Tide turns but battles still being waged between buyers and sellers.

Draghi's comments stirred the hornets nest for the EURUSD and that is having a knock on effect for some of the other currency pairs as well. The latest (and the market has been up and down), is in the favor of the dollar. The greenback is moving higher. That does not mean that battles are not being waged at key levels, but the bias has simply turned more dollar bullish.

Below is a snapshot look and thoughts on some of the pairs currently (with thoughts).

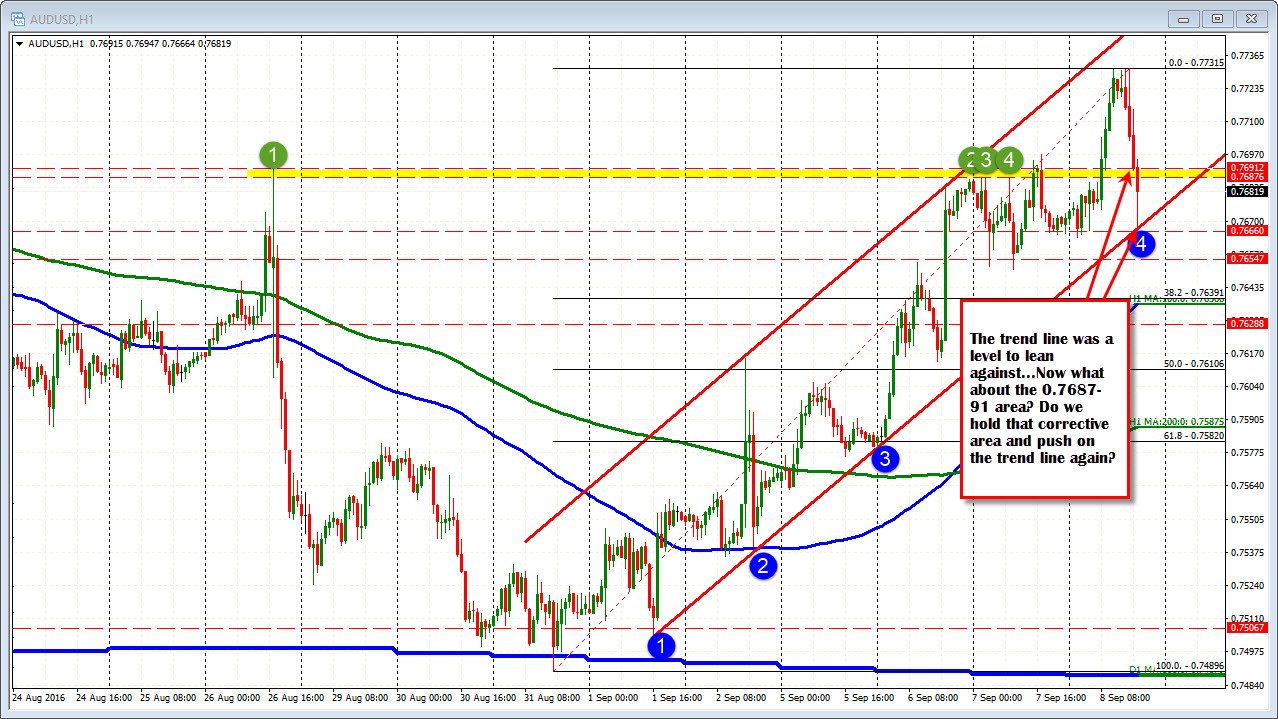

EURUSD.

The EURUSD went through some choppy waters but rallied above the aforementioned 1.1318 trend line through Draghi's presser. The two separate moves above that level took the price to 1.1326 and 1.1325 respectively, but those pushes failed each time - and fairly quickly. The fall has now taken the price below the support outlined before the whole battle started at the 1.1272 level (see earlier post here). The same question applies at the bottom as it did at the top...Can the price stay below the 1.1272 level?

