A quick summary

- US leading index was up as expected at 0.3%

- The Senate healthcare proposal is out and there are some republicans who say they will vote against it. There is only a 2 vote cushion for the Republicans on the vote. Right now, the call is for the "nays" to be greater than 2. The vote will be next week (if not pulled).

- US yields are a little lower although the 30 year is unchanged.

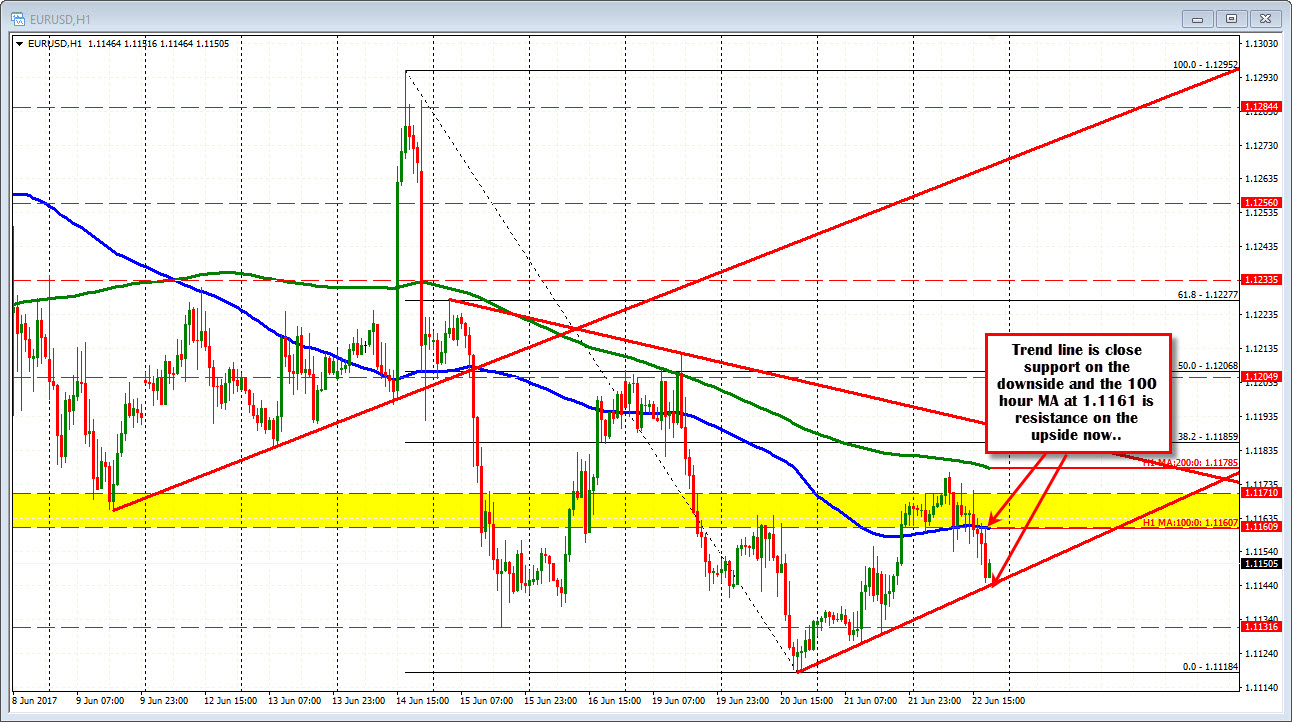

The EURUSD has wandered further away from the 100 hour MA at 1.1161, but let's be honest....the range for the day was 24 pips at the start of the day. The range is 32 pips now. The low reached 1.11449. A trend line on the hourly chart comes in at 1.1144 currently.

