BUT....sellers are making a play.

The GBPUSD sellers are making a play today. The price is running lower. The price is moving away from the 100 day MA. The price is back below an old trend line connecting lows from March and June.

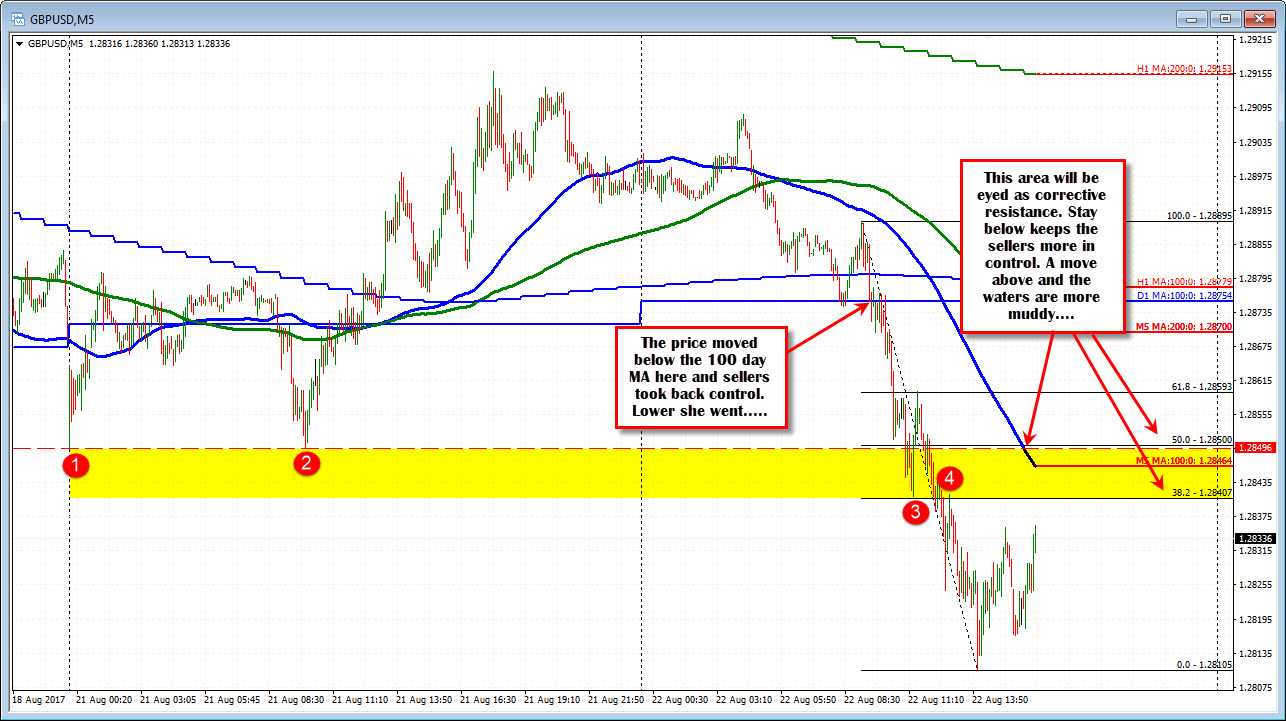

The problem is the price has traded above and below the trend line and the 100 day MA the last 6 trading days. So that is nothing new (see chart above). The market has been consolidating around the key MA level (see blue line in the chart above). It is unsure of the next move.

However, the low today is the lowest this month. We currently trade below the 61.8% of the move up from the June low at 1.28478. That is close resistance (ps. the low from yesterday stalled ahead of that level at 1.2849). The not so bearish news, is the low today for the most part equaled the low from July at 1.2811 (the low today reached 1..28105). So buyers leaned at the low extreme and the support level held.

Let's say the bears are trying, but they have more work to do.

Drilling to the 5 minute chart below, the price fell below the 100 day MA and that turned buyers more into sellers. The 38.2%-50% of the move down from the high of the last trend leg lower comes in at 1.28407-1.2850. Remember the 61.8% at 1.28478. That area (yellow in the chart below) is in that range intraday retracement range. Use it as topside resistance now for the pair. Stay below, keeps the sellers more in control. Move above, and sellers become more cranky as the technical waters get more muddy.