Trades near days highs

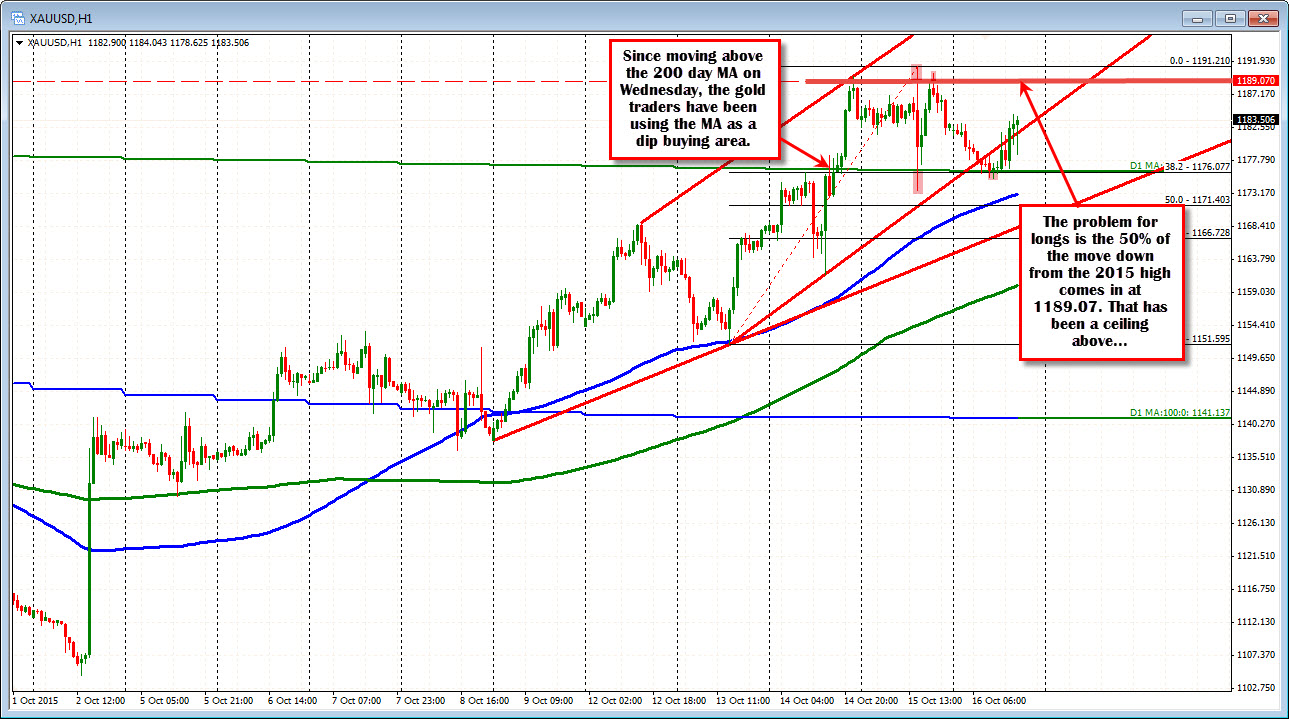

Gold moved above the 200 day MA on Wednesday. It was the 1st venture above this moving average since a 4 day period in the middle of May.

The price has been able to spend most of the trading time since then, above the key MA. There was a single hourly price bar that dipped below yesterday. That look below failed. Today, the dip below was very small and there has been a modest rally higher over the last few hours.

So bulls are trying to keep control above that MA line.

What is not so bullish is that the 50% of the 2015 trading range comes in at 1189.07 and the peaks above that level yesterday found sellers.

As a result, there is a little bull, and a little bear in the market at these levels.

I will give the benefit of doubt to the buyers being above the 200 day MA, but traders will be looking for some follow through buying at some point. If not, the rally higher that has seen the price move from 1104.50 to the high of 1191.20, may correct back down.

PS. Gold is trading around the closing level from 2014. So the market seems to be at a crossroad that has traders taking cleansing breathes before taking the next plunge.