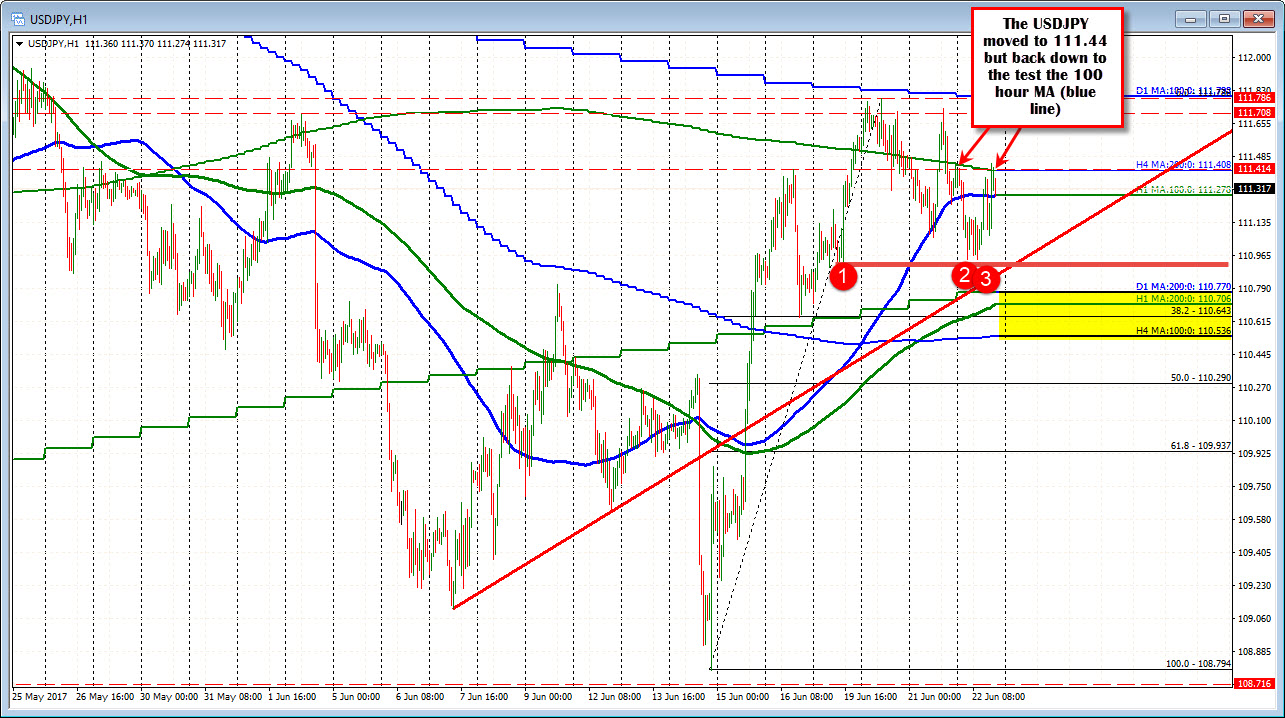

I know the price of the USDJPY move above the 200 bar MA on the 4-hour at 111.41 (high reached 111.44) but is back lower (see hourly chart). The 100 hour MA at 111.278 is being tested below. A move below swings the very small pendulum more to the downside. The price is little changed on the day. The price did move lower, but it did not go far either.

The USDCAD has been the big mover in the US session. The price fell below the 200 and 100 hour MAs at 1.3263 and 1.3259 respectively and stayed below. That gave sellers the confidence to sell further and the price has moved to a swing area at 1.3203-10. There is some profit taking. Sellers are in control. The fundamental data supported that view (and the view of the central bankers too).

