action around 0.8490/0.8500. This pair isn't really known for its volatility so there is a good chance to see some of the fall retrace. However, if we are seeing a real trend change, that may not get very far. If we do then the broken levels back up towards the 2007 line and 0.8720 is where I'd expect to see the strongest resistance coming in.

Should we continue lower there's a big area to watch down at 0.8320/40. Why is this an important level? It marks 1.20 in GBPEUR.

GBPEUR monthly chart

It's a significant level, as most big round numbers are and we can see that it one that's worth watching. We don't often look at this pair in reverse but I was curious so I checked with Mr Interbank (Mike) who says that probably around 90% of interbank physical and corp traders (cross purposes in my chat with Mike) trade it as GBPEUR, so they will be looking at this level too. That's still some 350 pips away, so it's one to jot down and remember.

So why are we seeing such a move?

I think there's a mix of factors at play.

The BOE turning neutral changes the possible interest rate dynamics between the UK and EU

Sentiment around the ongoing Brexit mess is currently leaning towards a non-hard exit, after the court case

Sentiment around the ECB is leaning towards them continuing QE

The US election, as we've seen, has not been the scary mess some thought it would be and the buck has strengthened. The Fed is now potentially clear for a Dec hike

Simply put, there's more reasons why the euro should falling than there are for it rising, and sometimes that's all it takes.

If you're short then you want to squeeze as much as you can out but you'll need to watch the approaching tech levels to make a decision. If you're long, you need to think about where this might be going. If you want to take a short or a long, you need to wait until we see the stronger levels.