It's a bad day to be short EUR

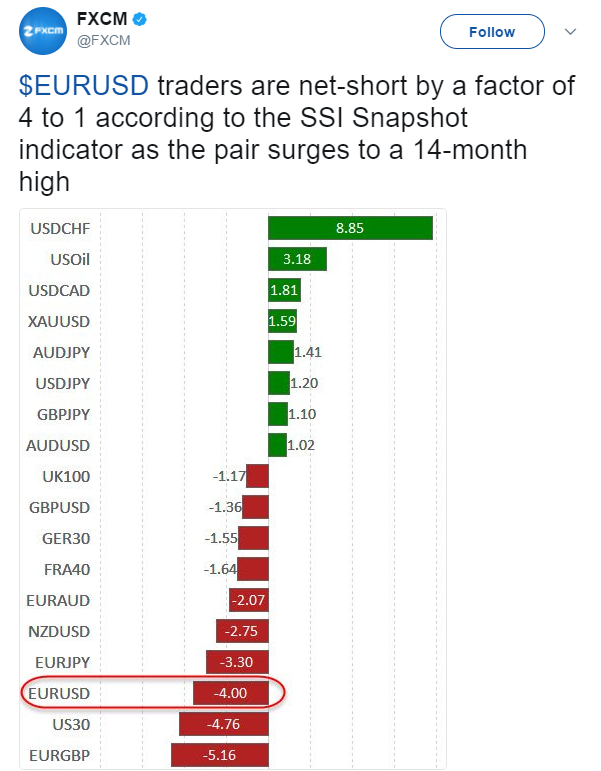

I don't know how reliable this data is but it has the ring of truth to it. Depressing truth but truth nonetheless.

FXCM says that retail traders are short EUR/USD by a ratio of 4:1 at the moment. That means most accounts are taking an absolute beating today as the euro hits a 10-month high. They're also short every other euro cross and losing money there as well.

Why?

Time and time again retail traders try to pick tops and bet against trends. The euro is at extremely depressed levels and -- if you haven't been paying attention -- things in Europe aren't getting worse anymore. The ECB isn't stepping harder on the gas pedal, it's easing off.

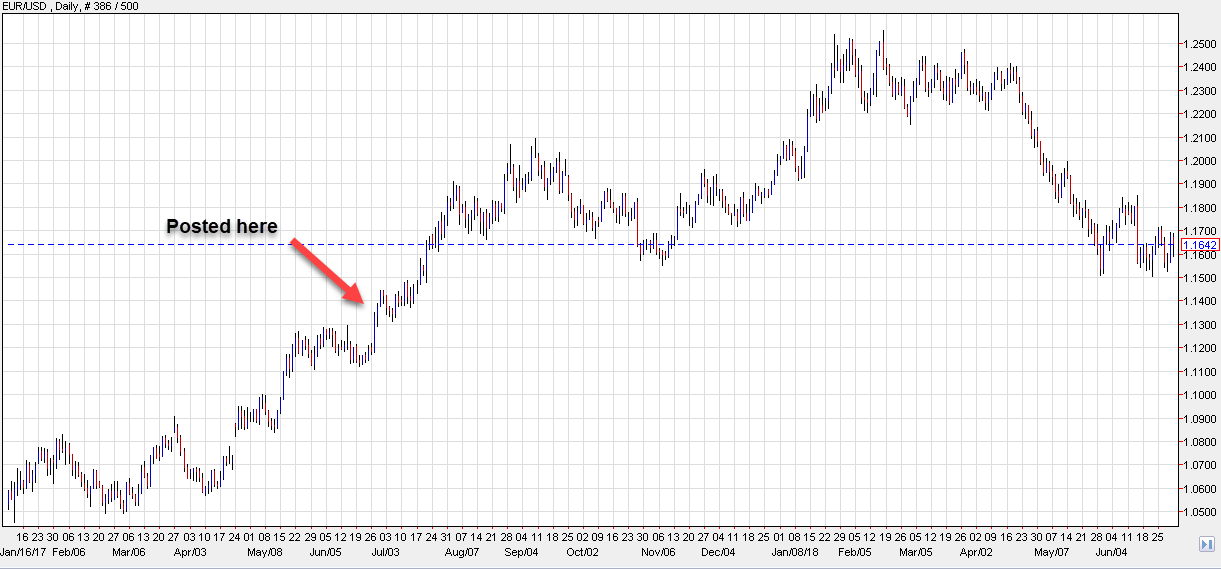

Update: So this post was made on June 27, 2017 as the euro broke to a 10-month high. Here's why it was a bad idea to short it then and why it continued to be for many weeks.