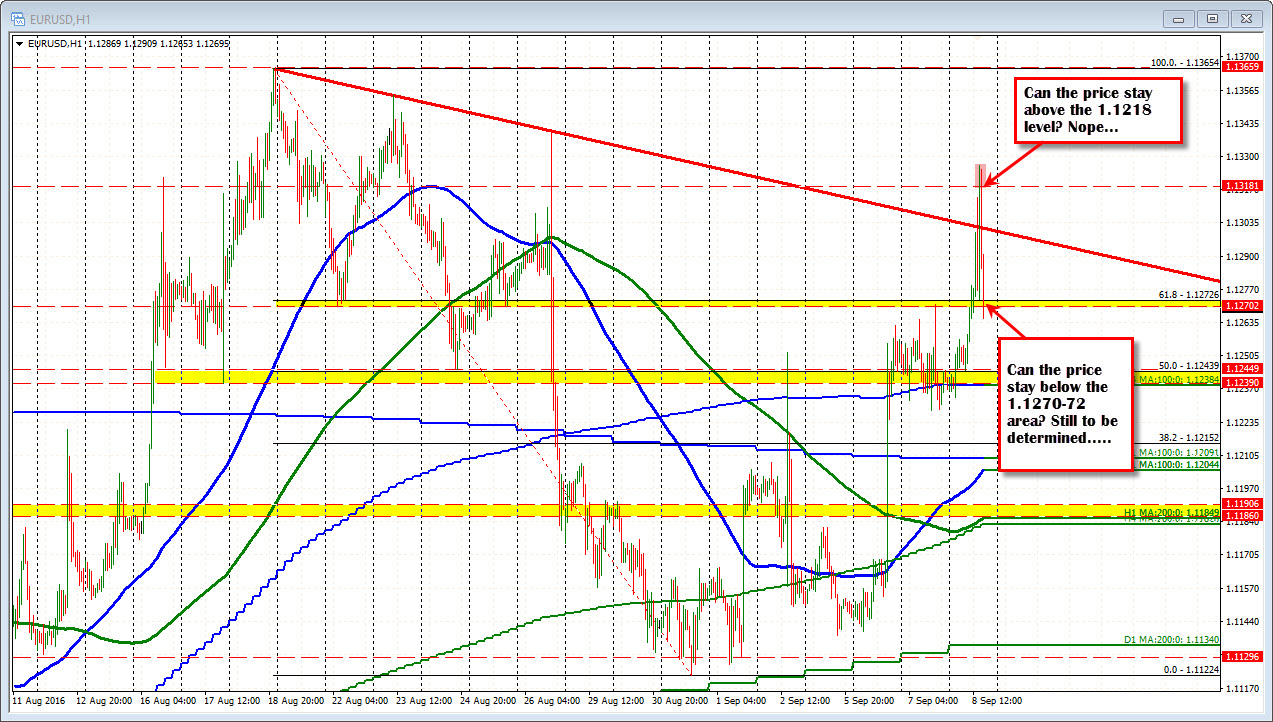

GBPUSD

The correction in the GBPUSD stayed below the 100 hour MA (the sellers meant it when they moved below the 100 hour MA I guess). The fall took the price below the 38.2% at the 1.3296. The next targets are at 1.3272-78 (see yellow are in the chart above). The 50% and 200 hour MA is a formidable support target on the downside. The pair should find support buyers on the first test with stops below. The low from yesterday at 1.3318 will now be eyed as resistance intraday.

