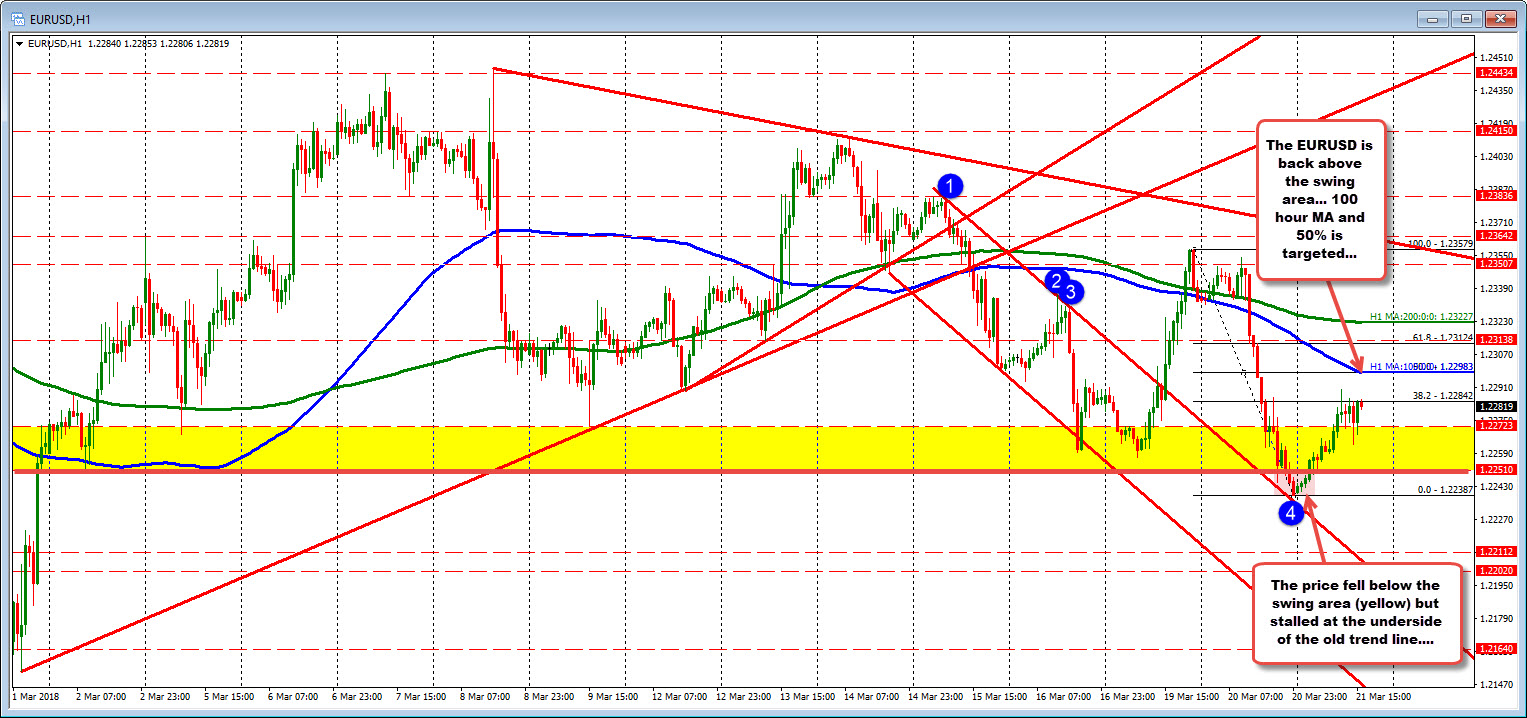

Back above swing area. Tests 38.2% of the move lower this week.

The EURUSD ran lower yesterday and in the process moved below a swing area that stalled falls going back to March 2nd (see green numbered circles). That fall reached the underside of the broken trend line at 1.22387 and stalled. The grind back higher today has moved back above the "yellow area".

The holding of the broken trend line and the move back above the swing area (i.e. yellow area) threatens the sellers hold on the market.

Now the high so far has only gotten to around the 38.2% retracement (below the 50%) of the move lower this week, and has stalled over the last 6 or so hours, The price is below the 100 hour MA too at 1.22983. That MA and the 50% of the week's trading range are both at that level. If the sellers are to keep control and make another run lower, staying below that level is key from a technical perspective. Sellers will start to get more concerned on a break back above.

SUMMARY: So sellers made a statement yesterday, but as mentioned yesterday in one of my posts, there are stories that can send the EURUSD higher or lower. The FOMC does meet, will tighten and could easily push the number of tightenings in 2018 to 4. That should keep a lid on the pair.

But technicals are a funny thing. They can change the story line but holding a support target or moving back above/below a MA or swing area.

Plan the trade. Listen to the technical story with an ear to the fundamental story as well. Watch the 50%/200 hour MA for sellers, but for sellers, get back into and below the "yellow area" too.