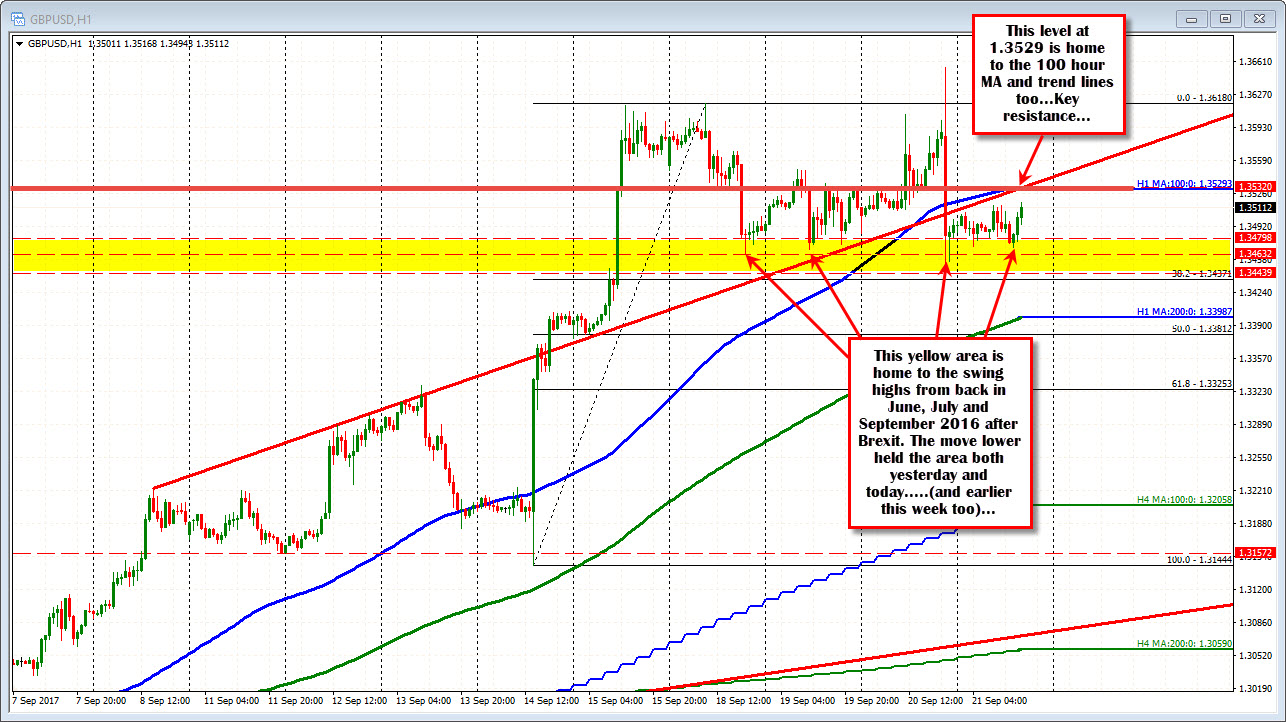

Post-Brexit corrective highs below. The 100 hour MA and trend line above.

I have spoken a lot about the post-Brexit highs from June, July and September on this site of late. On Friday last week, the price moved above the 1.3443-798 area. That is where the swing highs were reached AFTER Brexit (see daily chart below).

Yesterday, the low stalled just ahead of the lowest of levels at 1.3443. The low yesterday reached 1.3451.

Today, the lows reached 1.3471 and 1.3470. We are currently extending the upside. We trade at 1.35165. That range is only 47 pips. The 22 day average (around a month of trading is 101 pips). So there is room to roam on an extension. A move above the 1.3532 would be more bullish for the pair, but holding the yellow are in the chart above is showing buyers are still lining up.

The problem on the topside is some good resistance against the 100 hour MA and an old trend line (see hourly chart below) at 1.35293. That level is also home to some swing levels seen this week (red horizontal line) and is not too far from the 1.3532 level from the daily too. A move above, however, will likely trigger stops and get the range widening out.

Traders may lean against the area as there is some good resistance there. However, on a break, I would expect the sellers to switch to buyers. Be aware.