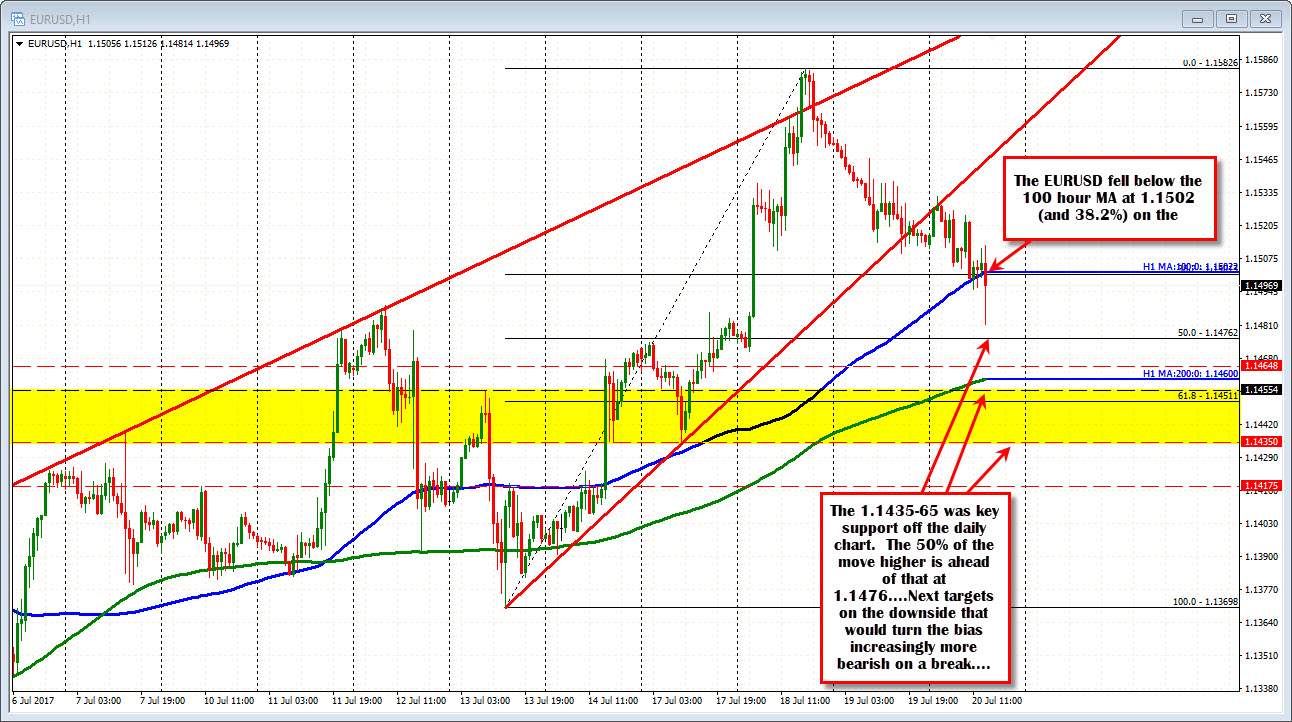

Back below 1.1500. The 1.1435-65 area eyed

The ECB left rates unchanged but said QE tapering won't start until Dec or beyond and that they would increase QE if they have to.

The EURUSD fell to new session lows on the headlines and back below the 100 hour MA at 1.1502 (and the 1.1500 as well). The low reached 1.1481 so far. Stay below this area is more bearish intraday. The prior support area at 1.1435-65 looms below. That level corresponds with a number of swing levels going back to Feb 2015. The price earlier this week cracked that area, based and ran higher. A move back below the area would be another failure and should solicit more selling. The 50% is before that level at 1.1476 and so far the market has respected that level.

The 10 year bund is moving lower and trades at the low yield for the day at 0.532.

Draghi takes the stage at 8:30 AM ET/1230 GMT. The market reaction is so far fairly muted and remains more bearish intraday but above key support levels below, and may be content to wait for his testimony before making the next move.