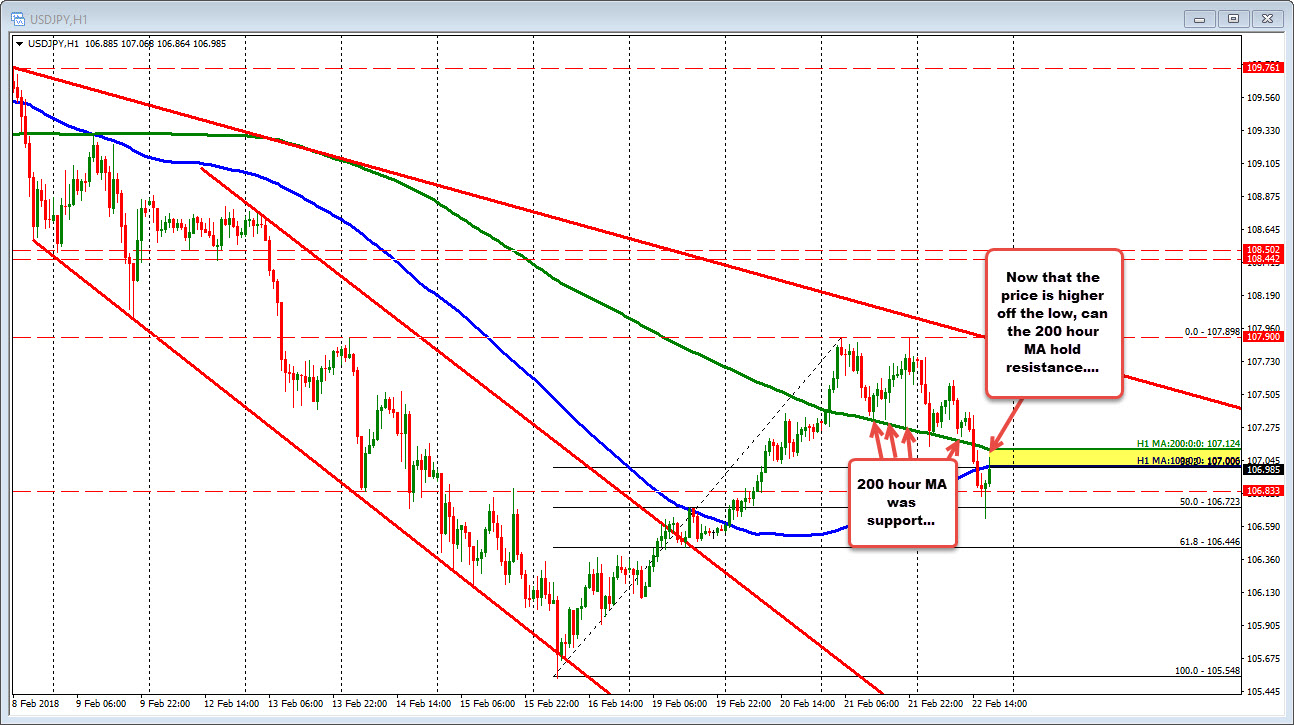

Can the old support MA, now keep a lid on the correction?

The USDJPY used the 200 hour MA as support in trading yesterday and for parts of today.

In the early NY session, the MA was broken followed by a break of the 100 hour MA (blue line). The fall took the price below the 50% retracement at 106.723 but that move was short lived, and the move has now taken the price back toward the MA levels.

The price high on the correction just reached between the two MAs (the 100 is at 107.00, the 200 hour is at 107.124), but is backing off. The technical question is now: "If the 200 hour MA was support, can it now be a ceiling?"

That MA is now a risk level for dollar bears. Stay below more bearish. Move above and the waters are more muddy.

PS Yesterday the USDJPY stalled twice against the 107.90 level. Going back to Feb 14, that level was also a swing high. That got the ball rolling to the downside. The break of the 200 hour MA was the next technical step to the downside.