CAD stronger after stronger-than-expected manufacturing sales

The USD is down a little after the US data today. The Philly Fed business outlook get to 22.7 versus 24.6. Initial jobless claims were higher at 249K versus 235K.

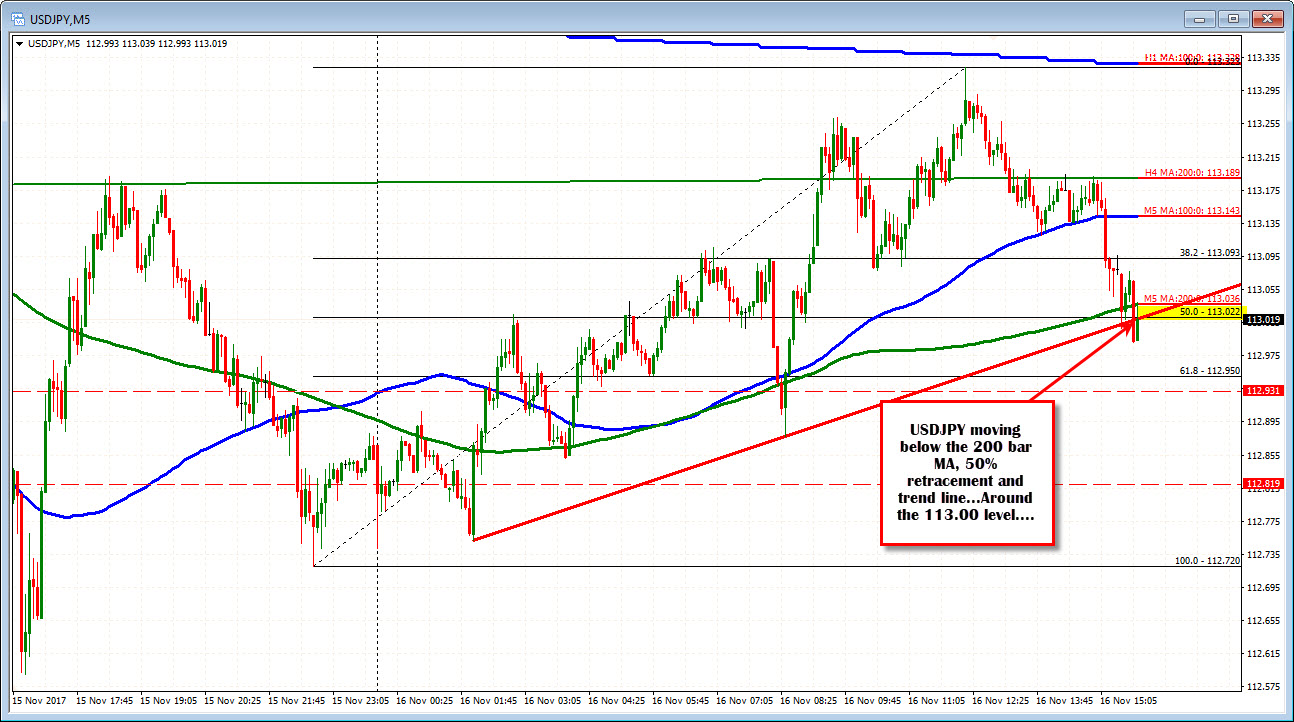

For the USDJPY, the price has moved back below the 200 bar MA (green line in the chart below), a trend line connecting recent lows, and the 50% retracement of the move up from the NY afternoon low yesterday (see yellow area in the chart below). Earlier in the day, the bias turned more negative when the price fell below its 100 bar MA (blue line in the chart below currently at 113.143). Staying below the levels, keeps the sellers more in control.

The GBPSUSD is moving to new session highs for the day. It is the strongest currency of the day. The EURUSD is recovering some of it's earlier losses SLOWLY though.

In Canada, manufacturing sales increase by 0.5% versus -0.5% estimate. That has the loonie trading at new highs vs the USD (USDCAD lower). The USDCAD approaches the converged 100 and 200 hour moving averages at 1.2730 level There is also a trend line that cuts across at that level. KEY TARGET and support level for the USDCAD. Yesterday, the pair stalled just ahead of the 100 hour MA but on the trend line.