Options may be in play.

The EURUSD is trading above and below the 1.18000 level. As Mike pointed out, the EURUSD has a pretty lumpy option expire at the 1.1790-1.1800 area,with 1.28 B set to expire at 10 AM ET/1400 GMT. Option sellers make the most when the option expires worthless. If there are some large option sellers out there, and they have a lot riding on the position, they may look to stall the pair around the level. PMI data helped the EURUSD today with German data beating. The EU PMI numbers were also a beat.

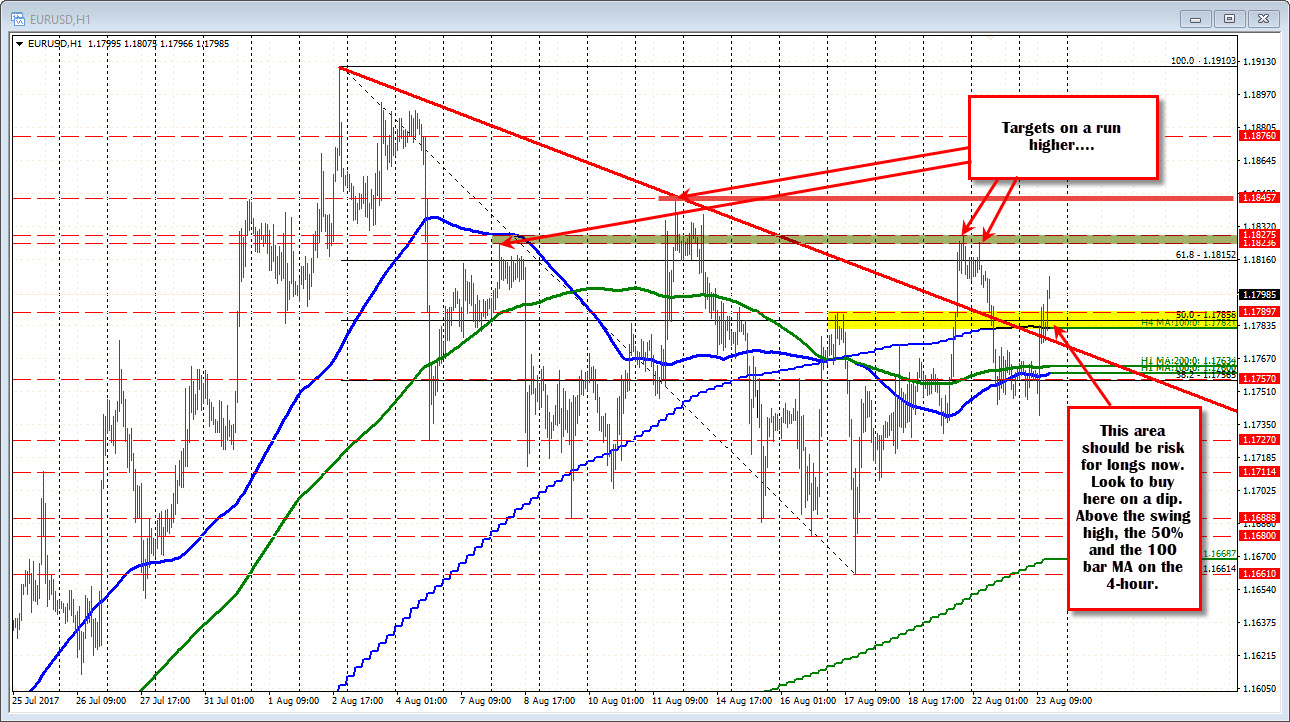

Technically, the pair moved back away from 100 and 200 hour MA (blue and green lines in the chart above) at 1.1760 and 1.1764. The pair is also moving back away from the 100 week MA at 1.1757. A trend line was busted at 1.1776. The 100 bar MA on the 4-hour comes in at 1.1782. The 50% of the move down from the August high comes in at 1.17856. There was a spike high on last Thursday at 1.1789.

Being above all that stuff gives the buyers the upper hand. A move back below them (gets progressively more bearish on each break), would put some doubt in the buyers minds.

On the topside, the high from the week at 1.1824 and 1.18276 are the obvious targets. The August 11 high reached 1.18457. There is room to roam. The range today is 68 pips. The 22 day average is 94 pips (would equate to 1.1834).

Right now though the option expiration seems to be stalling the pair. Be on the lookout for a dip toward the 50%/ 100 bar MA on the 4-hour chart and buyers to show up there.