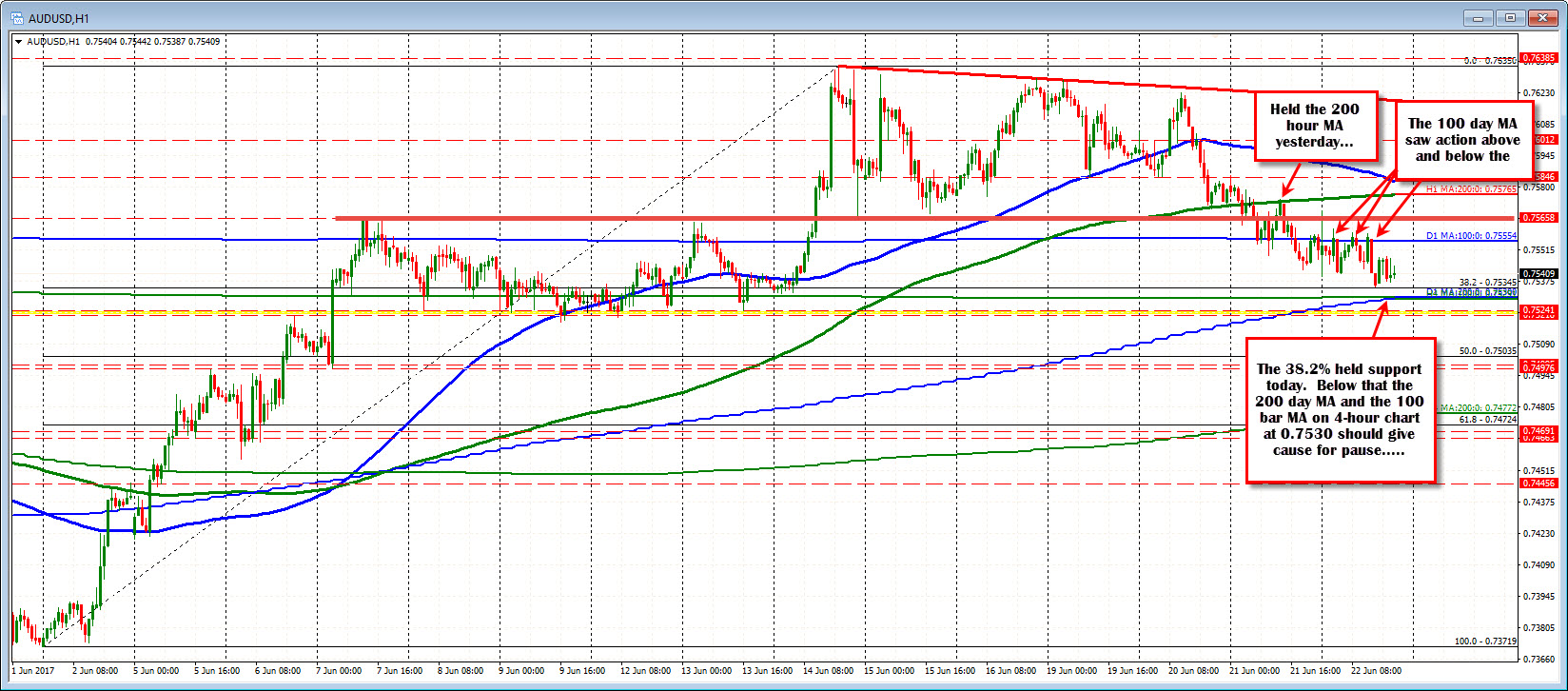

The AUDUSD (see chart above) saw the price rise stall against its 200 hour MA yesterday and continue below the 100 day MA at 0.7555 today albeit with some hesitancy. The 38.2% of the move up from the June low stalled the fall at 0.75345. Below that, the 200 day MA and the 100 bar MA on the 4-hour chart at 0.7530 make the downside sledding tough. There is just a lot of support (add the 0.7521-24 too).

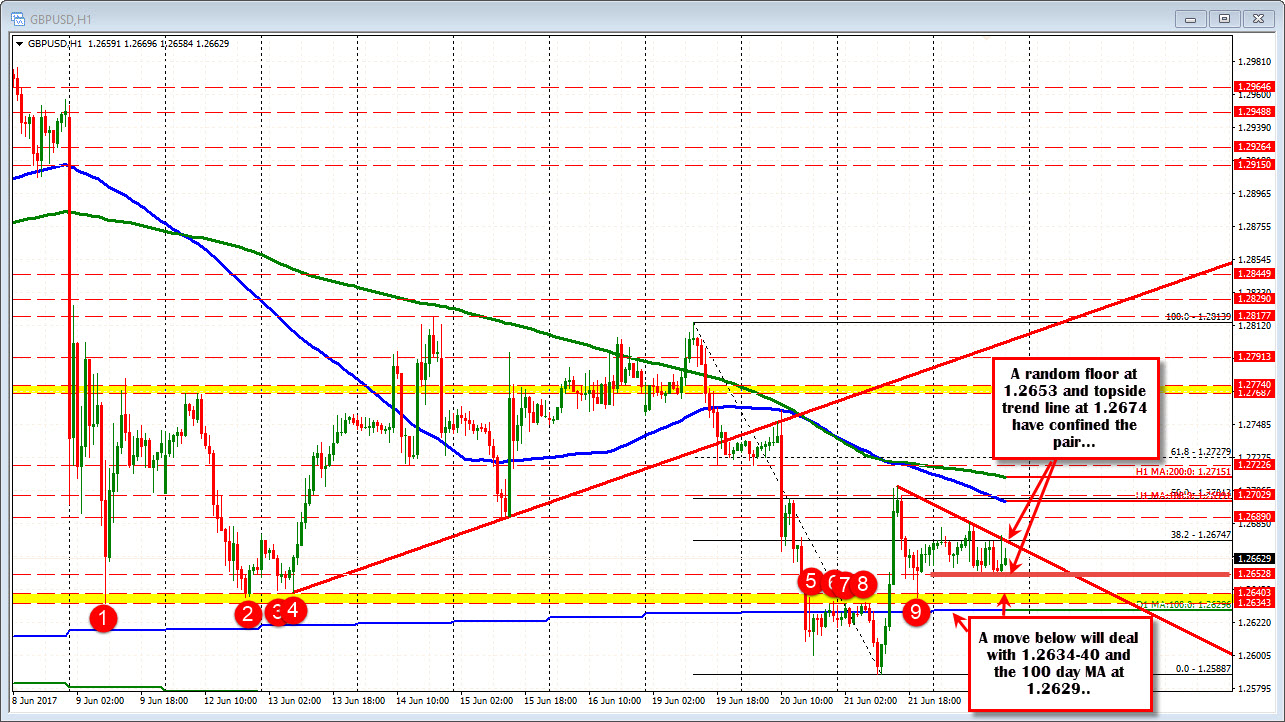

The GBPUSD is taking a holiday today. For the technical review click here, or just see the picture above.....