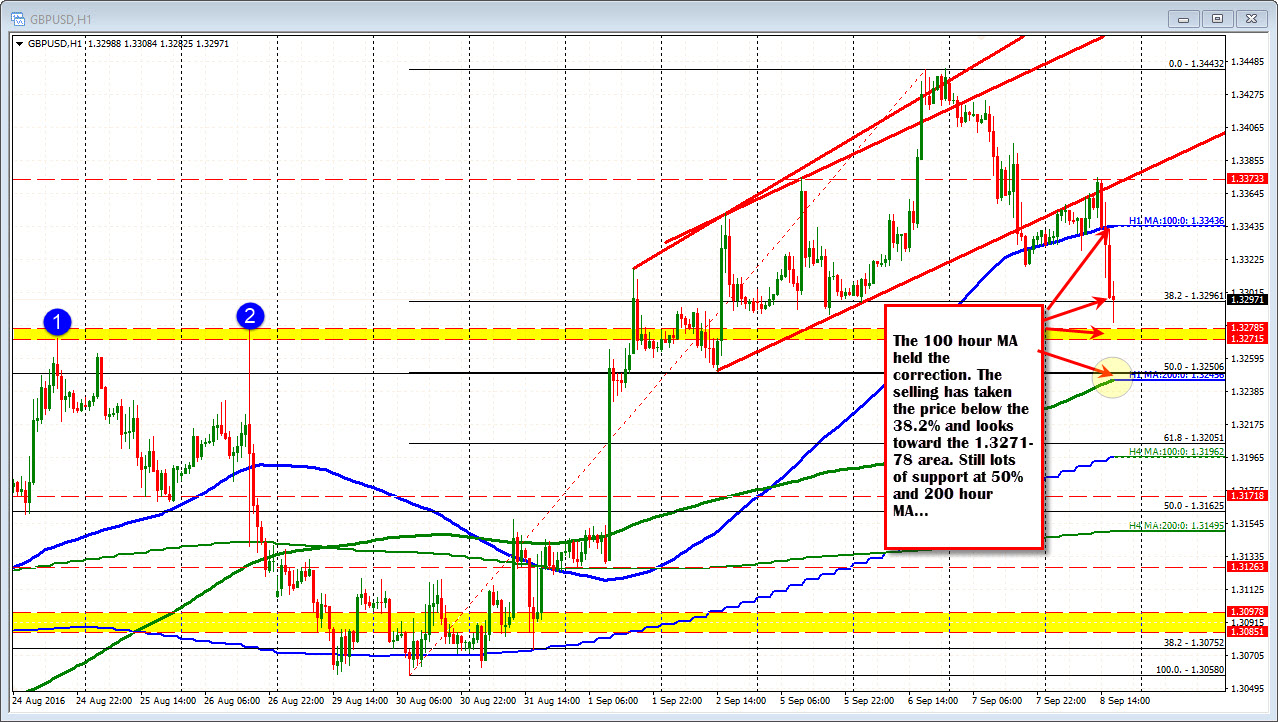

USDCAD

The USDCAD moved above the 100 hour MA at the 1.2907 level. There is another key resistance target at the 1.2941-45 area where the 100day MA and the 100 bar MA on the 4 hour chart is found. Good support below. Good resistance above.

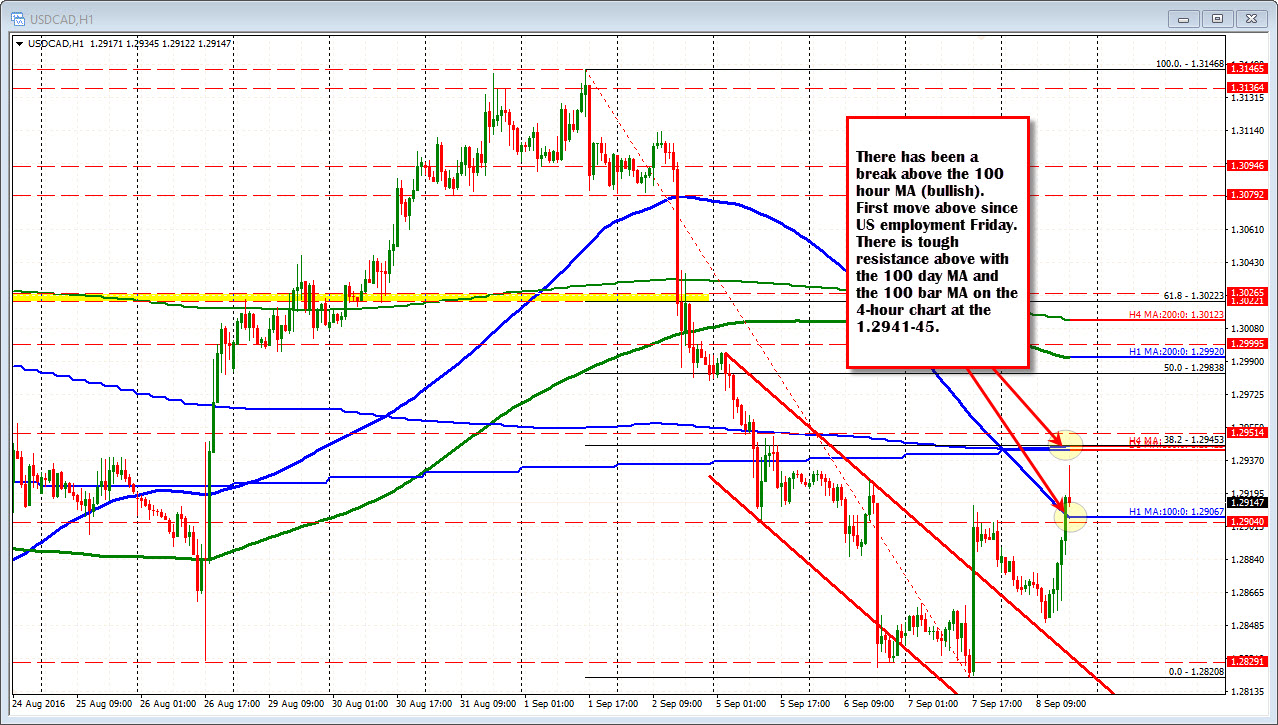

AUDUSD

The AUDUSD was looking weak, but it did run into a nice trend line at the lows. So we are seeing a bounce.