The Fed disappoints again so it's over to Kuroda and his box of BOJ tricks

The dollar has taken a hit once more as the market shows its disappointment at the message from the Fed. The statement read like it was written by a dove trying to be hawkish. It didn't work and the charts show you the story since then.

It looks like the market has guessing games fatigue and is just going to put its fingers in its ears until the BOJ announcement.

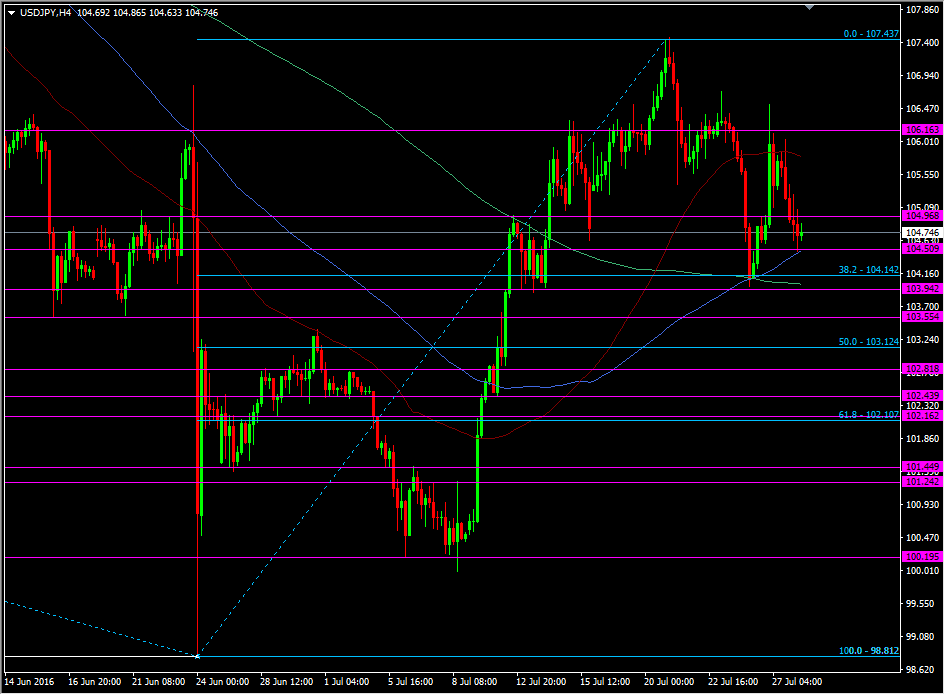

The pair has been trading very simply this week. the big and half figures have been where we've found the bulk of support and resistance.

USDJPY H4 chart

As per my FOMC/BOJ plan this week, I've taken a small long at 104.55 against this fairly decent support at 104.50. I'll add to it further if we trade down to 104.15/20, ahead of the next support around 104.00/103.90/95. I'd like to see a fairly good profit margin built up before the BOJ but if there's not a lot, I'll decide what I want to do with it before I finish later tonight. What I really want to catch is any further expectation rally, the likes of which we've seen recently. If I get that I'll lock in a trailing stop and let it run over the BOJ, or I'll get out and take what I've got. Stop wise, I want to keep it fairly tight so I've got my stop just under 103.75.