EURUSD take out last weeks highs on the news.

The EURUSD has taken out the highs from last week (was 1.1212) after the weaker than expected durable goods orders (-1.1% vs -0.6% estimate. Prior month -0.9% vs 0.8%). The high price has so far reached 1.1218.

Technically, the price has also moved above the 50% of the move down from the June 14 high at 1.12068. The earlier high for the day reached 1.12074 and backed off. On Friday the high reached 1.1208. So the area (give it to 1.12000) is an area that traders used to sell against. They should now use it as a support level.

The next target above for the pair is 1.12277 and then keep an eye on 1.1235 where there has been a number of swing levels (see red circles in the hourly chart above).

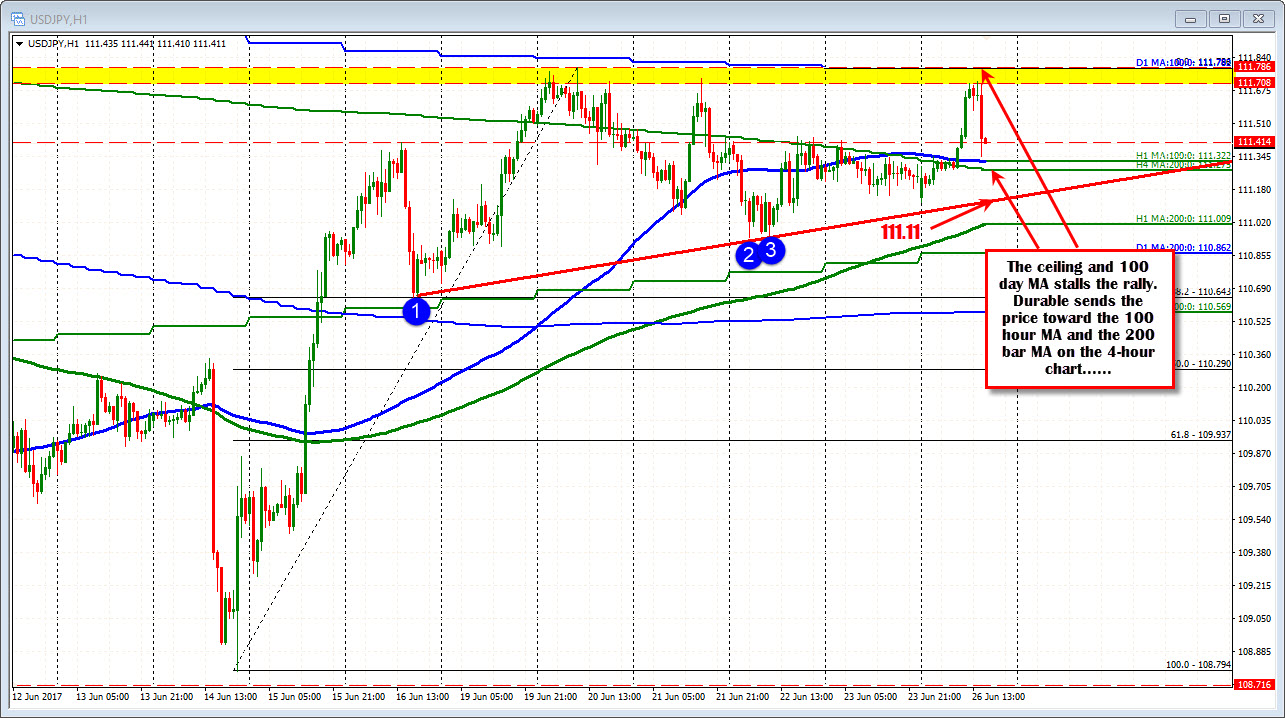

For the USDJPY, it has seen a big drop. The high today reached 111.71, just shy of the 100 day MA at 111.78. There were a number of swing highs last week in the 111.70-78 area.

The fall takes the pair back toward the 100 hour MA(blue line) at 111.32 and the 200 bar MA on the 4-hour chart (green step line) at 111.287. The low reached 111.348. The price has bounced a bit (trades at 111.44 off the support area). A move below those two MAs and the trend line at 111.11 wil be eyed. The 200 hour MA comes in at 111.00 and the 200 day MA at 111.86.

The try to get above the 100 day MA failed again. That should help to turn the buyers back to sellers and the market consolidates near the month of June highs.