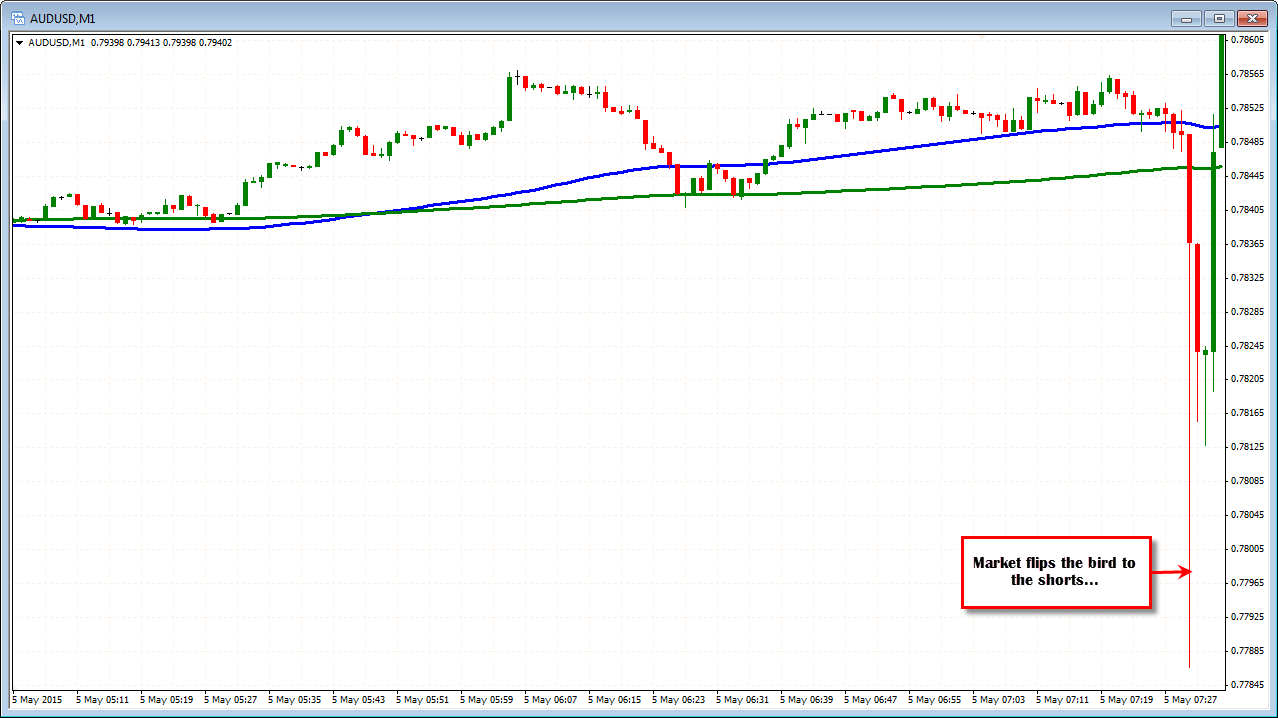

Cut rates and quick in your face rally

The recent history has shown the AUDUSD move sharply before the interest rate decisions and move in the direction of the decision. It was as if the data was leaked. An investigation, put the blame on liquidity conditions. Whatever.

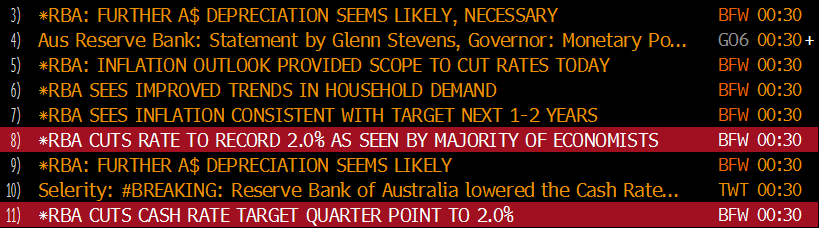

For this meeting, there were articles in the press saying the RBA would cut despite the better data. A perfect opportunity to sell before or on the news. After all not many CBs are cutting rates, Steven's was more dovish at a speech a few weeks ago in NY. Maybe they know something the market does not know about the 2nd quarter. The stage was the RBAs.

The cut and headlines came out, the price tumbled and the chart gave the sellers the equivalent of "flipping the bird" to the shorts. Within 3 minutes the 62 pips decline was reversed. Two minutes later, the price was 50 pips higher. Currently, the AUDUSD is up 111 pips on the day.

We of course know the RBA omitted the sentence "further easing the policy may be appropriate over the period ahead" (so it was not highlighted in the headlines), which had traders scurrying to cover shorts as it may signal the end of the easing cycle. The surge higher in the AUDUSD during the NY session has been helped by a dollar bashing across the board.

However, in my deepest "good wins over evil" conspiracy theory brain cells, the script was to catch the thieves who have been benefiting from leaked information and teach them a lesson - a financial lesson. The crooks did not come in the 30 seconds before (that would be too obvious) but on the number. The headlines were mostly bearish. They had the sells timed electronically. Instead of seeing the market gap and run in the direction of the break, the price gapped and ran the other way. Sting. Stang. Stung.

For us mortals on the "good" side, it stinks because some may have been stung selling as well.

If we can learn a lesson, it would be that it is always best to ignore the first move, and get in on a correction with a stop - even if you miss the move. I like to limit any correction on a spike to 50% - maybe 61.%. If it goes above that, something is up, and get out with a small loss ...There will always be another trader. After all, that "something" may be an omitted sentence, a technical level holding or may even be a sting set up to catch some crooks (in my crazy minds eye at least).