Forex news for North American trade on December 7, 2017:

- EU commissioner says Brexit talks making progress

- US initial jobless claims w-e 2 Dec 236k vs 240k exp

- US Oct consumer credit +$20.52B vs +$17.0B expected

- GE will cut 12,000 jobs in its power division

- Bin Salman was the buyer of $450m Da Vinci as he cracks down on corruption

- WikiLeaks is under criminal investigation - report

- US Q3 household net worth rises by record $1.74 trillion

- Global regulators complete Basel III capital framework

- DUP says talks with UK government continuing on Thursday

- Canada November Ivey PMI 63.0 vs 62.5 expected

- Canada October building permits +3.5% vs +1.0% expected

- US Nov Challenger job cuts 35.0k vs 29.8k prev

Markets:

- Gold down $16 to $1247

- S&P 500 up 7 points to 2636

- WTI crude up 63-cents to $56.59

- US 10-year yield up 2 bps to 2.36%

- GBP leads, NZD lags

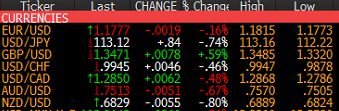

The US dollar had a strong finish to the day with USD/JPY gathering momentum after Europe went home. A steady rally took the pair to 113.16 from 112.65 as part of a broader bid in the dollar that was driven in part by higher Treasury yields.

Cable caught a bid as Brexit negotiations appeared to take some steps forward. Various reports led to a quick move up to 1.3480 from 1.3420 and now it will be up to May and Irish officials to deliver something the EU can accept.

EUR/USD climbed initially with cable but EUR/GBP selling sent it quickly back down. From there, the late USD bid weighed on the pair and it's finishing near the lows at 1.1770.

USD/CAD climbed for the second day as the BOC fallout continued to boost the pair. The high of 1.2868 came early in the day before a dip back to 1.2812 and then a send bid up to 1.2853.

AUD/USD fell for the second day in a drift down to 0.7500, a six-month low. Bids there are holding so far but Australian home loans are due up later.

The shocking move on the day was in Bitcoin as wild swings led to some prints close to $20,000 but that was followed by drops below $16,000. Still, it's a major climb from last week's $10,000 levels and a sign that many crazy days are still to come.