Forex news for US trading on December 4, 2017

- New Zealand Q3 volume of all building 2.7% vs +2.0% expected

- Bitcoin, Stocks and Common Ground

- US stocks give up gains (most gains) and close at the lows

- S&P erases gains. Nasdaq down over 1%

- Barclays capital FX strategy: Expects no change from RBA

- US crude oil futures and Brent crude futures settling lower

- Bitcoin technical analysis: Bitcoin is trading up $328 or 3.11% but...

- The USDCHF is tests the topside channel trend line. Stalls the rally?

- Pelosi and Schumer accept WH offer to meet with Trump/GOP leaders

- Irish PM Varadkar: Brexit talks have made substantial progress

- European stock up across the board

- Rotation in the US stocks as Nasdaq falls, Dow gains

- UK PM May: Need more consultation on some issues

- EU Juncker: UK PM is tough, not easy negotiator. Not possible to be reach deal today

- BBC reporting they don't expect a deal from the Brexit talks today

- US factory orders for October -0.1% versus -0.4% estimate

- ISM New York business conditions for November 58.1 versus 51.6 last month

- London's Kahn: Special status for Northern Ireland after Brexit could be huge

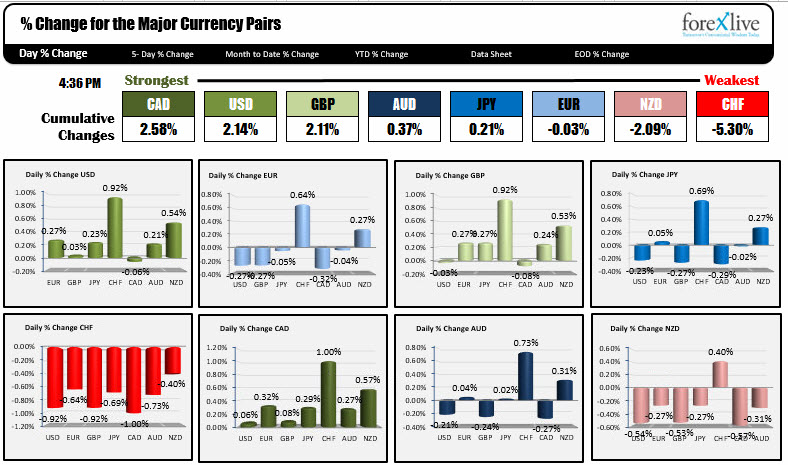

- A quick look at the winners and losers as NA traders get at it

- DUP's Wilson says no rule divergence contrary to UK government promises

- Kremlin says Flynn was not in a position to ask Russia's ambassador to do anything for him

- ForexLive morning news wrap: Pound steals the limelight in a busy start to the week

In other markets, a snapshot near the NY closes is showing:

- Spot gold is trading down $4.69 or -0.37% at $1275.81

- WTI crude oil futures are down $.91 or -1.56% at $57.45

- US treasury yields are higher but well off the highs: two-year 1.806%, +3.4 basis points. Five-year 2.142%, -3 basis points. 10 year 2.372%, plus 1 basis point. 30 year 2.763%, unchanged. The benchmark 10 year note had a high yield of 2.4187% while the 30 year bond reached a peak of 2.8159%.

- US stocks gave up large chunks of their gains and closed at the lowest levels. S&P index fell 2.78 points to 2639.44. The high price reached 2665.19. NASDAQ fell -72.219 points or -1.05% to 6775.36. The high price was at 6899.22, nearly 125 points off the lows.. The Dow industrial average was up over 300 points at the peak and closed up only 58.46 points at 24290.05

- Bitcoin is trading at $11,495, up $595.76 or 5.47%. The high reached $11,845.33 (record high). The low traded down to $10,549.51.

The focus today was on the negotiations between the UK and the EU. The hope was to cross off the divorce settlement and the Irish border situation. The talks are understood to have broken down after the DUP refused to accept concessions on the Irish border issue. PM had been prepared to accept that Northern Ireland may remain in the EU's customs union and single market in all but name. However, DUP's Foster said her party "will not accept any form of regulatory divergence" that separates Northern Ireland from the rest of the UK. After consultation during a lunch break, PM May and EU's Juncker decided to call off the meetings without an agreement and announced they will meet later in the week.

The word of the breakdown initially sent the GBPUSD tumbling lower. The pair fell about 100 pips to 1.3411. That took out the prior lows for the day and cracked below the 100 hour MA in the process at 1.3442. However, within 5 minutes the price was back above the level and spent the rest of US afternoon session tracking above that MA level. The 100 hour MA is at 1.3457 currently (and rising), and will be a risk defining and bias defining level in the new trading day. Stay above is more bullish. Move below will be a more bearish signal for traders.

In other market developments, the weekend news that the GOP had passed their tax reform bill on Saturday, sent stocks higher in early trading. However, there was a big rotation out of the tech stocks and into the big cap stocks of the Dow on thoughts the industrial would benefit more from a tax cut as they now tended to pay the most taxes (and tech companies the least). The Dow was up nearly 300 points at one point and was up nearly 250 points as European traders headed for the exits. The Nasdaq, on the other hand went from up about 50 points at its high point, but was down about -22 points when Europe left. Into the close, the momentum started to accelerate, with the Dow giving up all by 58 of the gain and the Nasdaq tumbling -72 points at the close.

The fall in stocks helped to push the USDJPY to new session lows. The pair cracked below a floor at the 112.63-65 floor area and moved an additional 30 pips by the close. The price still remains above its 100 hour MA at 112.25 (the low reached 112.35 so far). A break of that level on continued weakness would be turn the bias more bearish.

A snapshot of the winners and losers into the close shows CAD taking over as the strongest currency at the close. The late day dollar selling on the stock market fall, took the USD lower (although it was still up vs most of the currency pairs (even the JPY). The weakest currency was the USDCHF which benefited from flight out of risk, but recovered some of the losses by the close on the back of the late day sell off of stocks.