Forex news for New York trade on October 13, 2017

Data:

- September US CPI 2.2% y/y vs 2.3% y/y expected

- September US advance retail sales 1.6% vs. 1.7% estimate

- U Michigan Oct prelim consumer sentiment 101.1 vs 95.0 expected

- August US business inventories +0.7% vs +0.7% expected

- Baker Hughes US oil rig count 743 vs 748 prior

- Atlanta Fed GDPNow Q3 tracker rises to 2.7% from 2.5%

- New York Fed GDP Nowcast +1.70% vs +1.53% prior

Central banks:

- BOE's Carney: UK running out of spare capacity

- Fed's Evans: Latest inflation data doesn't seem encouraging

- Evans: US economy has really quite strong fundamentals

- ECB's Nouy: New NPL proposal does not go beyond the existing framework

- Fed's Bullard: Balance sheet reduction to be done very slowly

- Kaplan: Fed can be 'patient' in removing accommodation

- ECB's Constancio: Recovery has beat expectations, inflation goal hard to reach

- Fed's Fischer: Tax cuts could boost growth in the short-term

- ECB's Nowotny: ECB has to take decisions on stance in October

- ECB's Weidmann: Global economy has firmed further

- Fed's Rosengren: Rates likely to hit zero again in future recessions

- Rosengren expects underlying inflation close to 2% over 2018

News:

- CFTC Commitments of Traders: Yen shorts ramp up bets

- Trump says Iran a terrorist nation like few others

- Iran's Rouhani responds to Trump's comments

Markets:

- S&P 500 up 3 points to 2553

- US 10-year yields down 4 bps to 2.28%

- WTI crude up 75-cents to $51.53

- Gold up $10 to $1303

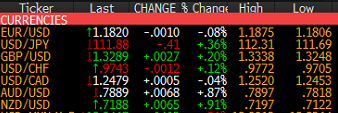

- AUD and NZD lead, EUR lags

It was a busy day to end the week in part because so many central bankers were in Washington for the IMF meetings. For a group that did so much talking, they had very little to say and nothing that moved markets.

It was all about the CPI report released early in US trade. The market was leaning towards a strong report after Thursday's upside PPI report and the dollar held a bid in the last hour before the release. Instead, the numbers were weak and the US dollar dropped.

USD/JPY fell to 111.70 from 112.20 in a straight line. Other pairs had similar sized moves, or larger. The dollar selling began to unravel when the super-strong U Mich sentiment numbers were released, but that was tempered somewhat by the inflation expectations subcomponent.

USD/JPY climbed to 111.95 but couldn't retake the big figure.

Cable started US trade at 1.3280, skidded to 1.3260 before CPI, then jumped to 1.3330 before sliding back just below the figure to close out the week.

USD/CAD had a mind of its own. There was a relentless bid early that was broken up by the CPI data and then resumed to new highs at 1.2520 before the bid vanished and the paid slipped back to 1.2480. It looked awfully curious and was likely flow-driven trade.

By contrast, AUD jumped 60 pips on the CPI numbers and stayed strong into the close, finishing near the best levels of the day at 0.7889.

Looking back on the week, politics were a big story, especially in cable but also in the US dollar and elsewhere. The week ahead will shift the glare to China, where weak trade balance numbers on Friday didn't get nearly enough attention.

Have a great weekend.