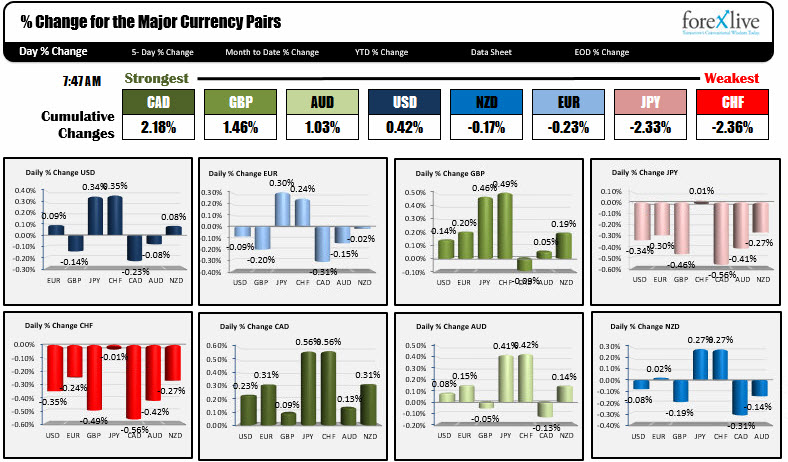

The CAD is the strongest. The CHF is the weakest.

The snapshot of the strongest and weakest currencies are showing that the CAD is the strongest while the CHF is the weakest. The USD is mixed in Monday morning trading - rising against the EUR, JPY, CHF and NZD and falling against the GBP, CAD and AUD. The USDCHF and USDJPY are the biggest movers.

Another big mover today is Gold. It was tumbled over -$15 lower (it was lower by as much as $20 at the lows. The dollar is up a little but certainly not running away. As Mike speculates, it may just be a big seller or some risk on trading as well.

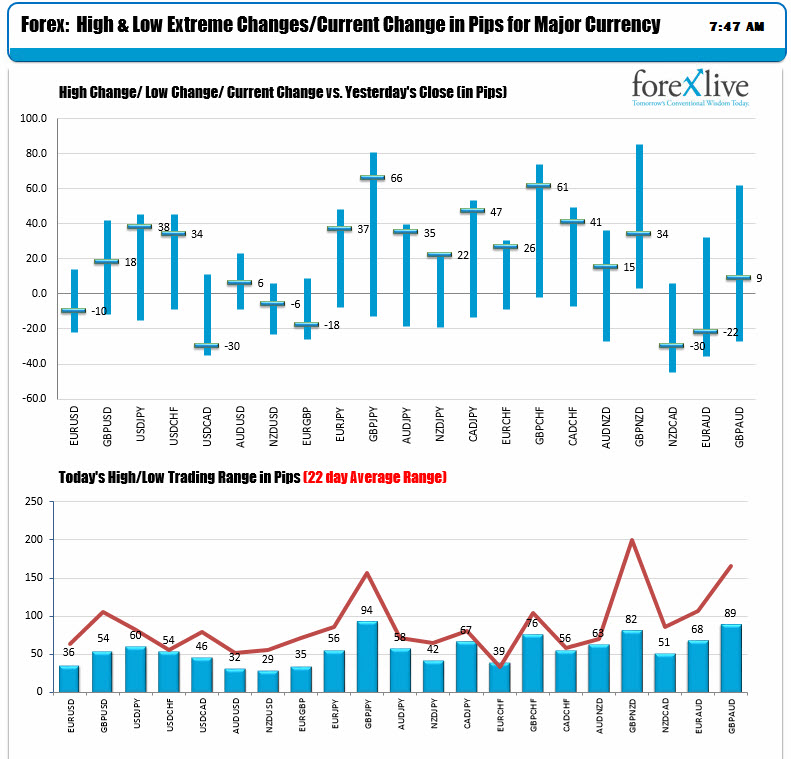

The low to high trading ranges are running a bit light vs the 22 day averages (lower chart below). The EURUSD range is only 36 pips. The AUDUSD is even lower at 32 pips. The USDJPY has the largest trading range vs the USD at 60 pips (most of it is to the upside and it trades near the session highs as NA traders enter for the day).

In other markets:

- Spot gold -$15.85 to 1240.87.

- WTI crude oil +$0.12 to $43.13

- US stock futures are higher: Dow futures up 73 points. S&P futures up 7.0 points. Nasdaq futures up 28.25 points

- US yields are little changed: 2 year 1.344%, +0.4 bp. 5 year 1.758%, unchanged. 10 year 2.1439%, unchanged, 30 year 2.7154%, unchanged.

US durable goods orders will be released at 8:30 AM ET/1230 GMT. The estimate is for the headline to come in at -0.6% vs -0.8% last. Ex transportation is expected to rise by +0.4% vs -0.5%. Cap good orders non defense ex air +0.3% est vs +0.1%. Cap goods shipments non defense ex air, +0.3% est. vs +0.1% last.

The Chicago Fed Nat Activity index is expected to fall to 0.20 vs 0.49 last month. It too will be released at 8:30 AM ET.

Dallas Fed mfg index for June will be released at 10:30 AM ET with estimate for a dip to 16.0 vs 17.2 last.