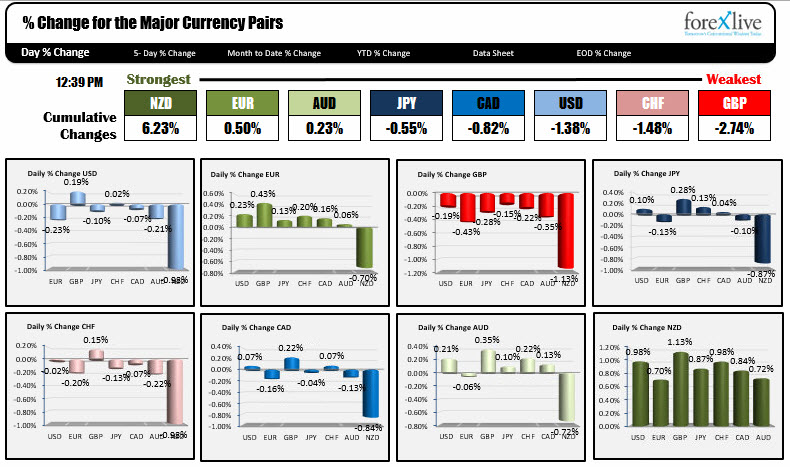

NZD remains the strongest currency...

As London traders hit the pubs or head home on the trains, the NZD remains the strongest currency. While the GBP is the weakest. That makes the GBPNZD the biggest mover and indeed, it has moved 1.13% from the Friday close.

What do the technicals tell me/us?

Looking at the 4 hour chart, the pair has been trending higher since the January 16th low, and more so since the March 13th week.

The high reached 1.89586 on May 11th. That high occurred after Gov. Wheeler and the RBNZ kept rates unchanged and added that rates would remain the same past 2018. The price moved above the double top at 1.8875.

Bullish right?

Well for about 80 pips, but since that high, the price has been chopping back and forth - mostly below the 1.8875 double top from April 28th and May 4th (red circles). "Mostly" because on Friday, the price moved above the 1.8875 to a high price of 1.88975. However, that "break" failed.

The price today has now moved below the 100 bar MA on the 4-hour chart and trades at the lowest level since May 3rd. The fall took the price below the low floor at the 1.8605 (close risk level for shorts now). The low just reached 1.85865.

Is the high in place?

There is work to be done. Staying on the 4-hour chart, the price needs to get below the 1.8544 and then the 200 bar MA on the 4-hour chart at 1.84329. Nevertheless, you can argue that a corrective move is underway.

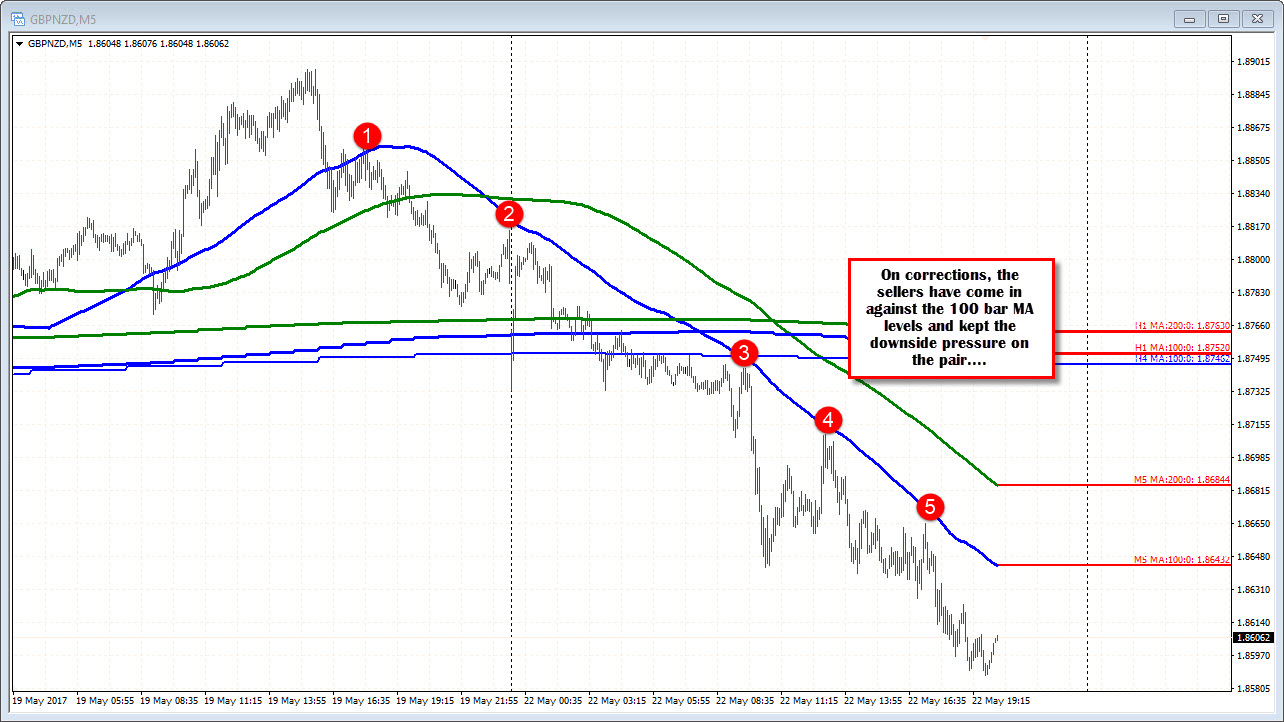

Drilling to the 5 minute chart today, the pairs price action has been trending. The corrections have been limited. The price has stayed below the 100 bar MA on the 5-minute chart (currently at 1.86439). For traders looking for more downside, staying below that MA would be another risk defining level. The 200 bar MA is a level to eye.

Yes...the GBPNZD is the biggest mover today. There has been some levels taken out on the downside, and certainly, the price has trended lower today. Is the top in place? There is more work to do but if the price can stay below overhead technical levels, the tide may be turning.