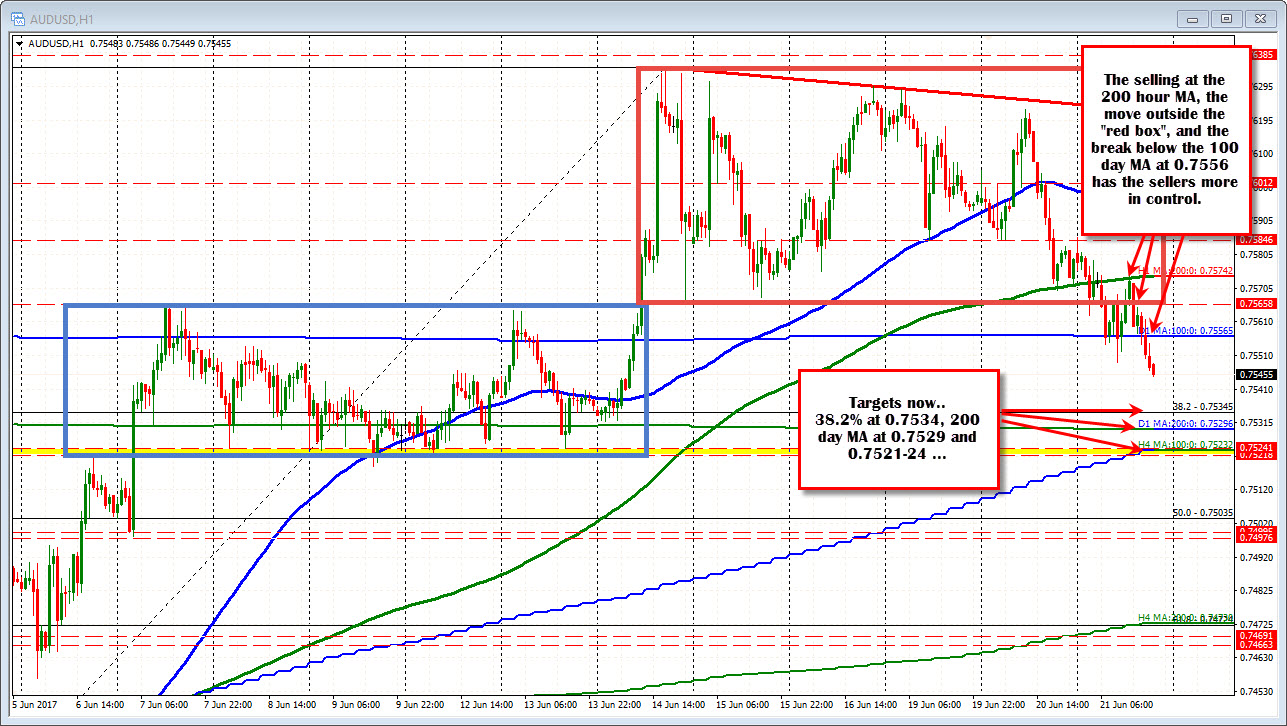

Moves out of "red box" and below 200 hour MA/100 day MA.

The AUDUSD stalled is trading at new session lows - spurred on by the breaking of some key levels.

Looking at the hourly chart, the price yesterday stalled against the 200 hour MA (green line). The swing ceiling floor level was also nearby at 0.7566. That level defined the low of what I called the "red box". It was also the high of the "blue box" from earlier in the month (see red and blue boxes in the chart above).

Today, the price has had a choppy time of it in that area, but:

- The 200 hour MA (green line in the chart above) stalled the rally in the early NY session.

- The fall from that high took out the 0.7566 level and stayed below (low of the red box and high from the blue box).

- The 100 day MA was broken at 0.7556

We are now moving away from those levels (trading at 0.7545). I would now expect that the 0.7556-66 becomes risk for shorts. That is stay outside the "red box".

The targets below are:

- 0.7534 - 38.2% of the move up from June 1

- 0.75296 - 200 day MA

- 0.7518-24. 200 bar MA on 4-hour chart and the "blue box" support area

The price action was not all that clean, but the NY session has shown more bearishness as the day progressed and the technical targets have been taken out.